The Norwegian VOEC scheme

26 October 2025

By Norwegian CustomsNorway is the first country in Europe to design a general system for the taxation of low-value cross-border e-commerce transactions in accordance with the OECD guidelines for the application of VAT to international trade. In 2024, the threshold under which items were not subject to VAT was removed and a simplified reporting regime for importation of “low-value” items was created. Businesses who register under this regime also benefit from a higher “de minimis” threshold under which no Customs duties apply.

Large increase in the number of low-value goods

Over the last 10-15 years, there has been a large increase in cross-border e-commerce transactions. The rise of major online marketplaces such as Amazon and e-Bay, and more recently Shein and Temu, has fundamentally transformed the landscape of cross-border e-commerce and has had significant impact on border control and taxation.

Abolishing the de minimis VAT rule

This emergence of new logistics and trade patterns has, in particular, put pressure on the de minimis VAT rule, which allowed low-value imports under NOK 350 (about $32 USD) to enter Norway duty free. This strain derived both from the inability to efficiently control this flow of goods and from the growing concern for the loss of revenue. In addition, there were complaints about unfair competition from domestic retailers, which were obliged to charge VAT on all goods regardless of their value.

Norway was not the only country looking to solve this problem. In 2015, the Organisation for Economic Co-operation and Development (OECD) published their report entitled “Addressing the Tax Challenges of the Digital Economy”, recommending to reassign the responsibility for VAT collection to non-resident suppliers and digital platforms. Australia and New Zealand were the first countries to try this concept some years after, and Norway followed suit. On 1 January 2020, Norway launched the first step of this concept, when all food and comestibles, goods subject to excise duties and restricted goods were exempted from the de minimis rule and were subject to declaration and taxation for any value. The second step was launched in April 2020, when the remaining types of goods were made taxable for any value.

While the de minimis rule was abolished, the VAT On E-Commerce (VOEC) scheme was launched. The VOEC scheme obliged the foreign online sales platforms to follow a simplified registration and reporting scheme. The platforms should collect VAT on sales under NOK 3 000 (about $275 USD) and pay the collected VAT quarterly to the Norwegian Tax Administration. To ensure smooth logistics and encourage the logistics companies to refrain from charging administrative fees, only a simplified notification with limited data requirements and no ordinary Customs declaration was required for goods under the VOEC scheme.

However, the VOEC scheme was not an instant success, and many small consignments still came through under the old scheme. To avoid congestion of low-value goods that were not imported under the VOEC scheme, an intermediate arrangement for those low value goods sent to private persons (B2C) was implemented. As a temporary measure, small consignments with a value beneath NOK 350 were also exempted from the duty to submit a Customs declaration. The full abolishment of the de minimis rule was completed on 1 January 2024.

Implementation of the VOEC scheme

Norway was the first country in Europe to design a general system for the taxation of low-value goods from traders to consumers in accordance with the OECD guidelines for VAT in international trade. The design of the simplified VOEC scheme is closely aligned with OECD guidelines, emphasizing the importance of minimizing complexity to facilitate compliance.

To ensure a more level playing field for taxation, Norway launched a VAT collection system aimed at foreign e-commerce platforms and online stores. As mentioned above, VOEC makes the online platforms responsible for calculation of VAT at the time of sales and collection of VAT on behalf of the Norwegian Tax Administration. As of 2020, foreign e-commerce platforms and online stores have been able to register in the VOEC scheme for the purpose of selling low-value goods to Norwegian consumers and collect VAT when private persons make purchases from them.

The VOEC scheme is administered by the Norwegian Tax Administration, and the e-commerce platforms and online stores must register with them before they can collect VAT. Registration is mandatory when the turnover to Norwegian recipients exceeds NOK 50 000 (about $4 600 USD), but registration can also take place voluntarily. Norwegian Customs is charged with the control of the goods and the simplified declarations.

The VOEC scheme applies to goods intended for private use with a value of up to NOK 3 000. The value limit applies to each item. The customer can purchase as many items as desired and have these items shipped in the same package, as long as each one has a value of under NOK 3 000 and is intended for private use. Foodstuffs, and goods subject to import restrictions or excise taxes are not covered by the VOEC scheme.

Simplified Customs procedures

To facilitate compliance, goods handled under the VOEC scheme are exempt from Customs duty and benefit from simplified Customs procedures. To clear VOEC shipments, the couriers are required to submit a simplified dataset consisting of the VOEC number, commodity code in accordance with the Customs Tariff, the carrier’s consignment number and the value of the goods in Norwegian kroner excluding VAT, shipping costs and insurance costs. This information shall be submitted together with the obligation to notify and provide information upon arrival at the destination in the Customs territory. Based on this information, Customs analyses data to ensure that the goods meet the VOEC conditions, performs a risk assessment and asks the transporter to present goods for inspection if needed.

Simple and effective for end-users

An effect of the VOEC scheme is that purchases from the e-commerce platform shall be regarded as simple and effective for the end-user. Since the e-commerce platforms and online stores collect the VAT, it can be expected that the shipments will cross the border faster and and that the transport company will lower or eliminate administrative fees they usually charged to consumers. The scheme is meant to give the e-commerce platforms and online stores a reasonable advantage compared to non-registered platforms that do not receive the benefits of the VOEC scheme.

Gradual implementation

Norway has adopted a phased approach, allowing foreign suppliers to gradually adapt to the new regulations over an implementation period spanning nearly four years. Throughout this period, Norway has maintained extensive dialogue with stakeholders, both from the supplier side and the logistics sector. The Norwegian Tax Administration and Norwegian Customs have for several years collaborated to inform e-commerce online platforms, carriers and Norwegian consumers about the implementation of the VOEC scheme and the changes resulting from it. Work meetings have been held with carriers, digital meetings with the e-commerce online platforms, and large information campaigns through public websites and social media have been carried out to reach consumers. One of the biggest challenges has been to ensure that the information reaches the entire chain of actors, so that the necessary information about VOEC goods is provided in the correct manner.

In anticipation of potential implementation challenges Norway adopted several temporary measures. These exemptions have since been gradually phased out. In 2024, the temporary Customs clearance exemption for all goods valued below NOK 350 was finally removed. The same year, the option to provide information about VOEC shipments on paper also disappeared; now this must be done digitally.

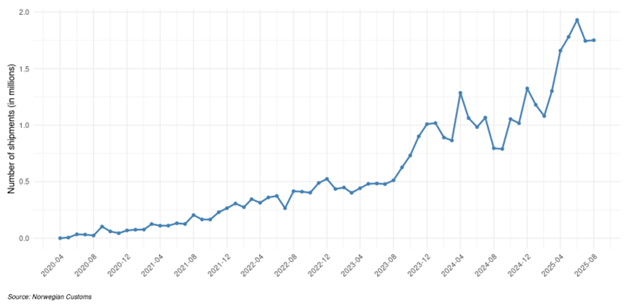

Five years after the introduction of the VOEC scheme, it is now well known and has been integrated for relevant actors in the logistics chain, while the scope of its use is increasing significantly, especially since the fall of 2023. Today, the number of monthly VOEC shipments is around 1,75 million. This means approximately 80 percent of the total number of shipments with a value beneath 3 000 NOK to private recipients are benefitting from the VOEC scheme.

Alternative modes of declaration of low-value goods

According to Norway’s Movement of Goods Act, all shipments are subject to an obligation to notify and provide information upon arrival at the destination in the Customs territory. This also applies to low-value goods, regardless of which scheme is used for import.

Low-value goods to private recipients in Norway can be handled in different ways. The largest proportion of these goods are handled through the VOEC scheme. In these cases, the necessary data is provided together with the obligation to notify and provide information upon arrival at the destination in the Customs territory, and the goods can be released to the recipient immediately.

If the foreign supplier is not registered in the VOEC scheme, the goods must be declared. In these cases the recipient must pay VAT and possibly Customs duty when the goods arrive in Norway. In addition, the carrier usually charges a fee for Customs treatment. If the goods are not subject to restrictions or excise duties, they can usually be declared through a simplified scheme with a reduced data set. Otherwise, a complete declaration must be submitted.

Identified challenges

One of the major challenges in the Customs handling of e-commerce is data quality. Low-value shipments have traditionally had lower data requirements to ensure a fast and efficient flow of goods. It has therefore been a challenge to introduce requirements for data submission and ensure that foreign suppliers and intermediaries provide sufficient and correct data about the goods to Customs throughout the logistics chain. From January 2024 there has been a requirement that information about VOEC shipments must be communicated digitally to Customs before or at the latest upon border crossing. Digital data requirements contribute to standardized information and better data quality, ensuring that goods are handled correctly, while also giving Customs the opportunity to perform better risk analyses before the goods arrive.

Another challenge is balancing simplification versus control. To ensure an adequate level of control, it has been important to set up the system in a way that allows Customs to receive the necessary information before the goods physically cross the border. In order to recognize which goods can use the VOEC scheme, certain information must be provided which shows that the conditions have been met. At the same time, it is important to ensure a smooth and efficient flow of this enormous amount of low-value goods.

A third challenge is the risk of double taxation. If the VOEC number is missing in the submitted data files, a normal declaration must be filled out. In these cases, the consumer will be charged VAT twice, and, according to the regulation, the sales platform must repay the VAT. But this is not always followed up by the platforms, or they might require information from the consumer that they do not have. The importance of good data quality has therefore been highlighted in communication with stakeholders.

Continuous evaluation and improvement

Despite some initial challenges, Norwegian authorities consider that the scheme is gradually improving and is functioning as intended.

Norway continues to evaluate and, if necessary, refine the regulatory framework to respond to the challenges posed by e-commerce imports. The Norwegian Tax Administration and Norwegian Customs collaborate closely on the VOEC scheme, including on issues related to tips, risk and control, with a common goal of increasing compliance among e-commerce platforms.

Norway being part of the European Economic Area signatories (a homogenous single market consisting of the EU Member States and Iceland, Liechtenstein and Norway), it also closely monitors the situation in the EU, such as the proposed Customs reform and the broader discussions on safe and sustainable e-commerce.