How the Customs Integrity Perception Survey helped reinforce integrity in El Salvador and Mozambique

25 June 2024

By the WCO’s Anti-Corruption and Integrity Promotion (A-CIP) ProgrammeThe WCO Customs Integrity Perception Survey (CIPS) makes it possible to check how a Customs administration is perceived by its own staff and by individuals who engage with them in the areas of promoting integrity and combating corruption. Thus, the CIPS is an instrument that can help improve the capacity of Customs administrations to measure their performance in these areas. In this article the Customs Administrations of El Salvador and Mozambique, having conducted the survey, explain what is involved and how the CIPS has helped them to identify areas for improvement and strengthen their dialogue with the trade community.

El Salvador and Mozambique are among the WCO Members partaking part in the WCO’s Anti-Corruption and Integrity Promotion (A-CIP) Programme for Customs administrations. The Programme has benefited from the financial support of the Norwegian Agency for Development Cooperation since it was launched in 2019, and of the Canadian Government since 2021. As part of the Programme, the Customs Administrations of El Salvador and Mozambique have each conducted two Surveys to find out how Customs officials and private sector stakeholders perceive the level of Customs integrity, and to collect experiences and data on existing behaviors. By conducting the CIPS twice, with a two-year gap as recommended by the WCO, the Administrations were also able to assess the success of their integrity and anti-corruption measures over time.

About the CIPS

The CIPS is made up of two questionnaires, one for Customs officials and one for private sector stakeholders. It is based on two important principles, as follows:

- each question is designed to collect information that a Head of Customs can act on, or make a decision on. The objective is to avoid collecting aggregate data which does not provide sufficiently specific information, or provides information which is irrelevant to the domain of Customs administration and operations, thus making it impossible to act upon.

- the questions are grouped into modules around each of the 10 key factors of the WCO’s Revised Arusha Declaration.

The combination of both internal and external perspectives (i.e., both Customs officials and private sector stakeholders) provides a 360-degree overview of how the Customs administration is seen to perform in terms of integrity and combating corruption. For each of these two target groups, a set of performance indicators has been developed to quantify to what extent a certain goal is being achieved, with each individual indicator being linked to a question. The questions posed are intended to measure either perception or behavior.

The metrics used to assess performance under each indicator are similar for both questionnaires. The main metric used is the extent of agreement with a specific statement, along a 4-point scale ranging from “Strongly agree” to “Strongly disagree”. A second metric employed regularly throughout the questionnaires is occurrence and frequency of occurrence (i.e., Always, Often, Sometimes, Never). This is used particularly to measure behavior – i.e., whether and/or how often the respondent has engaged in certain behaviors. A specific type of behavior-related question included in both questionnaires is a scenario test. In these questions (specific to each target group), the respondent is presented with a hypothetical scenario, along with some possible reactions to it.

The responses to the questions are scored on a 4-point Likert scale; a weighted mean, or score, can be calculated for each indicator. The most positive response has the greatest weighting, i.e., 3, and the least positive response, 0. The higher the score for a given indicator, the more positive the result.

The scores presented in this article represent the average for the modules.

Roll-out of the Survey

The WCO A-CIP Team managed the development of the Survey itself, designing the approach and the methodology employed. It also provides technical assistance and support to Customs administrations in terms of interpreting the Survey results and taking action accordingly. However, when it comes to implementing the data collection in-country, the Team hires independent consultants selected through an international competitive tendering process.

In both countries, the Surveys were conducted using a hybrid mode of computer-assisted interviews (hybrid CAWI). Specially encrypted computer tablets, or Mobile Survey Stations (MSS), were used to display the questionnaires and record the responses. The respondents, once their eligibility had been validated by a third party, were given a single-use token to use the MSS to complete the Survey anonymously. Several protocols were put in place to ensure the integrity of the data. Initial data analysis was conducted using a Microsoft SQL server. Both Customs administrations were provided with a .CSV file via a secure data transfer link containing the complete data sets, which could then be handled by their own internal analysts using their preferred data analysis tools.

One important task before the rollout of the Surveys was to determine the sample sizes, or the number of responses that needs to be collected. The data received from the participating Customs administrations as well as open-source company databases served as an estimate of population sizes to determine the relevant sample sizes for the survey in the respective country. Moreover, the Surveys were conducted with a target margin of error of 4% and a confidence level of 95%. A margin of error of 4% states that the results from the survey may deviate up or down by 4% from the actual values that would have been obtained if the entire population had been surveyed. A confidence level of 95% means that, if a survey is conducted 100 times, in 95 cases the true value lies within the confidence interval.

In El Salvador

As the questionnaires are intended to cover the entirety of the integrity improvement framework set out in the Revised Arusha Declaration, they contain an exhaustive list of indicators/questions. The WCO Secretariat advises administrations to identify their priority areas and focus on the indicators that are most relevant to their evaluation needs and strategic goals.

The General Directorate of Customs (DGA) of El Salvador decided to use the full set of CIPS indicators to conduct both iterations of its CIPS, aiming to gain a comprehensive understanding of how Customs officials and private sector partners perceive the level of integrity of the Administration. While gaining this broad view, the DGA also focused on those indicators that would help them tack issues related to two specific key factors in the Revised Arusha Declaration, namely Reform and Modernization, and Audit and Investigation that it had identified as priorities.

First Survey

The DGA rolled out the first CIPS between November and December 2021 in San Salvador (the country’s capital and largest city) with the data collected by the independent service provider (EY Germany). In total, 504 employees and 213 private sector representatives responded. Statistically speaking, these sample sizes produced a confidence level of 96% and 94%, respectively, guaranteeing that the responses were reflective of the wider target populations. The private sector target group consisted of stakeholders who were presumed to interact with Customs agencies as part of their business operations, such as brokers, carriers, importers and exporters, and industry associations.

Experts from the WCO A-CIP Programme worked with DGA staff to produce a summary analysis of the data, taking into account both the A-CIP Programme objectives and the DGA’s own strategic priorities.

The following opportunities for improvement were identified:

- Strengthening of human resources, through training.

- Creation of an internal affairs department.

- Automation of key Customs procedures.

- Coordination of working groups with the private sector.

- Renewal of Customs infrastructure.

Following the Survey, a number of measures were taken to automate processes and modernize regulatory frameworks and human resource management, including for example:

- Implementation of electronic baggage declarations.

- Launch of new digital services.

- Modernization of the border posts of “El Amatillo” on the border with Honduras, and “Anguiatu” on the border with Guatemala.

- Development of the new Salvadoran Customs Code (CAS).

- Promotion of the national AEO programme called “Reliable Operator Programme”.

- Adoption of a human talent management approach through timely hiring, benefits management, training management and infrastructure improvements.

- Use of the WCO’s CLiKC! e-learning platform.

- Deeper integration with Honduras and Guatemala through Customs Union.

Second survey

The CIPS is designed to track the evolution of integrity performance in Customs administrations by offering a standardized measurement instrument that can first set a benchmark, and subsequently be implemented repeatedly over time to assess the success of measures taken to improve integrity.

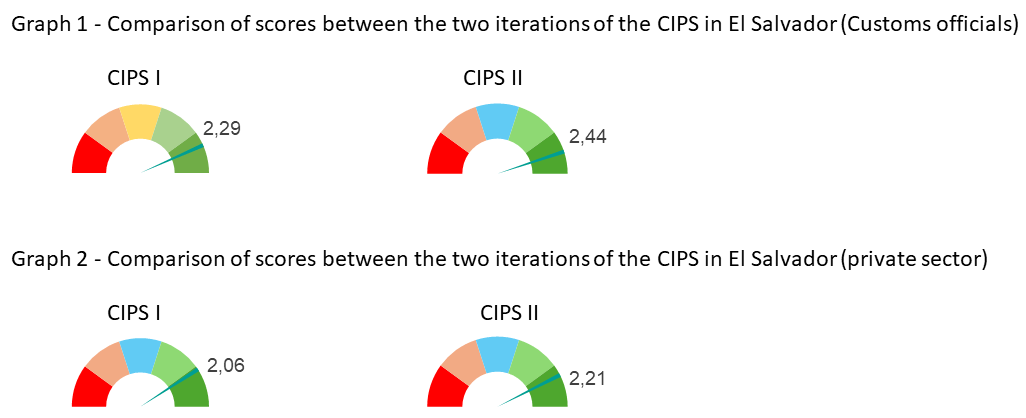

The second CIPS was carried out between September and October 2023. On this occasion, data was collected from 458 DGA employees by another independent service provider (PwC Germany); and from 441 private sector representatives – more than double the number involved in the first CIPS – also took part. The number of responses received was sufficient to ensure that the results would accurately reflect the true opinions of both the private sector and the Customs personnel, with a confidence interval of 97% for the former and 96% for the latter. The responses show an improvement in how Customs officials and the private sector perceive the DGA.

The Customs officials who participated in this second CIPS were more positive about all the areas covered by the ten key factors in the Revised Arusha Declaration. Both of the priority key factors chosen by the DGA (Reform and Modernization, and Audit and Investigation) saw significant improvements; for example, compared to the first CIPS, 13% more respondents to the second CIPS agreed fully that they were involved in the DGA’s modernization programmes to promote integrity, and 14% more respondents expressed confidence that these programmes could reduce the risk of corruption. Regarding the perceived safety of whistleblowing, 15% more respondents indicated that they would feel safe to report integrity violations, and 31% more agreed that reports of integrity violations were investigated in a fair manner.

Positive results were also gathered from the private sector segment of the Survey. 15% of the respondents confirmed their involvement in the DGA’s modernization plan, and the vast majority of them (98%) expressed satisfaction with how the DGA had followed up on their feedback.

In both Surveys the DGA obtained global scores above 2, placing it close to the ideal score of 3.

Transparency

The DGA is committed to improving transparency, and the results of both Surveys have been published on the DGA’s website, in an interactive and user-friendly manner in order to facilitate their understanding. These efforts have been recognized and applauded by the private sector.

Way forward

Guided by the insights obtained from the Surveys, the DGA is continuing to deploy efforts with the support of the A-CIP Programme Team. The activities being carried out include the preparation of a Code of Ethics and Integrity, the creation of the Internal Affairs Unit, the implementation of ISO Anti-Bribery Standard 37001-2017, the strengthening of the training programme for DGA personnel, and the expansion of reporting channels through the use of social networks, chat and email, among others.

In Mozambique

As part of its integrity promotion efforts, the Mozambique Tax Authority (AT) has been focusing on collecting and analysing evidence to inform policy development. Conducting the CIPS was at the core of this strategy. With support from the WCO A-CIP Programme, the AT conducted two iterations of the CIPS, using the full set of questions.

Results

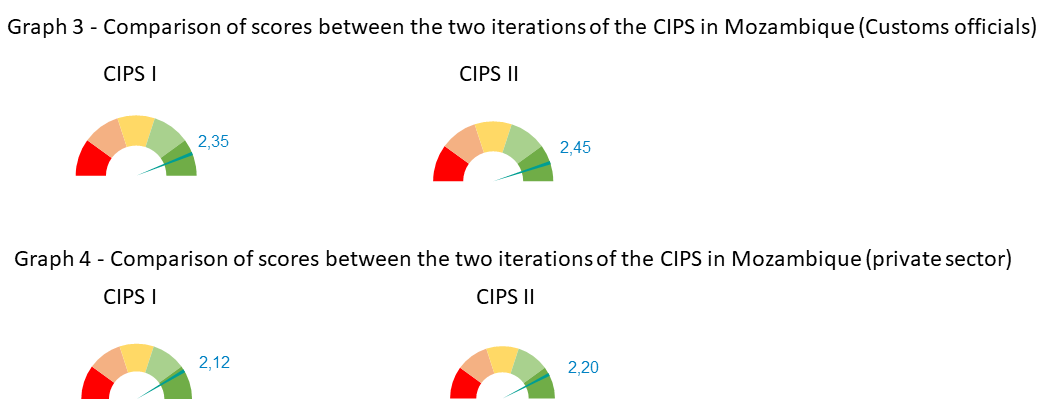

The AT’s first iteration of the CIPS was conducted in 2021 at the three largest sea ports (Maputo, Beira and Nacala), Maputo Airport, the Tete Customs office and the Ressano Garcia border post. AT employees and private sector representatives involved in trade operations at the selected points of entry were randomly invited to participate in the Survey, responding anonymously on specially encrypted tablets. A total of 211 Customs officers and 123 private sector representatives completed the Survey, giving the AT a statistically significant snapshot of both groups’ perceptions with a confidence internal of 94% for Customs officials and 92% for the private sector.

Two years later – in 2023 – the AT repeated the Survey at the same locations, this time with 298 Customs officers and 305 private sector representatives responding, producing a confidence internal of 95% and 96%, respectively. A comparison of the data collected from the two iterations of the CIPS was produced with the support of A-CIP.

On both occasions the AT obtained global scores above 2, with the results gathered from Customs and private sector representatives being slightly more positive during the second iteration of the Survey.

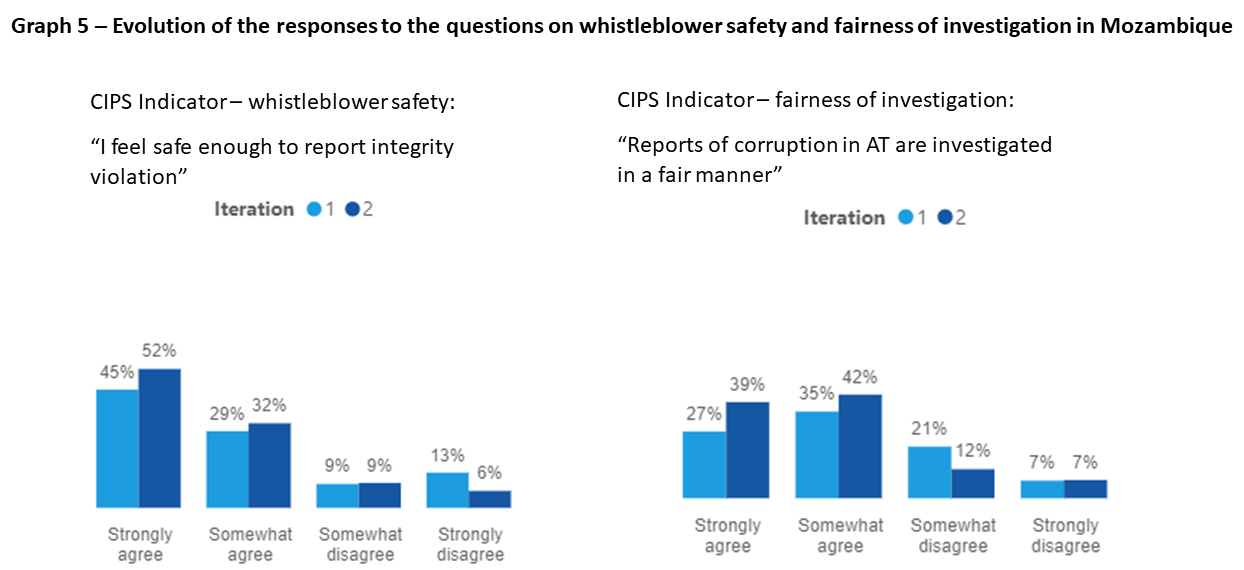

In the second iteration, more AT officials expressed confidence that they would feel safe enough to report corruption, and agreed that reports of corruption are investigated fairly (see graph below). Moreover, the percentage of private sector respondents strongly agreeing that they feel responsible for achieving high standards of integrity when dealing with AT officials went up from 82% to 87%.

Transparency fosters dialogue

The AT published the results of the CIPS to help build trust with its private sector partners and with society as a whole. Disseminating the CIPS results provided an opportunity to bring together representatives from ministries and governmental agencies, the AT, Port authorities and business and traders’ associations[1]. The meetings were carried out in the main provincial capitals of Mozambique, namely the cities of Maputo, Beira and Nacala Porto, and involved provincial representatives from the three regions of the country: South, Center and North.

The CIPS, and these meetings that followed on from it, played a crucial role in launching the opening-up of communication between all these actors, providing valuable information to guide discussions and strengthening civil society engagement in combating corruption. A number of critical issues were identified through dialogue, including lack of harmonization of Port timetables, lack of consistent communication between Micro Importers Associations and Customs, and lack of disclosure of procedures.

Taking action

The AT has taken steps to address these issues, such as introducing harmonized timetables in all the three main Ports, updating its Customs procedures and publicizing more strongly the periodic meetings organized with private sector representatives, during which they can come forward with their concerns. In addition, the AT aims to improve bulk merchandise export procedures, set up a pilot communication channel for reporting corruption, and engage further with the private sector regarding the simplification of Customs procedures.

Lessons learned

After supporting over 20 of its partner administrations in conducting CIPS, with 18 of them having repeated the Survey a second time, the A-CIP Programme Team has learned lessons about how to ensure successful implementation of the Survey. These lessons are presented below.

Survey preparation

- Understanding the diversity of partner administrations and offering tailored support: different administrations may have unique contexts, challenges and priorities.

- Communicating to key stakeholders on the purpose of CIPS, its methodology and processes: national contact points can use the Guide to CIPS and Frequently Asked Questions Sheet to inform Survey participants and address their questions.

Survey implementation

- Ensuring the presence of staff from the Customs administration: even though the CIPS is run independently by a third-party service provider, there is still a need for the presence of staff from the Customs administration in order to facilitate communication in the native language(s), reassure respondents regarding the confidentiality of data, and react to ad-hoc issues in a timely fashion.

- Tracking results weekly: weekly reports of the number of respondents surveyed can reveal the gap between the responses collected and the target, thus allowing the Survey implementer to take immediate action.

Survey analyses

- Producing summaries of Survey results: short data reports facilitate the communication of the results.

- Distributing and publicizing the CIPS results: results should be communicated and discussed, to ensure transparency and foster stakeholder engagement and dialogue.

Conclusion

Although developed for the administrations participating in the A-CIP Programme, the Survey can be deployed by any Customs administration wishing to evaluate and/or track its integrity performance in a more standardized way. Published on the WCO website, the Methodological Guide of CIPS contains the main materials needed for the organization of a CIPS, including an overview of the different options for data collection, their pros and cons. While on-the-ground data collection was implemented in the cases of El Salvador and Mozambique, an online survey offers a less resource-intensive option with some compromises with regards to the data. The WCO A-CIP Programme has supported the development of an online version of the CIPS. This online CIPS tool should be available to any interested WCO Member from the second half of 2024. The WCO Secretariat remains available for any questions on this matter.

More information

Capacity.building@wcoomd.org

Methodological Guide of CIPS

[1]Among the entities participating in the meetings were the Chamber of Dispatchers, the Confederation of Economic Associations of Mozambique, the Chamber of Commerce of Mozambique, the Timber Industry Association, Micro Importers Associations (Mukhero, Frescata, AMMO), Mozambique’s Ports and Terminal Management Concessionaires, and the Ministry of Industry and Commerce.