Bahamas Customs takes huge leap forward on recouping lost and evaded revenue

12 October 2022

By Chris Thibedeau, Mike Squirrell, Nabil Almouslli, TTEK Inc., with Simon Wilson, Financial Secretary, Bahamas Ministry of Finance, and Cloretta Gomez, Assistant Comptroller, Bahamas CustomsThrough the use of AI analytics, Bahamas has identified over 115 million USD in evaded revenue since 2020, while simultaneously modernizing its revenue collection management capabilities.

In 2020, Bahamas Customs began seeking solutions to help identify and recoup lost and evaded revenue at the border. While significant modernization efforts have already been made towards deploying an Electronic Single Window System to promote coordination and interoperability between Customs and Other Government Agencies for the cross-border movement of controlled and regulated goods, the government Financial Secretary realized that Customs revenue management needed to be enhanced and strengthened. That year, the Bahamas Government sought out the expertise of a firm to deploy Artificial Intelligence (AI) technologies to identify suspect shipments. In the first phase, a diagnostic was conducted of Bahamas Customs’ ability to identify, and recoup lost or evaded revenue at the border.

Enhanced Capacities and Assessable Results

Using AI-based analytics, and a small snapshot of historical import declarations, the firm initially identified over 28 million USD in evaded revenue likely owed to the government. Most of these suspect historical importations were flagged for attempts at undervaluation, misclassification, and misdeclaration of origin. The suspect importations were then referred for a more in-depth Post Clearance Audit (PCA) to confirm or negate the findings. The process also highlighted the potential misuse of permits and concessions.

The diagnostic highlighted the need to modernize the PCA programme by creating a single Revenue Enhancement Unit (REU) that would merge both Customs PCA and the Inland Taxation Audit Unit into one cohesive programme and a sound operational set-up. As both entities fall under the Ministry of Finance, the merge was a natural and logical decision as it would further enhance the “ease of doing business” in the Bahamas.

With the REU now in operation, and the deployment of new technology in place, the results continue to be impressive in terms of revenue collection. Analyzing a small data set from 2 August 2018 to 19 October 2021, and focusing only on a few HS codes to start with, Bahamas has already identified over 115 million USD in evaded revenue, representing 5% of the revenue collected during this period. As audits and collections are underway, the Administration is aware of the need to strengthen the REU and to hire and train new officers. As more fraud is identified, it is also clear that more resources are required for auditing, investigation and collection.

How the Solution Works

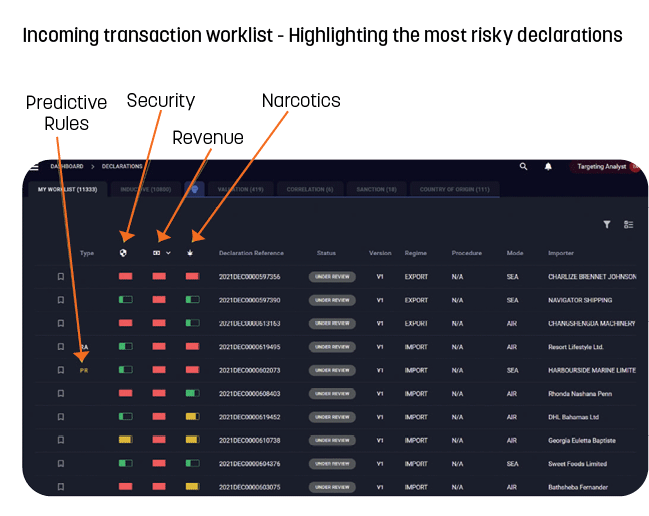

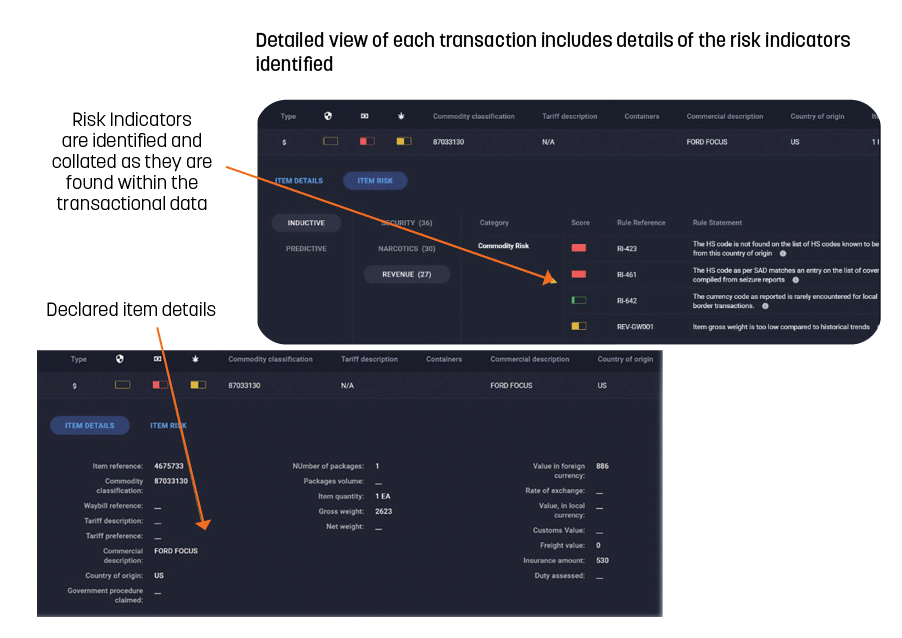

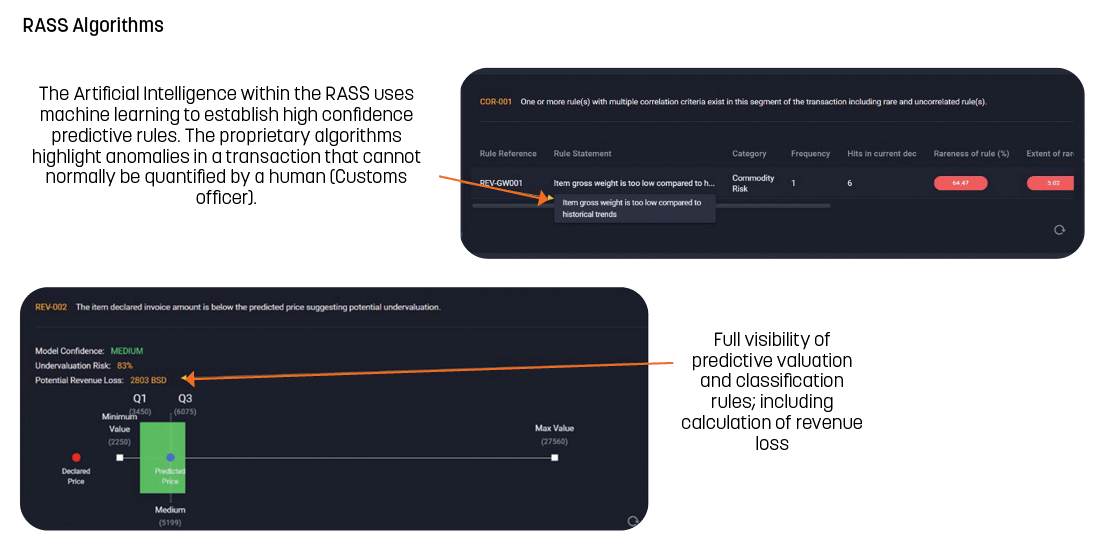

The technology selected by Bahamas is deployed as a service under a subscription license. Called the “Risk Assessment Screening Service (RASS)”, the solution uses a combination of deductive (vetting of watch lists and commodity targets) and inductive (identifies known risk indicators found within the trading data) analytics. It also applies predictive modelling, using proprietary algorithms to identify suspect shipments and importations. These models draw upon all available historical data and establish relationships in the data to identify normal behaviours and anomalous or suspicious transactions. Customs can then use the outcomes to support decisions with scenario-based targets to identify and select suspect shipments for both fiscal and non-fiscal threats. The algorithms modify themselves or create new algorithms in response to learned inputs and new data, in an automated model.

Each transaction receives a risk score, with an appended scorecard summarizing the inherent risk and an indication of whether the shipment is High (red), Medium (yellow), or Low (green) risk. The objective is to provide a better understanding of risk by assigning numerical values to factors representing different types of threats and the danger they pose.

The service uses a rules engine of 1.5 million rules and risk indicators to establish threats of evading revenue owed, including undervaluation attempts, misclassification attempts, and misdeclarations of country of origin. This risk indicator library is the largest and most extensive of its kind available on the market. It also includes the risk indicators listed by the WCO in its Risk Management Compendium. Risk patterns are extracted in the form of risk profiles. Risk profiles provide an objective and quantitative analysis of the factors that might cause threats to the clearance process.

Benefits

The major benefits obtained by Bahamas thus far include the following:

- Bahamas can now obtain a full risk assessment on trade transactions in real time, allowing Customs officers to take any necessary action at the first point of operational intervention.

- Methodologies used are leading edge and are more advanced than those used by the most advanced administrations.

- Risk indicators are continually updated (AI), ensuring that the process is tailored exclusively for Bahamas trade and always pulsing to identify the latest smuggling threats and trends.

- Predictive models and algorithms for valuation, classification, country of origin, and sanctions lists are updated dynamically and in real time.

As for the benefits offered by the tool in terms of implementation, they are as follows:

- The service paid for itself in just a few weeks of operation.

- It was implemented in phases, and benefits were proven to be fully realised at each step of the implementation.

- It used a secure cloud-ready environment and was deployed and operational in just a few days.

Way forward

For the time being, the solution focuses on identifying fiscal threats for improved targeting and selectivity by the PCA unit. However, the RASS includes additional modules and may be expanded to enable Bahamas Customs to identify non-fiscal threats (narcotics, weapons, prohibited items, etc.) before cargos enter the country, for inspection on arrival.

With about 1.5 million rules and risk indicators continually updated and expanded, the RASS can therefore provide a full risk assessment and inspection lifecycle management system. It also provides for the collection and use of field results for inspections, seizures, and other enforcement actions.

The RASS also includes proprietary rules and risk indicators for the identification of non-fiscal threats including narcotics smuggling, security threats, weapons and ammunition, prohibited items, agricultural threats, endangered species, chemical weapons precursors, dangerous goods and hazardous materials, pandemic threats, illegal migration, and more. While the system can identify potential threats, the Customs Administration has full configurability to prioritize the threats deemed most significant or likely to cause damage to the country’s sovereign interests. Steps can then be taken to address and negate the potential threat, collect inspection or audit results, and use this outcome data for machine learning to complete the AI lifecycle within the RASS technology framework.

The solution can also support coordinated border management by including risk indicators developed with or for Other Government Agencies (OGAs), as well as inspection workflows to enable operational coordination between various teams.

By investing in technologies, Bahamas is on pace to recoup significant revenue loss it would never have realized otherwise. This additional revenue will help bolster government programmes to the benefit of all Bahamas citizens.

More information

www.ttekglobal.com

www.bahamascustoms.gov.bs

Bahamas Ministry of Finance:

Simon Wilson, Financial Secretary, Bahamas Ministry of Finance

simonwilson@bahamas.gov.bs

Cloretta Gomez (Mrs.), Assistant Comptroller of Customs, Customs REU, clorettagomez@bahamas.gov.bs

TTEK Inc.:

Chris Thibedeau, Founder, Chris.Thibedeau@ttekglobal.com, +1-613-884-8162

Mike Squirrell, Chief Technology Officer, Mike.Squirrell@ttekglobal.com, +84 165 773 1730

Nabil Almouslli, Director Consulting, Nabil.Almouslli@ttekglobal.com, +1 (647) 212-2523