Bahrain Customs implements digital warehouse management system

22 February 2024

By Bahrain Customs Affairs, Customs Clearance DirectorateBahrain Customs Affairs (BCA) is constantly developing its systems and infrastructure to support and improve Customs operations, thereby helping to build a safe, advanced, investment-friendly business environment in the Kingdom. Bahrain, an active Member of the WCO, regularly examines the standards, recommendations and tools developed by the Organization and wishes to act as a leader to the Customs community by demonstrating excellence and creativity in Customs practices.

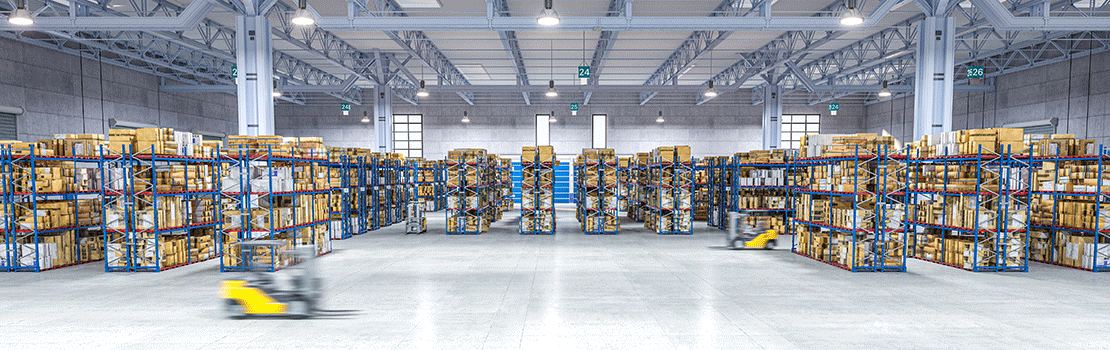

Recently, BCA has taken the initiative of developing an effective and advanced electronic warehouse management system that operates in accordance with the best practices and experiences world-wide. With 60% of the goods imported into the Kingdom of Bahrain being deposited in warehouses, it is expected that the new digital system will enable the Administration to greatly facilitate the movement of goods inside and outside the Kingdom of Bahrain, while ensuring that Customs duties are paid and controls are efficient.

Challenges

Customs warehouses play a role in lowering technical barriers to trade by enabling goods to be temporarily stored without being cleared through Customs; import duties and other taxes are therefore not collected. This means that importers do not need to draw on their cash resources as long as their goods have not been released for free circulation. Fraudulent practices mainly consist of making false statements regarding the quantity of goods which enter and exit warehouses, and combating such practices requires strict monitoring of all warehouse operations.

Warehouse E-System

The new warehouse management system, called the Warehouse E-System, was developed as part of the BCAs single window system – “OFOQ”. It was designed by Customs officials working in the warehouse division, with input from private sector representatives. Periodic meetings were held with relevant parties, including operators in the logistics sector, to ensure that the system covers all their needs and concerns. Operators can now complete procedures related to Customs warehouses through OFOQ and receive goods without being present at the Customs Service Centers, thus saving both time and money.

An important factor has been the mutual trust developed between BCA and the logistics sector through the Authorized Economic Operator (AEO) programme, other simplification schemes and Post-Clearance Audit.

The Warehouse E-System platform enables BCA to offer additional services and simplifications, providing for:

- An electronic coding system which identifies goods entering warehouses according to their barcode number or product number, and establishes a link to the description provided on the Customs declaration. A unique number is created for each Stock Keeping Unit (SKU) – the unique identifier for a product which is used to track inventory and often appears as a bar code or QR code on products. As a result, each warehouse has its own database.

- An electronic storage system (Data Warehousing System) which merges Customs data with data from the warehouse databases.

- The possibility to track the movement of goods using the Stock Keeping Unit (SKU).

- Automated calculation of storage units for use in the warehouses, and automatic calculation of all taxes and fees due.

- Automated analysis of the data entered into the system through algorithms.

- Automated verification of Customs declaration data against the data entered in the system.

- A reporting system (Dashboard) registering all operations in warehouses as well as financial revenue collection procedures.

- Smart control procedures enabling Customs employees to remotely control the movement of goods and Customs warehouses, operating 24 hours a day, 7 days a week.

- Direct electronic clearance (E-Exit) when goods are removed from warehouses.

The feedback from regulatory border authorities and trade operators has been positive. Logistics companies seem especially happy with the new system, with a satisfaction rate reaching 80%.

More information

www.customs.gov.bh