Cigarette smuggling: how Uzbekistan managed to turn the tide

5 March 2025

By Mr. Akmalkhuja Mavlonov, Chairman of the Customs Committee, Ministry of Economy and Finance, UzbekistanThis article introduces the measures taken in Uzbekistan to combat tobacco smuggling that led to a significant reduction in the volume of Customs seizures in 2024 together with an increase in the volume of importations.

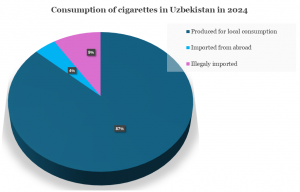

According to researchers at the Tashkent State University of Economics, 576 million packs of cigarettes were sold in Uzbekistan in 2024: 500 million were produced domestically, 24 million were imported, and the remaining 52 million were smuggled into the country. Even though official imports of tobacco products have increased eight-fold since 2019, the estimated volume of cigarettes smuggled into the country remains extremely high.

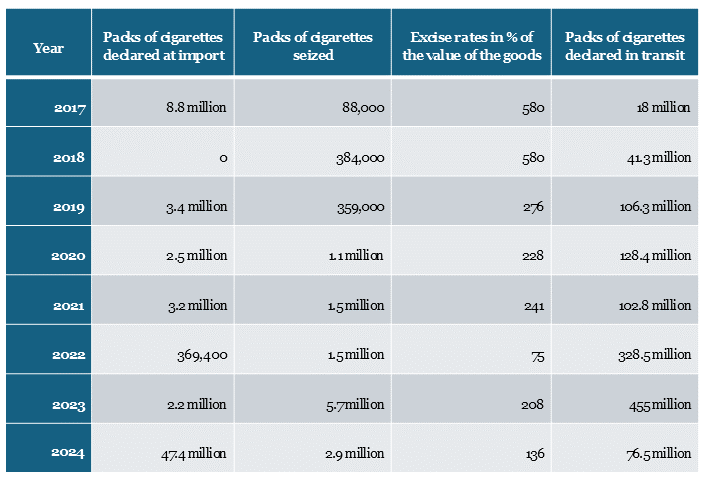

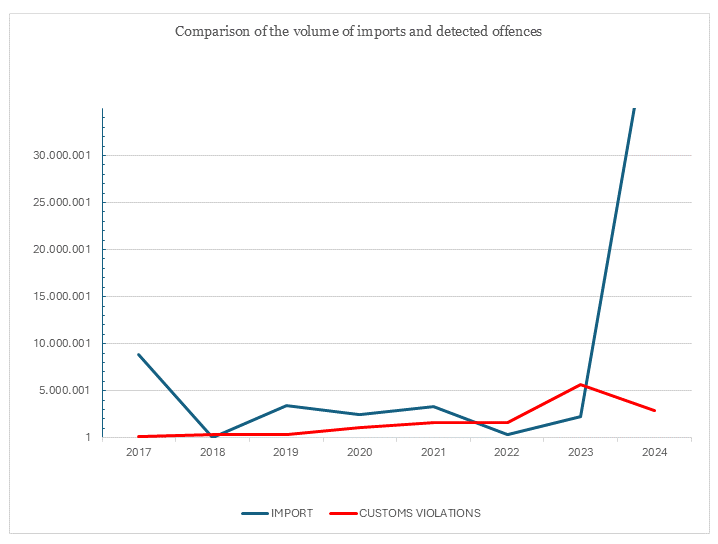

To address this issue, the Customs Committee has, in recent months, taken several measures aimed at increasing control capacities, especially over transit operations, which have proven to be very effective. For instance, trade data show that the volume of cigarettes seized by Customs has rapidly increased from 2017 to 2023, before decreasing in 2024, while the volume of cigarettes entering the country under the transit procedure has decreased and the volume of imports increased (see Table below).

Enhancing the monitoring of transit operations

Uzbekistan is a landlocked country bordered by Kazakhstan, the Kyrgyz Republic, Tajikistan, Turkmenistan and Afghanistan. Located along the ancient Silk Road, it has been the centre of commerce and trade in Central Asia for many centuries and is still today a key transit hub for trade between Europe, Asia and the Middle East.

One-way smugglers are importing cigarettes illegally into the country is by transporting them to neighbouring countries under the transit procedure, and then transporting them across the border again as contraband. This type of modus operandi is especially common in the Kyrgyz Republic, from where some shipments are “re-exported” to Uzbekistan.

In 2024, the Customs Committee took several measures to improve the monitoring of shipments of cigarettes entering the country under the transit procedure.

The following documents must now be sent electronically to Customs and presented at the Customs border post of entry and exit:

- Confirmation that the cigarette packs have been marked with the excise stamp of the receiving state, except in cases where the receiving state does not require one.

- Certificate of origin, a contract (agreement) for delivery and a transportation schedule if the goods in transit are divided into multiple shipments with different destinations.

- Confirmation that the payment of the Customs duties for the transit of goods has been transferred to the deposit account of the Customs administration. The Customs duties must be paid within five working days after the goods have exited the country.

In addition, vehicles transporting tobacco products are allowed to pass only through border posts equipped with inspection and screening systems. Finally, cooperation with neighbouring countries has been strengthened and data on shipments of tobacco products are exchanged in order to verify that the goods reach their final destination.

The volume of tobacco products entering Uzbekistan under the transit procedure has decreased sharply, going from 10,467 tonnes in 2023 to 1,772 tonnes in 2024.In the first 11 months of 2024, Customs duties collected on tobacco imports increased by almost12 times compared to the same period in 2023.Moreover, 138 tonnes of tobacco products were returned to Uzbekistan, as their importation was not approved by the Customs administration in the country of destination.

Strengthening risk management capacities

The Customs Committee has also improved its risk management system by developing new risk indicators for the detection of illicit movements of tobacco products and incorporating them in its risk-profiling module. These indicators are based on historical data stored in the information system for registered offences which is linked to the risk management system, on the WCO Customs Risk Management Compendium and on recommendations provided by the Customs Administrations of Japan and Germany.

The Customs Committee has also developed various automatic threat detection tools that were deployed for use with scanners at entry and exit border posts. Such tools enable non-intrusive inspection (NII) systems to recognize tobacco products or discrepancies between what has been declared and what appears in the image, and send alerts to Customs officers. The use of these tools has already proven to be effective. For example, a railway wagon loaded with cigarettes declared as tea was detected at the Customs post of Khojadavlat on the border with Turkmenistan.

With the assistance of the Uzbek Ministry of Internal Affairs, Uzbekistan Customs has also connected its IT system to the national network of road surveillance cameras. Managed by the Road Traffic Safety Authority, this network consists of more than 10,000 cameras. When goods and vehicles are placed under control, the information system of the Customs Committee determines the best route to the internal warehouse using Google Maps and Yandex Maps. The information is then sent to the Road Traffic Safety Authority’s IT system which will monitor the vehicle and identify any deviation from the planned route and schedule. If the route taken differs significantly from the route set by Customs, a signal is sent to the Customs risk management system, and the team working at the Customs targeting centre will take measures to locate the vehicle and identify the cause of the deviation from the route in cooperation with the field units working in the periphery of the incident.

Seizures

Since 2019, there has been a notable increase in cigarette seizures. If illegal trafficking was primarily detected within the country and linked to lack of compliance with the rules and regulations governing the storage and sale of goods, including excessing duty-free allowances, new trends emerged in 2023 and 2024 with smugglers misdeclaring shipments or concealing cigarette packs in vehicle parts.

In 2024, a total of 510 violations related to the illegal circulation of cigarettes were detected at border Customs posts. Of these, 96 (29%) involved products concealed in hidden compartments in suitcases, bags, containers, vehicles and other means of transportation. All detected shipments were confiscated. In 2024, according to a court order,1.3 million packs of cigarettes were destroyed.

Three large seizures, totalling 2 million packs of cigarettes, were made as follows:

- On 19 January 2024, 402,000 undeclared packs of cigarettes were found in a railway carriage at the Sariosiya border post near Tajikistanon the “Iran-Turkmenistan-Uzbekistan-Tajikistan” route.

- On 19 July 2024, a shipment of 866,000 packs of cigarettes not bearing any excise stamps and declared as containing tobacco raw materials was found in a truck at the “Olot” border post near Turkmenistan on the “UAE-Iran-Turkmenistan-Uzbekistan-Kyrgyzstan” route.

- On 14 September 2024, a shipment of 706,000 packs of cigarettes declared as containing black tea was found in a railway carriage at the Khojadavlat border post on the “Iran-Turkmenistan-Uzbekistan-Kazakhstan” route.

All these shipments were selected based on risk-profiling, and non-intrusive inspection equipment was used to confirm the suspicions raised by officers.

Most of the seized cigarettes were manufactured in the United Arab Emirates and Korea under various brands, including “Milano”, “Essè” and “Oris”.

Cooperation with manufacturers

There are three major tobacco manufacturers operating in Uzbekistan:

- JSC “UzBAT”, part of the British American Tobacco Group, with a share of 74.7%.

- JTI TURON INC, part of the Japan Tobacco Group, with a share of 13.8%.

- Philip Morris International, with a share of 11.5%.

A memorandum of cooperation was signed between the Customs Committee and JSC UZBAT, the largest producer in the country. According to the memorandum, JSC UZBAT is to provide the Customs Committee with modern technologies to detect counterfeit cigarettes and organize seminars and workshops in order to build Customs capacity.

Informing the public

In Tashkent city, a pack of Milano cigarettes sells on average for 15,000 Uzbekistani sum on the black market and 12,000 sumon the legal market, while a pack of Essèis sells for 45,000 sumon the black market and 25,000 sumon the legal market.

There are two possible explanations for why illegally imported cigarettes are more expensive than legally imported ones:

- Cigarettes sold on the black market come from leftover stock that was bought by smugglers at a price which was lower than the price of legal cigarettes at the time, but no longer is.

- Packs of illegally imported cigarettes do not bear warning messages or images on the harmful effects of smoking, and some buyers may prefer to buy those.

An analysis carried out by Uzbekistan’s Central Customs Laboratory show that cigarettes sold on the black market often contain more harmful substances such as tar, carbon monoxide, lead and arsenic, and, in some cases, up to 500% more toxic cadmium. Smuggling also harms the state budget and poses a threat to national security, funding criminal groups and corrupting officials.

The Customs Committee has launched a communication campaign to raise public awareness on the impact of this trade, involving its participation in radio broadcasts and publication of educational materials. In 2024,it organized several public events during which a total of 1.3 million packs of cigarettes were destroyed.

A reward for individuals providing information

Individuals are financially rewarded for reporting activities related to tobacco trafficking. Information can be provided online via the “Tax Partner” platform which has been established by Uzbekistan’s State Tax Committee. Any citizen can use this platform to report tax, economic and financial violations.

Way forward

To prevent the illicit trafficking of tobacco products in Uzbekistan, a number of additional measures are being considered.

The first such measure is the improvement of detection capacities by enhancing intergovernmental information exchange, monitoring duty-free tobacco sales via an IT system and integrating the digital labelling system into the excise stamp system.

Developed by the Tax Committee, the digital labelling system require importers of cigarettes to obtain unique serial numbers with crypto codes for each pack of cigarettes they wish to import. All codes are issued and stored through an IT system. The importer transmits the codes to the manufacturer who then encodes them into Data Matrix codes (high-density two-dimensional barcodes that can encode a large amount of data with minimal space utilization, which makes them perfect for labelling small items) and prints them on individual consumer packs. Cartons and master cases are likewise labelled with unique codes assigned by the manufacturer. All cigarette packs must also be marked with an excise stamp of the receiving state, except in cases where the receiving state does not require one. Once the cigarette packs have been cleared, Customs sends the list of codes to the Tax Committee. With every purchase being recorded, it is possible to monitor the journey of a pack from the place of manufacture, through the distribution chain and on to the retailer and the consumer, ensuring in the process that all relevant duties and taxes have been paid. Connecting the IT system used to manage such a scheme to the excise stamp system would enable Customs to monitor movements of cigarettes more effectively.

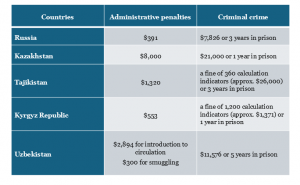

The second measure is the strengthening of the liability and penalty scheme for illegal tobacco smuggling, including the introduction of penalties for selling and buying illegal tobacco and for selling tobacco products to minors, in line with Article 1 of the WHO Convention on Tobacco Control.

Table 2 – Penalty schemes in the region

The third measure involves maintaining the rate of excise and Customs duties, as well as of value-added taxes on tobacco products. Any change should be based on thorough economic econometric analyses.

Finally, the fourth measure is to continue carrying out awareness-raising activities to inform the public about the detrimental effect of illicit trade.

More information

info@customs.uz

f.olimjonov@customs.uz