Dubai Customs’ five-year leap in e-commerce facilitation

26 October 2025

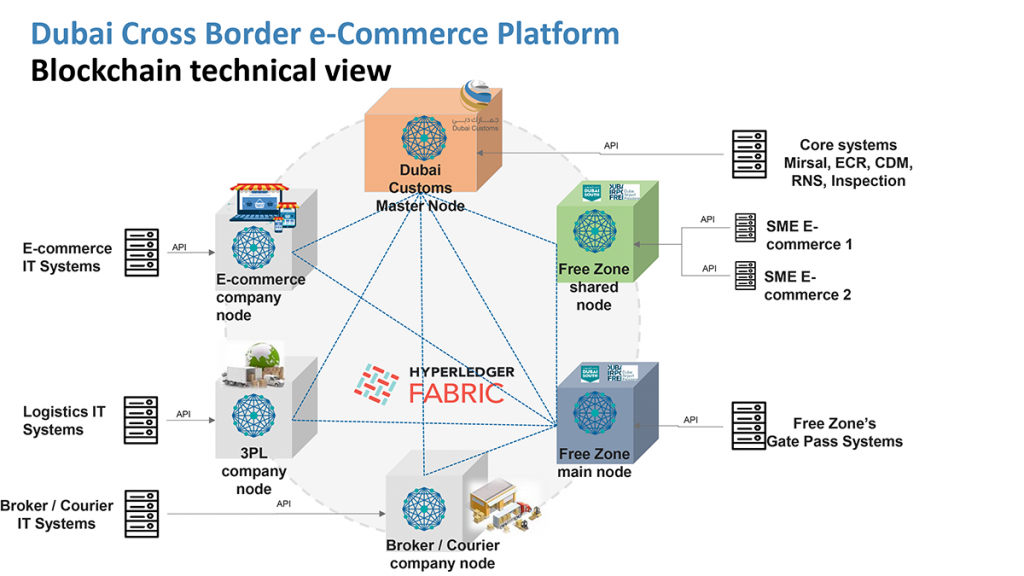

By Dubai CustomsWhen Dubai Customs unveiled its blockchain-based e-commerce facilitation platform in early 2020,[1] it was initially viewed as an ambitious experiment. It was the first of its kind among the Customs community, designed to provide full visibility and traceability over e-commerce supply chains by connecting Customs systems seamlessly with e-commerce companies, logistics providers, couriers and free zones on a single, secure ledger. Just five years later, that experiment has evolved into one of the world’s most advanced digital trade ecosystems.

The platform is now a cornerstone of the Dubai Government’s broader E-commerce Strategy, which aims to solidify Dubai’s position as a global e-commerce hub through the facilitation of trade operations going in and out of Dubai Free Zones. It encourages foreign direct investment, attracts global e-commerce players to set up regional headquarters and reduces operational costs for businesses – making Dubai an ideal gateway for e-commerce. It also actively shapes e-commerce policy, expands trade corridors and directly supports the UAE’s Digital Economy Strategy 2025 and the Dubai Economic Agenda (D33), which aims to double the size of Dubai’s economy over the next decade.

From blockchain foundations to AI acceleration

The original platform was built on Hyperledger Fabric blockchain technology, providing immutable, tamper-proof trade records and transparent transaction histories. While Dubai Customs hired a technology provider to develop certain components, the platform is fully owned by Dubai Customs and managed by its internal technology team.

To be registered on the platform, a company involved in e-commerce trade must have a legal presence in Dubai, be registered in the Dubai Customs Registration system and operate through a free zone, and hold a Tax Registration Number (TRN). Importation and exportation must be managed through free zones (enclosed areas within Dubaï Customs territory where foreign goods can be introduced free of import duty, other changes and commercial policy measures): e‑commerce platforms or vendors pre-stock goods in free zones; these goods are processed as parcels and released through Customs only after consumers place orders online. Additionally, companies operating on the mainland, as well as courier and broker companies holding mainland licenses, can also join the platform to facilitate operations with their customers.

Since its inception, the platform has evolved significantly and is now integrated with artificial intelligence (AI) powered Customs systems featuring key functions: automated Customs audits, predictive shipment routing, real-time risk profiling of parcels and traders, and immediate compliance checks.

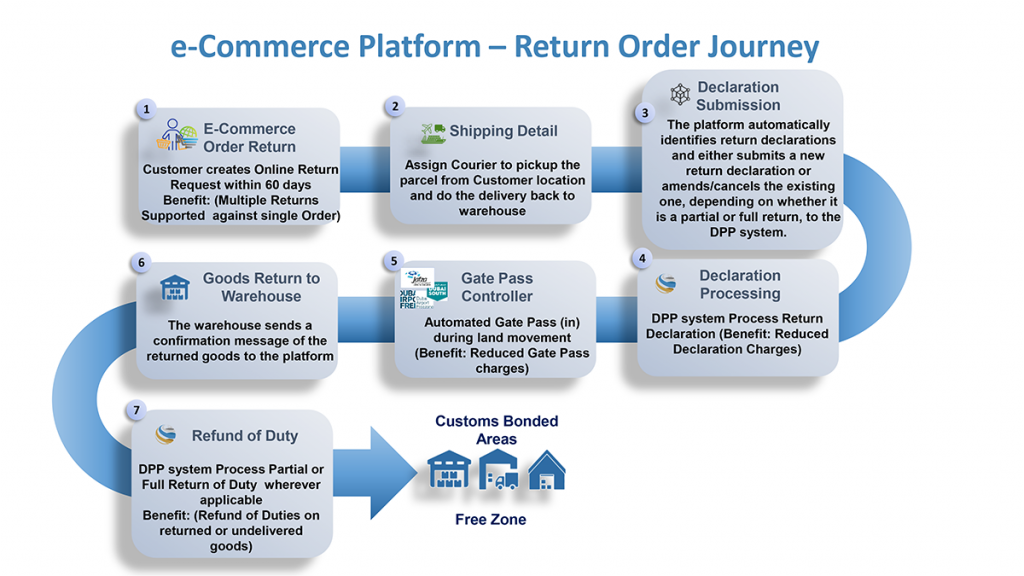

These AI-driven capabilities have helped reduce clearance times. This remarkable performance improvement earned Dubai Customs international recognition, including the prestigious Hamdan Flag for Government Innovation. Another major breakthrough is the complete digitalization of the e-commerce returns process, enabling instant duty adjustments with no manual paperwork or delays – resolving one of the sector’s most persistent operational challenges.

Data flows

E-commerce transactions and their delivery processes are largely computerized, with each participant holding specific data at specific points in the transaction timeline. The blockchain platform collects data from each participant and shares relevant portions among stakeholders.

When an e-commerce business (the shipper) registered on the platform receives an order for goods to be imported into Dubai Customs territory, the order data is transmitted directly to the platform, and a Customs declaration is automatically created. The data is also shared with the transporter in charge of delivery.

Overall, the process flow is as follows:

- The e-commerce company (the shipper) receives the online order from the customer.

- Order details are shared with Customs through the platform.

- The e-commerce company (in case of self-fulfilment) or the 3PL company provides the shipping/transportation details, which are also shared with Customs.

- Based on this information, e-commerce declarations are automatically generated and approved after completing internal processes such as risk assessment. Duty and VAT are paid by the e-commerce or 3PL company, depending on their onboarded business model.

- The declaration clearance message is shared with the e-commerce company (in case of self-fulfilment) or the 3PL company or the broker, as well as with the last-mile delivery provider (if a separate company). A Free Zone Gate Pass is generated, and exit information is shared with Customs.

- Goods are shipped either to the mainland or to the rest of the world.

- Once the goods are delivered to the end customer, a delivery confirmation message is shared with Customs, completing the e-commerce transaction.

Duty and VAT payments

Customs customers (e-commerce companies, 3PLs and brokers) maintain accounts with Dubai Customs, such as Credit/Debit Accounts, Standing Guarantee Accounts and Virtual Guarantee Accounts. These accounts are used to pay applicable charges and are also credited in the case of duty refunds. VAT, on the other hand, is managed through a separate account uniquely linked to the TRN and administered by the VAT authority.

Strategic partnerships and collaboration

The platform’s success is as much about its partnerships as its technology. Its rollout would not have been possible without strong collaboration from Dubai’s leading free zones, including Jebel Ali Free Zone (JAFZA), Dubai Airport Free Zone (DAFZA) and Dubai South.

Key companies already live on the platform include DHL, FirstCry, DB Schenker, Reliance Freight Systems and Al Tayer Insignia. These early adopters process thousands of declarations daily and benefit from waived service charges on e-commerce declarations and claims. Duty is waived on shipments with CIF value under AED 300. Each order will generate a Customs declaration. If two items belonging to two different sellers are ordered, resulting in two different invoices, two Customs declarations will be created. Duty waiver is applied based on the CIF value of the goods in each declaration.

More partners are in advanced testing, with integration expected to be completed by late 2025. This group includes industry giants like Landmark Group, DP World Logistics, FedEx, Hellmann, Naqel and Aramex. Their onboarding will scale platform adoption across diverse industry verticals – from fashion retail to electronics and cross-border marketplaces.

Dedicated e-commerce hubs like Dubai CommerCity and EZDubai have also played a special role. They are not only onboarding large players but also piloting “shared blockchain nodes” for SMEs. A node is a computer that shares a copy of the blockchain and is synchronized with other nodes. Under this shared services model, instead of each e-commerce company setting up its own blockchain node, they can use a shared node established by the hubs and integrate with it through APIs to share their orders and shipping/transportation details. This model drastically reduces technical and cost barriers, enabling smaller e-commerce companies to join the platform with minimal investment while still accessing the full range of policy benefits, including duty and service charge exemptions. However, there is a cap on daily order processing through the shared node.

Data-driven impact and risk management

The platform collects e-commerce order data, rich product descriptions and shipping details directly from source systems. All data is authenticated with digital signatures, and permits are automatically validated to ensure companies hold the necessary approvals.

Providing granular details at the e-commerce order level, the platform also enables end-to-end tracking from purchase to delivery and returns. This gives Dubai Customs a comprehensive analytical view of goods movement, as well as the ability to cross-reference data from different parties – drastically improving risk management.

The Administration can now effectively detect and address risks such as undervaluation and misclassification. This wealth of data also helps shape better policies, giving Dubai Customs a competitive edge and positioning the emirate as a leader in trade facilitation.

Impact

Since the Customs E-commerce Policy launch, the data has been compelling. From 2023 onwards:

- 72,000+ B2B e-commerce declarations have been processed (CIF value: AED 2.4 trillion)

- 17 m+ B2C declarations have been processed (CIF value: AED 4.2 trillion)

The UAE’s total e-commerce revenue reached $8.8 billion in 2024, with projections to hit $13.8 billion by 2029. The waiver of service charges has provided substantial cost savings, creating a powerful incentive for adoption and compliance.

Dubai Customs is targeting a shift of 20-30% of all low-value courier shipments shipping e‑commerce goods – approximately 5 to 10 million declarations annually – to the platform.

By integrating major logistics multinationals and SMEs, Dubai Customs has ensured that the benefits of advanced trade facilitation are inclusive. The platform’s reach is also deeply regional, supporting GCC-wide e-commerce corridors and enabling faster, compliant trade between the UAE, Saudi Arabia, Oman and beyond.

The national impact is clear:

- Foreign direct investment (FDI) in e-commerce and logistics reached AED 14.24 billion in 2024 (+33% YoY).

- 58,680 new jobs have been created in warehousing, fulfilment and last-mile delivery.

- Significant growth has been recorded in port and air cargo volumes, fulfilling Dubai’s D33 vision of becoming a global hub for logistics-driven economic expansion.

A model for global Customs innovation

This evolved platform represents a new template for cross-border trade facilitation, promoting the use of national free zones to provide clarity and visibility on e-Commerce shipments. Dubai Customs’ journey demonstrates that digital transformation in Customs is not only possible but also highly achievable with the right combination of policy, partnerships and technology. The future roadmap – including integration with permit authorities, a B2B expansion module and trade finance connectivity – will extend the platform’s influence beyond Customs clearance into the full trade and supply chain finance cycle. This will cement Dubai’s position as a global model for e-commerce facilitation.

More information

Contact Dubai Customs Client Relations office

[1] See article published in February 2020 in WCO News 91 edition Dubai Customs introduces blockchain-based platform to facilitate cross-border e-commerce – WCO