Moving from risk management to decision intelligence: what it means and where to start

3 March 2023

By Tom Saltsberg, Product Manager, CognyteThe delicate balance between facilitating legitimate trade and combatting illicit trade raises numerous challenges for Customs administrations. Three of these appear to be common to all administrations.

The first shared challenge is a disproportionate ratio of personnel to workload. This has always been a significant issue but now, with ever-growing e-commerce in cross-border trade, Customs officers need to track a significantly higher number of shipments, along with more paperwork and stakeholders.

This is amplified even more by the second common challenge: many administrations and Customs investigators need to analyse massive amounts of data, which is often scattered across disparate sources, making the efficient uncovering of Customs infringements extremely difficult.

The third challenge is that, even with a proportionate number of personnel and efficient handling of data, many Customs administrations still fail to share meaningful insights and information with other administrations, leaving room for breaches and inefficiency.

To overcome all of these, Customs authorities need to work smarter and more efficiently. They can accomplish this by shifting their focus from risk management to a decision intelligence approach. This approach consists of three layers: data fusion, advanced analytics, including machine learning-based models, and a decision support interface that allows review and collaboration using data viewed through a single pane of glass. Letting technology do the heavy lifting can ease the first two challenges and facilitate resolution of the third. This would ultimately give Customs organizations the ability to go beyond retrospective investigations to detect trends and patterns and, above all, make data-driven decisions at all levels of Customs operations.

Going beyond risk management

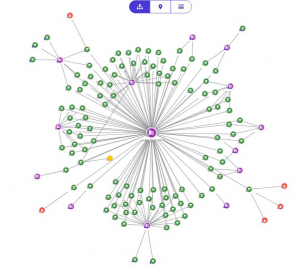

What does it mean to shift to decision intelligence? Rather than considering one container or shipment at a time, Customs authorities can use a variety of exploration techniques to unveil hidden insights in the big data. For instance, they could use link analysis (Figure 1) – sometimes called graph or network visualization – to reveal suspicious connections between shipments, consigners, brokers or even merchandise and past events that were captured by the administration. In this way, fusing, modelling, analysing and visualizing data could help the authorities derive actionable intelligence.

Many Customs authorities today commonly employ risk assessment IT solutions to prioritize which containers or packages to check. However, this exacerbates personnel issues, leaving authorities with exceedingly long – though prioritized – lists of shipments to review. It is a tactical solution to a strategic problem that leaves Customs agents inspecting many single containers or packages or, to save time, randomly inspecting shipments.

In moving to a holistic decision intelligence modus operandi, Customs investigators look for time patterns or geographical patterns, as well as relationships that reveal insights into which containers to inspect, making better use of limited personnel. Instead of needing to inspect 200 containers, for instance, agents would receive a shorter list of shipments to inspect that would be more likely to be undervalued or contain contraband.

However, decision intelligence also goes beyond identification of short term-targets. It aims to reveal Customs fraud methodologies that cannot be easily identified from the agent’s perspective. For instance, identification of a broker who repeatedly misclassifies merchandise with incorrect harmonized system (HS) codes. The decision that would be derived from an insight such as this is very different from the result of the tactical solution described above.

By using data-driven methods to uncover patterns of Customs infringements, Customs authority inspections can be more efficient, focused and effective, with a significant by-product being increased revenue collection and optimization of the clearance process.

Leveraging big data for decision intelligence

Implementing a data-driven approach is required to harness the power of big data. However, the scale of the big data problem that Customs authorities face is huge, even in the smallest of countries. For example, a country of only a few million people can have nine different databases and more than 4.5 billion records – an astonishing amount of data to handle manually or in disparate IT systems.

This is such a big problem that the World Customs Organization (WCO) has developed a Data Model that aims to facilitate electronic data exchange between authorities and trade stakeholders. In addition, the WCO Data Model enables Customs-to-Customs information exchange. As such, the model addresses the challenges of overwhelming big data and disparate IT systems, as well as information sharing to improve cross-border Customs intelligence and efficiency.

Data is, of course, crucial for decision intelligence and Customs processes. However, when it comes from disparate sources, is both structured and unstructured, and sits in separate IT systems, its usefulness diminishes. Customs authorities have access to many data sources, including company registries, reports (manifests, bills of lading, invoices), governmental databases, and other Customs organizations’ databases. These sources provide different types of documents that may be cross-referenceable, but the databases may have different interfaces, networks or permissions that increase the challenges in accessing and using the data.

Unstructured data is a major challenge

Once a Customs authority manages to bring all the data into one IT system, the challenges of handling the unstructured data come into play. Unstructured data includes images, videos, multimedia, scanned handwritten documents, X-ray images and more. Some might reside in a computer, others on phones, or perhaps in an archive. This means this information cannot be easily correlated, insights cannot be extracted, and they cannot be cross-referenced with other databases. The objective is to fuse the data and extract metadata so it can be correlated, and insights can be brought to light.

Relying on internal sources is not enough

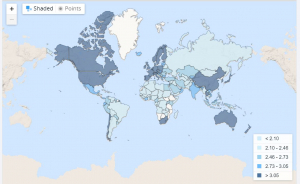

There are also external data sources that Customs authorities should consider using. Social media, for example, may help Customs investigators identify parties who are smuggling weapons. Some instant messaging apps are known platforms for selling drugs. Collecting data from these sources can provide more insight and identification of potential illicit actors. Online marketplaces are another good source for Customs to analyse – on a mass scale – the pricing of items coming into a country to verify the taxes due. Lastly, people and vessel movement trackers such as SITA, AIS and others can provide useful data for Customs authorities. This could allow the administrations to better prepare for incoming shipments or people, thereby prioritizing their resources accordingly. Additionally, trackers may allow the identification of suspicious movements of shipments, revealing infringements such as transhipment. These external data sources are not typically used by Customs authorities at the moment, but could improve intelligence and data-driven decision-making.

Data from other Customs agencies is also very useful for discovering Customs infringements on both sides of transactions, thus increasing efficiency. By sharing data with each other, Customs administrations can better prepare for incoming people and shipments, so they can be more strategic in allocating resources. The WCO already provides the infrastructure for potential collaboration using the Customs Enforcement Network (CEN(.Such data, fused with other data owned by the administrations, could provide extremely important insights. For instance, one country can report that illegal activities have been detected in one of its ports, guiding other Customs administrations to review shipments arriving from that port more carefully. When combined with an administration’s historical data, authorities could also act against already-cleared illicit goods or their consignees.

At the end of the day, uncovering the relevant information and gaining the most insights is a delicate balance between what data the Customs administration has access to and the way all of that data is analysed.

With so much data and so many sources, Customs authorities need to determine what new data is truly worth analysing, in addition to the data that is already being collected and analysed. Historical data can provide a retrospective and help to trace suspicious actors or locations that may eventually lead to more effective seizures. This type of retrospective can also highlight inefficiencies in a Customs administration. For example, if the data shows that a box was inspected three times by three different agents, then this process should be flagged as an inefficiency and streamlined in the future.

Low-quality data is often overlooked

Data quality is another big factor in leveraging the power of big data. Customs administrations need to handle low-quality data and unstructured data, as mentioned previously. Low-quality data includes fraudulent or inaccurate data, names spelled in different ways across different documents, incomplete declarations, and more. This type of data may be overlooked or excluded from the process if it cannot be easily upgraded or corrected. Unstructured data such as scanned documents, photos and videos requires an added layer of analysis using technology, as described.

Customs authorities need to find ways to mitigate these types of low-quality or unstructured data that may come from importers, exporters and other countries. These data types are not within the control of a Customs authority, so using technologies such as optical character recognition (OCR), fuzzy string searching (or approximate string matching) and object detection may improve the data quality, making it more useable on a mass scale and hence more effective. In addition, stepping back to look at the big picture after fusing the disparate data may reveal fraudulent or inaccurate data that would not otherwise have been identified.

Sensitive Customs data requires special care

In applying various technologies to the data collected, Customs authorities may encounter data ownership challenges. Countries have different regulations in place, such as the General Data Protection Regulation (EU GDPR), or other local/regional regulations, that require transparency about who owns the data, where it resides, who has access to it and how it is protected. Since Customs authorities are government agencies and have access to sensitive data, this is important. It is possible to obfuscate, pseudonymize or anonymize specific data or identifiers to protect sensitive data. Customs authorities can also compartmentalize data or hide specific identifiers for further protection. One more aspect to consider is that there may be additional requirements and/or regulations for applying analysis technologies such as machine learning (ML) to the data, and this may vary by country. Compliance, data security and data privacy are paramount, yet add layers of complexity to leveraging big data.

Decision intelligence is a force multiplier for Customs personnel

An important aspect of leveraging big data for decision intelligence is its impact on human resources. Many Customs authorities already have investigative units, intelligence analysts and data scientists. A shift to using decision intelligence will not replace the need for these or other categories of Customs personnel. In fact, in many cases, more intelligence analysts or data scientists may be needed. Elevating the use of decision intelligence will enable data scientists and others to provide much-needed higher level insights.

Decision intelligence can also make better use of existing personnel. Today, many Customs authorities struggle to manage and stay up-to-speed on multiple systems. A unified decision intelligence solution can increase the productivity of Customs agents and analysts with simplified training and a more intuitive user experience. In addition, intelligence analysts, agents and others may be redeployed to better suited roles to leverage their skillsets and improve the effectiveness of a Customs authority.

Is decision intelligence necessary or nice to have?

The prospect of implementing a decision intelligence solution may seem daunting, expensive and possibly out of reach. Implementation will include connecting the system to all relevant data sources, building a data model and applying pertinent integrations. Data scientists will need to build dedicated ML models to reveal valuable insights, and training on the system and on intelligence methodologies will be required. However, in the long run, the revenue benefits will likely far outweigh the costs of a system, its implementation and the personnel and training required.

Taking it a step further, the shift away from risk management and toward decision intelligence may help prevent the smuggling of drugs, weapons and other contraband that are a societal drain. Such contraband entering a country ultimately increases law enforcement caseloads and adds significantly to healthcare costs.

Modernizing with decision intelligence provides a holistic view for Customs authorities to uncover patterns and relationships. It prevents Customs agents from focusing on single elements, and instead may elevate more significant smuggling or tax evasion. It may also change the mindset of those within Customs administrations, from feeling overwhelmed by big data to embracing all types and sources of data, thereby obtaining more valuable insights that increase revenue, prevent fraudulent trade and facilitate more efficient legal trade.

Decision intelligence can also improve communications between the back-office personnel and Customs agents within Customs authorities. Importantly, it can increase global collaboration with improved handling of data, automatically reveal insights relevant to other Customs administrations, as well as provide the ability to make data and insights accessible to them.

Getting started with modernizing Customs data analysis

The move to decision intelligence begins with mapping out a Customs authority’s main operational challenges: those that prevent the authority from making effective decisions and achieving the insights that would improve decision-making.

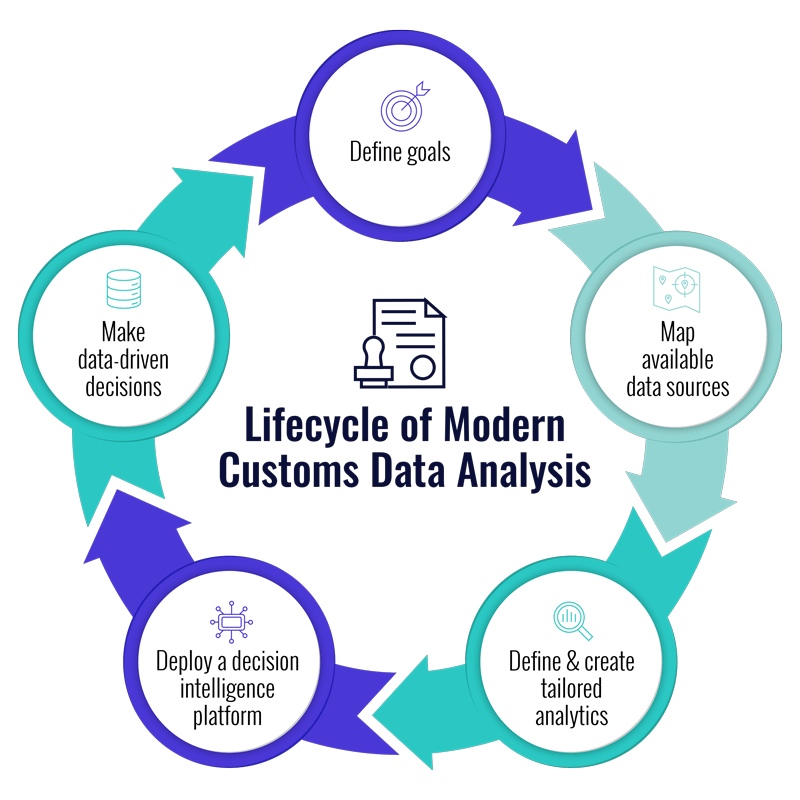

The modernization process is never-ending (see Figure 3). The recommended steps for a Customs authority to take when starting on modernization include defining the goals of the organization, mapping and analysing all available data so decisions can be made, using the right decision intelligence platform to leverage the data and the analytics into actionable decisions, and dynamically defining new goals for the administration at any time.

The conversion to a decision-intelligence approach can be achieved using the following step-by-step guide:

- Define goals

- What types of Customs fraud is it most important to prevent?

- How can Customs operations become more effective at ___? (Fill in the blank)

- What countries or contraband pose the greatest risk?

- What contraband, uncollected revenues or people would the Customs administration like to find?

- Map available data sources*

- Customs declarations, bills of lading and manifests

- Governmental repositories

- Customs operations data

- Data from other Customs administrations

- GPS trackers

- Open source: social media, marketplaces

*Data must be accessible and able to be used while adhering to different regulations

- Define and create custom-tailored analytics

- Custom-tailored risk scoring built upon real data samples from the authority

- Customized Machine Learning and AI models that leverage the data for fast insights

- Define and create big-data analytics and visualizations that provide a bird’s-eye view of the data

- Deploy a decision intelligence platform

- Fuse all data in a single place

- Define a data model relevant for the goals set

- Apply the analytics to the data

- View data and insights, including Customs operations, through a single pane of glass

- Share, report and collaborate on insights

- Make data-driven decisions, such as

- Several packages at the warehouse were inspected multiple times in a week: automatically notify officers when this occurs

- By reviewing the statistics, it looks like phones imported from country X are more likely to catch fire: ban phones arriving from country X

- The risk-scoring model indicated that e-commerce transactions in the USD 350-600 range are often misreported and caused a significant revenue gap last year: further retrospective analysis and revenue collection is required

- Return to step 1.

Data-driven Customs operations are a growing trend

Despite the challenges involved, many Customs administrations have already begun shifting their mindsets from risk management to decision intelligence, paving the way for the deployment and usage of such solutions by Customs administrations. The WCO has made a significant contribution to this shift – by emphasizing the importance of data-driven Customs operations, and even setting the 2022 theme as: “Scale up Customs Digital Transformation by Embracing a Data Culture and Building a Data Ecosystem.”

However, to truly leverage the power of data towards operational and strategic decisions, there is still much to be done. This includes applying tailored analytics, defining an appropriate investigative data model, and looking at the trends and patterns stemming from the data and analytics rather than potential seizures only. These measures, together with the tips provided above, should allow Customs administrations to handle the ever-expanding e-commerce trade effectively, and to collaborate more efficiently and successfully to address Customs infringements, while ensuring the free flow of legitimate trade.

More information

https://www.cognyte.com/nexyte/customs-investigations-risk-management