Why connection formulas in the WCO Harmonized System should be amended

25 June 2024

By Omer WagnerThe Harmonized System (HS) contains many formulas linking goods and their use. Such connection formulas add complexity to the classification of goods as they are not always well defined and the difference between them is not always clear. This article argues that only a couple of clearly defined terms should be kept, while undefined ones should be replaced.

Material versus usage

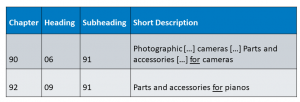

HS headings and subheadings often refer to a material or substance when describing goods, and some refer to their use by means of various formulas. Such “connection formulas” can be found in the text of the HS codes, as well as in the HS legal notes and the Explanatory Notes (EN). This article examines their use at the level of the HS codes only.

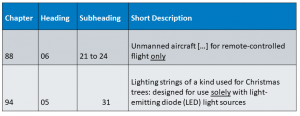

Exclusive use

Some connection formulas are exclusive, such as those using the words “only” or “solely”.

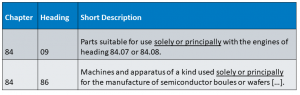

Almost exclusive use

The wording “solely or principally” is also used, implying an almost exclusive use.

In 2018, when settling a dispute between the Customs authority and an importer, an Israeli court ruled that monitors equipped with a high-definition multimedia interface (HDMI) connector were of the type “used solely or principally with computers”. The ruling rejected the Customs authority’s claim that such monitors were not solely to be used with computers.[1]

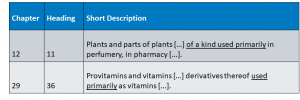

Primary use

Besides “used solely or principally”, the phrase “used primarily” is found in some descriptions.

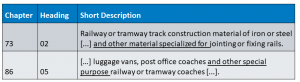

Special use

Some goods are characterized as having a specific or particular function or purpose.

This has been a stumbling block for Israeli courts many times and contradictory decisions have been made. The courts discussed the meaning of the terms, questioning whether they set an exclusive use, a primary use, or something else.

The following rulings, which refer to the Israeli nomenclature of goods with subdivisions at 7-8 digits, illustrate the issue:

- In 1997, a court ruled that the term “special” refers to a distinct, dominant but non-exclusive use, when discussing whether a beeper device was “special” for work use.[2]

- In 2001, using the same argument, a court ruled that radio splitters were not “special” for a motor vehicle, since they could be used for radios outside a vehicle.[3]

- In 2009 and 2011, courts ruled that the meaning of the term “special” is dominant, primary, with a specific use, when deciding that ironing machines were not “special” for the textile industry, since they also served the laundering industry.[4]

- In 2015 and 2017, courts discussed what would be considered a “special” filter for air-conditioning systems. For the magistrates’ court, special meant exclusive, and for the district court, special meant principal.[5]

- In 2021, a court was required to decide whether a communication device was “special for cable reception”. The court ruled that special meant exclusive or almost exclusive, and that the communication device concerned was not special for cable reception since it could be used with other types of internet connections.[6]

- In 2023, a court ruled that a machine to be used principally in the baking industry was to be classified as “special for” this industry.[7]

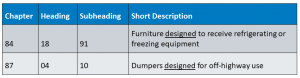

Designed

Designed can be defined as “made or done intentionally, intended or planned”, but it is not clear whether it refers to an exclusive or principal use, or something else.

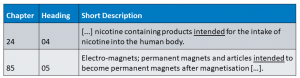

Intended use

Intended can be defined as “purposed or designed”. The European Court of Justice (ECJ) sometimes uses the “intended use” formula to classify goods, but sometimes ignores it.[8] Since an “intention” is something subjective, referring to an intention when classifying goods is problematic.

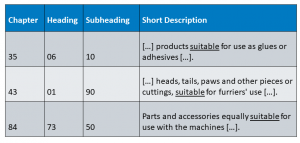

Suitable for a use

“Suitable for” and “equally suitable” are other connection formulas.

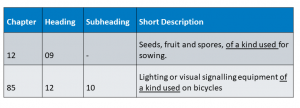

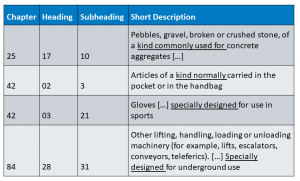

Goods of a kind

According to common opinion, the formula “of a kind” or “of the type” does not require a primary or special use.[9]

In 1998, a court ruled that a machine which could not be used to sell bus tickets at time of importation and needed simple adjustments to be used for this purpose was to be classified as a machine “of a kind used for selling bus tickets”.[10]

Goods for a use

“For” is the loosest connection formula. It does not require exclusive, primary, special, or intended use. If the goods can be used for the purpose defined, they can be classified under this description.

In 2007, a court ruled that to be classified under the subheading relating to “machinery and electrical appliances […] for television”, one of the uses of the goods concerned was to be for television and there was no need to prove exclusive or primary use.[11] The decision was appealed and the court issue the same ruling again in 2009.

More complex formulas

Some formulations are more complex, for example, “of a kind commonly used”, “of a kind normally used”, or “specially designed”. One might question the rationale behind the addition of adverbs such as normally, commonly or specially as this does not bring much clarity but, instead, adds complexity.

The HS needs fewer connection formulas, or none

The problem with the formulas in the HS connecting goods and their use is that they are not always defined and that the difference between them is not clear. Moreover, some subheadings combine two or more formulas, one at the heading level and one at the subheading level. In fact, importers may soon have to hire linguists, on top of accountants, lawyers, tax consultants and Customs brokers, to ensure they are compliant.

The suggestion made in this article is that Customs administrations which have ratified the HS Convention reduce connection formulas to three groups as follows:

- Exclusive use.

- Main use – other terms, such as principal, special and intended use, as well as designed for and suitable for, should be removed and replaced by main use.

- Any use.

The progress of technology is rapid and new products are invented every day, many of which can have multiple uses. This may raise the question of whether, in 2024, there will be products that have only one exclusive use.

Alternatively, since the “connection formulas” are quite subjective, the WCO could consider eliminating references to the “use” of goods, and instead limit itself to a narrow descriptive method.

More information

Issues discussed in this article are explained in more depth in the World Customs Journal (WCJ): Wagner, O. (2023). The connection formula in classifying goods under the Harmonized System (HS) Convention

[1] H.Y. Electronics and Components Ltd vs. The State of Israel, 2018. File no: 57133-11-12.

[2] Iturit Communication Services Ltd vs. The State of Israel, 1997. File no: 2512/93.

[3] Auto-Part Ltd vs. The State of Israel, 2001. File no: 1503/00.

[4] Tam. A.S. Industries Ltd vs. The State of Israel, 2009, 2011. File nos: 56946/06 and 2285/09.

[5] Filt Air Ltd vs. The State of Israel, 2015, 2017. File nos: 2846-10-12 and 5676-12-15.

[6] Hot Telecom Limited Partnership vs. The State of Israel, 2021. File no: 2670-08-15.

[7] Amit Frozen Pastry (2003) Ltd vs. The State of Israel, 2023. File no: 43468-12-21.

[8] “The ECJ also relies on an “intended use” criterion in its interpretive rulings under Rule 1. The Court argues that such criteria are too subjective: they are not inherent characteristics of the goods, so Customs authorities cannot rely on them at the time of importation.” Vermulst, E.A. EC Customs Classification Rules: Should Ice Cream Melt? 15 Mich. J. Int’l 1241 (1994). Pages 1271, 1282, 1283. https://repository.law.umich.edu/cgi/viewcontent.cgi?article=1556&context=mjil

[9] “To be classified in the tariff item, imports had to be capable of, or suitable for, use with the listed goods, but there was no need to demonstrate primary use or any actual use at all.” Irish, M., Objectivity and Statutory Interpretation: End Use in the Canadian Customs Tariff (2008) 46 Can YB Intl L 3-53. Pages 27, 28. https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2055329_code1086652.pdf?abstractid=2055329&mirid=1

[10] Haim Brunstein vs. Customs, VAT and Purchase tax Director, 1998. File no: 176271/96.

[11] Bi-Sat Ltd vs. The State of Israel, 2007, 2009. File no: 15119/03. 3507/07.