Controlling inputs of cigarette production: rationale, challenges and recommendations

3 March 2023

By Dr. Toni Männistö and Dr. Juha Hintsa, Cross-border Research Association (CBRA)Cigarette factories need various raw materials, intermediate goods, and manufacturing equipment to operate. Controlling trade in such inputs should therefore be part of Customs’ strategy in the fight against illicit cigarettes trade. This article presents the various types of inputs of cigarette production and lists some suggestions for Customs as to how to better control this trade. It features excerpts from a report entitled Key inputs of illicit cigarette production – A roadmap to controlling critical raw materials, intermediate goods, and manufacturing equipment.

Key inputs of cigarette production

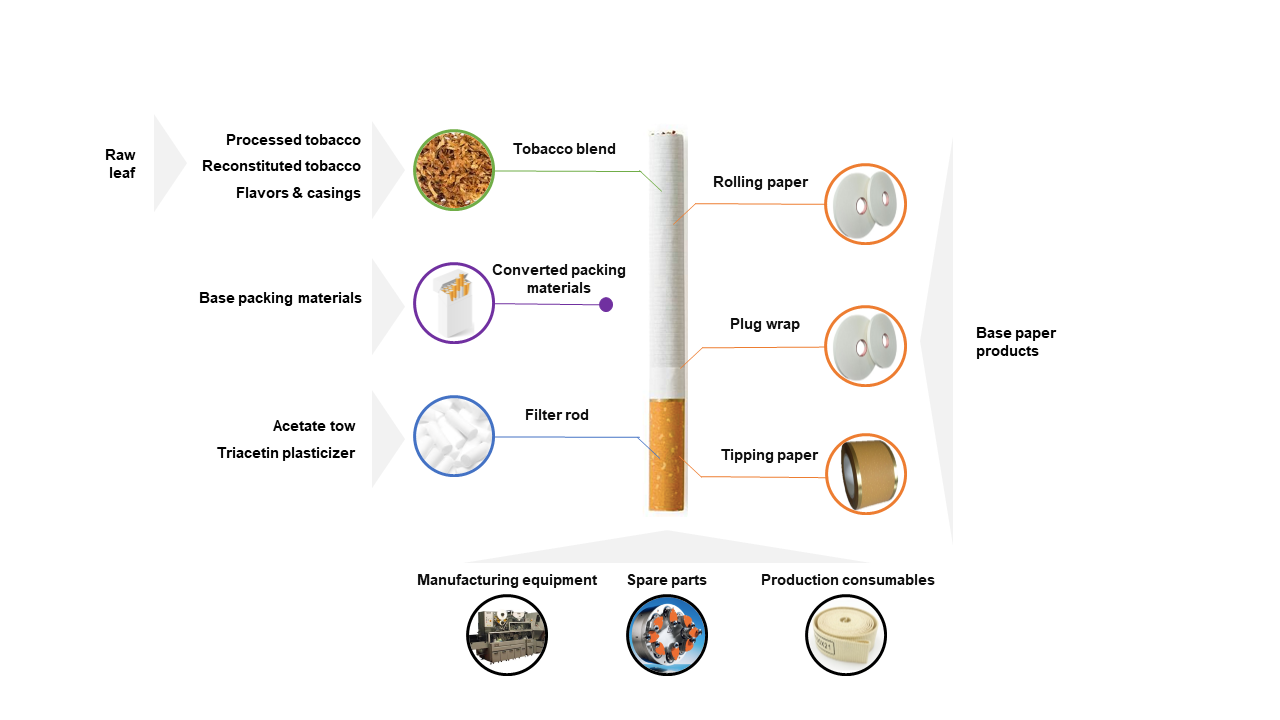

A cigarette is the result of a complex manufacturing process. Whilst the whole bill for materials needed to produce a pack of cigarettes varies by brand, the main components are always the same: tobacco blend, filter rods, rolling papers, plug wraps, tipping papers, and various packing materials. These inputs can be readily observed by taking a close look at a standard cigarette.

A deeper analysis reveals that these observable inputs are themselves made of various raw materials and intermediate goods not readily visible. For example, tobacco blend is a mixture of processed tobacco varieties, reconstituted tobacco, casings, and flavours. Cigarette filters are made of acetate tow and triacetin plasticizer.

Besides the material inputs, cigarette production relies on specialized machines, which require a regular supply of production consumables – special tapes, bands, and blades – to operate. The cigarette-making machinery also requires regular maintenance and occasional repair, and these servicing activities rely on a reliable supply of spare parts.

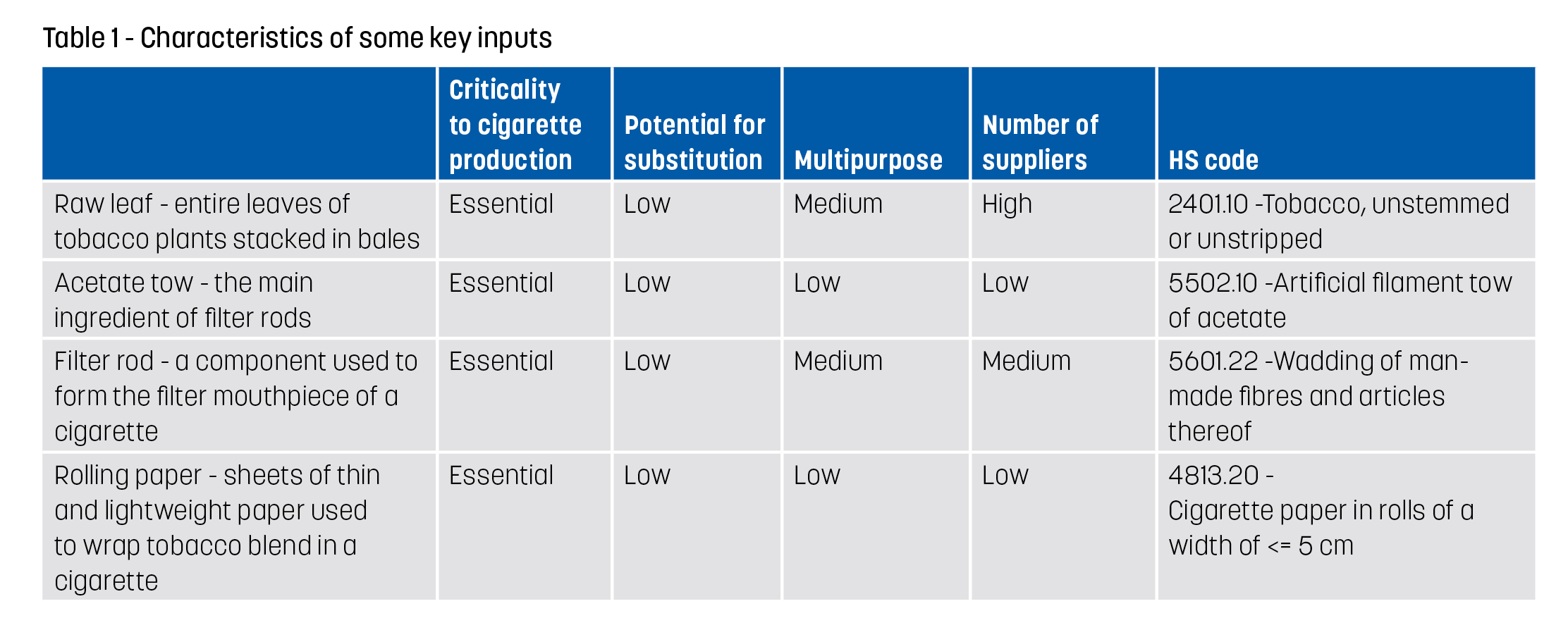

Some key inputs may be substituted with alternative materials, while others may be used to manufacture products other than cigarettes. They also differ in terms of number of suppliers which produce them, and ease with which they can be identified referring to their trade names and WCO Harmonized System (HS) code.[1] Customs control could therefore focus on inputs that cannot be substituted with other materials, are exclusive to cigarette production, are produced only by a few suppliers, and are easily identifiable by their WCO HS code.

The nexus between illicit cigarette trade and key inputs of cigarette production

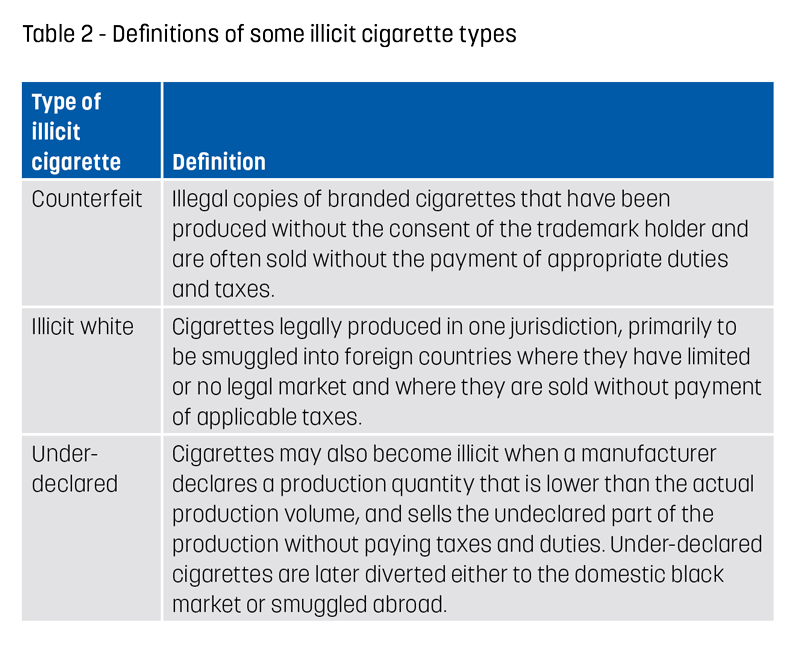

Uncontrolled access to key inputs of cigarette production fuels different branches of illicit trade, from genuine and counterfeit cigarettes to illicit whites. But, when it comes to extending Customs controls to cover the trade in critical production inputs, there is one problem: all inputs of cigarette production are legitimate and widely traded commodities. One solution would be to look at the material suppliers and determine risk profiles.

Sometimes, the illegal nature of a material supplier’s activities is obvious. A supplier producing branded materials – especially packing materials and cigarette papers – without the brand holder’s authorization would clearly know he is committing an offence. A supplier may also break the law by not having appropriate business licences (for example, growing tobacco without a licence constitutes a crime in many countries).

However, suppliers’ activities may fall into the grey area where business practices are questionable yet not outright illegal. One example of such borderline activity is when a supplier sells materials to a factory that is probably producing counterfeits.

The case with illicit whites is even less straightforward. A producer of illicit whites may be a legitimate business in its country of operation. This producer may hold appropriate licences, respect the local law, and manufacture cigarettes to be smuggled abroad, all at the same time. As a de facto legitimate business, the illicit whites producer has typically no trouble dealing with material suppliers. At the end of the day, the suppliers would have technically no responsibility if the client factory or eventual distributor chose to engage in illegal activities later down the value chain.

The situation is even more complex with under-declared genuine brand cigarettes. A material supplier may or may not know about unauthorized off-the-books production that takes place inside the four walls of a client’s cigarette factory. Many questions can be asked. Can the supplier be expected to conduct a thorough due diligence for every client and every transaction? What would constitute a reasonably thorough due diligence process that exempts the supplier from any responsibility in the event that the client factory chooses to engage in illicit production?

What Customs can do

What Customs can do

To fight illicit trade in cigarette production, Customs officers should obviously verify whether the clients of material suppliers hold appropriate permits and analyse data related to the trade of such products. Most inputs are identifiable by their trade names and specific commodity codes under the HS, so this is for most of them a routine and basic task.

But there is more Customs can do. Some suggestions are as follows:

- Make the control of such products a priority: awareness-building efforts are needed to make the control of trade in input materials a point on the Customs enforcement agenda.

- Upskill Customs officers: it is important to train Customs officers on the identification of inputs of cigarette production during checks, especially as not all inputs have easily distinguishable physical characteristics. Customs officers should also know common routings, concealment methods, and fraud techniques used to smuggle such products.

- Use detection technologies: investment in detection technologies and the use of sniffer dogs can enable Customs officers to identify undeclared or mis-declared shipments of input materials, especially undocumented tobacco leaf. Laboratory analysis is also often required to identify forged packaging materials.

- Ensure key inputs have specific HS codes: accurate HS codes are essential for monitoring international trade flows in key inputs of cigarette production. With reliable trade data, one can observe if a country and a company are importing a certain key input beyond its legitimate demand. Quality trade data can also pinpoint the origins of materials that end up in illicit cigarette factories. A crucial shortcoming is that not all key inputs have specific HS codes today. For example, filter rods are commonly declared under HS code 5601.22, “wadding of man-made fibres and articles thereof”, which encompasses many other fibre-based commodities, like swabs and special pulp products.

- Assign more resources to controls and investigations: the lack of enforcement deprives law enforcement from valuable insights that could help them to identify complicit individuals, dismantle trafficking networks, and confiscate criminal assets.

- Participate in international law enforcement operations together with polices forces, and share data at the international level.

The report Key inputs of illicit cigarette production – A roadmap to controlling critical raw materials, intermediate goods, and manufacturing equipment is available at ResearchGate.net. You can also request a copy of the report by contacting the authors. This study has been funded by PMI IMPACT, a Philip Morris International initiative, under the project Precursors of Illicit Cigarette Trade (PRECISE).

More information

toni@cross-border.org

[1] As a taxonomic hierarchy, the WCO Harmonized System (HS) creates an ordered system for the classification of goods by a six digit code, where more general classes of goods contain more specific classes of goods. Contracting Parties to the HS Convention base their domestic Customs tariffs on the HS, and dozens more use it despite not being signatories.