In an article published in October 2022 in WCO News, the Bahamas Customs and Excise Department (BCED) explained how it had strengthened its capacity to fight revenue leakages and losses by leveraging data analytics. Since the publication of that article, significant progress has been made and new tools have been developed, illustrating the Department’s determination to protect the revenue base while enhancing the business environment for the overall benefit of the nation.

In 2021, in a bid to help identify and recoup lost and evaded revenue at the border, the Ministry of Finance merged its Customs Post-Clearance Audit (PCA) Unit and its Inland Taxation Audit Unit into a single Revenue Enhancement Unit (REU). To support REU officers in identifying commercial fraud, it deployed a tool using artificial intelligence (AI) to analyse data collected via the Bahamas Electronic Single Window System (Click2Clear). The Post-Clearance Audit Section of the REU used the tool to identify cases of false declarations, misclassifications and invoice tampering. Within 24 months of implementing the tool, a significant increase was recorded in the revenue collected by the BCED, real property taxes and other sources of revenue.

As more fraud was identified, resources were required for auditing, investigation and collection purposes. In 2023, under the leadership of the Comptroller, Mr. Ralph Munroe, the BCED continued its efforts by expanding the REU. Today, Deputy Comptroller Cloretta Gomez oversees a unit made up of 10 auditors, 11 examination officers, three risk analysis officers and one intelligence officer. Their efforts in detecting activities involving undervaluation, misclassification and false declarations have led not only to an increase in revenue but also in the level of compliance of containerized imports. Recognizing the need to build stronger intelligence-gathering capabilities, the REU will hire another intelligence officer in the very near future.

Building skills

Cognizant that technological advancements need to be accompanied by trained and specialized Customs officials who can navigate the intricacies of any new technology, the Department invested heavily in the training of Customs officers and other agency personnel so as to enable them to execute their duties effectively in the new digital environment built around Click2Clear.

An app for passengers to declare importations

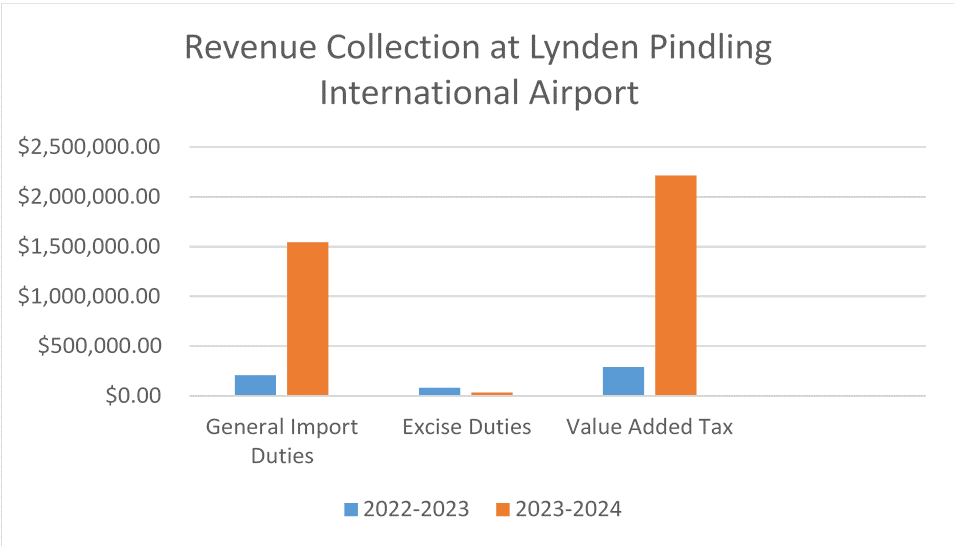

One of the new digital tools forming part of this environment is the “Exempt” application. Launched in June 2023, the application enables passengers to declare goods electronically prior to their arrival. The key features of this app include a duty calculator to determine the correct duty to be paid, an exemption tracker that helps to keep track of the exemptions that have been used, an online payment facility and a mobile scanning process that makes it easy to scan receipts obtained from the purchase of goods. For the first time, the BCED was able to track and generate statistics on the importation of goods entering the country in passengers’ baggage. The app also allows for the creation and management of risk profiles and the ability to track high-risk items moving through the country. Since its introduction, the BCD has realized substantial revenue growth of nearly 600% (see figure below). The data also provide a source of information for the national security apparatus of the Bahamas.

Digitalization of the management of permits and tax concessions yields success in identifying fraud

The BCED embarked on a mission to further streamline the Customs clearance process by launching the Other Government Agencies (OGA) portal within Click2Clear. While the Single Window environment facilitated the electronic submission of declarations and documents and dispatched data to all regulatory agencies, the OGA portal enables the BCED to receive and process applications for permits and tax concessions applied to international purchases under certain conditions.

The results have been robust and multifold. Tax concessions can range from general home consumption exemptions for Bahamian residents or businesses to those for emergency situations, natural disasters and so on. The paper-based system had allowed abuse and fraud to go undetected. The OGA portal enables the Government to obtain a more accurate accounting of the number of concessions granted and identify potential abuse of tax concessions and permits, while providing companies with an electronic platform for tracking their approval status.

Enhancing risk management

The BCED recognized the need to tap into and improve its internal resources related to risk management, thus developing a new risk management module called the Architecture Risk Analysis (ARA) system. Using network analytics, predictive analytics, anomaly detection and text analytics, the new system looks for blacklisted entities and unusual transactions. Geofencing tools based on positioning technologies are also leveraged to receive alerts when a ship enters or leaves a zone unexpectedly, or when a movement does not make any sense.

The ARA system is fully integrated with Click2Clear to enhance the capacity of the BCED holistically and systematically to monitor and assess the risks that come with incoming shipments, thereby assisting Customs officers in charge of risk management to identify those shipments that require further security, checks and inspections.

Thanks to this approach, revenue collection reached a record level in 2023/2024, business compliance rates have increased, the average time required to complete Customs clearance has been reduced, as well as the time required for completion of Customs processes. These processes include clearing air and sea manifests, processing temporary import/export operations and handling refund requests, as well as managing warehousing and cargo movement procedures.

As the BCED continues to develop its digital infrastructure and analytical capacity, efforts are also being made to enhance data integration and enable effective information sharing between Customs and other agencies. The objective is to obtain a comprehensive overview of the compliance of importers and exporters and to be able to streamline processes in order to increase the ease of doing business.

These agencies include the following:

- Road Traffic Department, which is responsible for managing vehicle licensing and registration;

- Immigration Department for the purpose of sharing data on persons arriving in the Bahamas;

- Department of Statistics for national statistical purposes; and

- Department of Inland Revenue with a view to providing real-time data on business licensees and VAT registrants regarding their level of compliance.

The creation of a portal for data sharing is in line with the Department’s broader goal of creating a fully digitalized, intelligent compliance environment for Customs, while complying fully with international standards.

The expansion of the Revenue Enhancement Unit, the development of new digital services and the implementation of superior analytical functions within both the Risk Management Unit and the REU have all positioned the Bahamas Customs and Excise Department to emerge as a reference of modern Customs administration.

The Comptroller of Customs is committed to the task of raising the standard of the BCED to the highest level of excellence and efficiency. For further information, he may be contacted at the email address below.

More information

Ralph Munroe