Supporting compliant traders: Bahrain launches compliance programme to ensure SMEs benefit from facilitation measures

6 March 2025

By Dr. Nada Ebrahim, Head of Post Audit and Compliance Assessment Division, Bahrain Customs AffairsBahrain Customs Affairs has developed a compliance programme with the ultimate objective of boosting international trade operations and increasing export opportunities, especially for companies operating in the key economic sectors identified in Bahrain’s Government Plan and in other policy documents such as the National Strategy to Achieve Food Security and the Industrial Sector Strategy of the Ministry of Industry and Commerce. The objective is also to ensure that measures offered to compliant companies benefit not only the largest ones, but also small and medium-sized enterprises (SMEs).

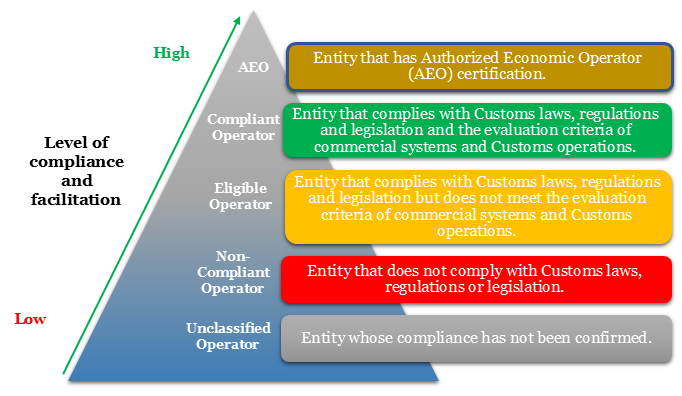

The programme is based on a compliance framework that categorizes companies into one of five groups according to their known level of compliance. The higher the level of compliance, the greater the benefits. The five categories are as follows:

- Authorized Economic Operator (AEO) for companies that have obtained AEO certification, which also validates their compliance with specific security requirements in line with the WCO SAFE Framework of Standards.

- Compliant Operator for companies that have demonstrated compliance with Customs laws, regulations and legislation, and whose commercial systems and Customs operations meet certain criteria.

- Eligible Operator for companies that have demonstrated compliance with Customs laws, regulations and legislation, but whose commercial systems and Customs operations do not meet certain criteria.

- Non-Compliant Operator for companies that have been found to be non-compliant with Customs laws, regulations and legislation.

- Unclassified Operator for companies whose compliance status has not been confirmed.

Certification as an AEO is obtained through a specific process initiated once an application to join the AEO programme is received. Other levels of compliance are measured through post-clearance audits (PCA), a process consisting of a structured examination, after Customs has released the cargo, of the relevant commercial data, sales contracts, financial and non-financial records, physical stock and other trader assets. The aim is to obtain a comprehensive overview of the auditee’s business operations and, on this basis, identify and analyse specific risk areas of the auditee’s systems and measure and improve compliance. An audit plan would then be drafted, specifying the audit objectives and scope, as well as the process. PCA also aims to increase the transparency of the Customs administration’s taxation process and, consequently, the trust of the business sector in the Customs administration. Additionally, it aims to provide the companies with recommended actions to improve their compliance and meet the required criteria for commercial systems and Customs operations.

A detailed explanation of the compliance framework can be found in the Post-Clearance Audit and Compliance Guide, which is published on the Bahrain Customs website. The guide describes the procedures in a transparent manner, serving as a policy tool for relevant stakeholders. It aims to raise awareness among companies in the business sector of the requirements of a post-clearance audit and compliance assessment, encouraging traders to self-assess their level of compliance and identify areas for improvement.

The compliance programme is particularly beneficial for SMEs that may not have the capacity to conduct internal audits, may need guidance on practice and procedures, and may not have established strong relationships with the Customs Administration.

To date, 131 companies have been classified as Compliant Operators, and their number is growing.

Compliant Operators receive a certificate of appreciation for their compliance and enjoy specific benefits such as:

- reduced number of inspections at ports of entry, which helps facilitate the movement of goods at the border;

- reduced release times;

- possibility to use the programme logo for marketing purposes in their correspondence and commercial invoices, as well as on means of transportation;

- nomination to other government regulatory authorities for inclusion in the list of operators to which they offer benefits (called whitelists).

Regarding this last point, Bahrain Customs has been working with these regulatory authorities to expand the benefits they offer to Compliant Operators and AEOs, with the objective of facilitating the development of promising sectors, such as the industrial sector, and SMEs. This will contribute to sustainable development and encourage investment in the Kingdom of Bahrain.

More information

PCA@customs.gov.bh