The work undertaken at the WGEC led to the development of the WCO Cross-Border E-Commerce Framework of Standards, approved by the WCO Council in June 2018. The Framework is a testimony to effective public-private collaboration, shaping norms, systems, and processes. It also promotes such partnership at the national level, with Standard 12 (Public-Private Partnerships) stating: “Customs administrations should establish and strengthen cooperation partnerships with E-Commerce stakeholders to develop and enhance communication, coordination and collaboration, with an aim to optimize compliance and facilitation.”

Douglas M. Browning, former Deputy Commissioner of the U.S. Bureau of Customs and Border Protection, and Antonis Kastrissianakis, former Director of the European Commission Directorate General for Taxation and Customs Union (DG TAXUD), highlighted in 2019 in the White Paper E-Commerce: Redefining the Cross-Border Trade Paradigm[2], that “the WCO and its Member Administrations have a history of effectively utilizing and leveraging public-private partnership to advance a number of trade facilitation and security related initiatives. There is no doubt that managing cross-border e-Commerce will require a similar effort.” Brazil is a perfect example of how collaborative efforts led to change.

While work was under way at the WCO, Brazil was grappling with the challenges posed by the escalating volumes of cross-border e-commerce. The Balanço Aduaneiro 2022 report highlighted that, while there had been a staggering 338.52% increase in the number of imported packages from 2020 to 2022 (from 52,779,466 to 178,666,498), the rise in E-commerce Shipment Import Declarations (Declaração de Importação de Remessa – DIR) had been lower, at 201.93% (from 2,805,702 to 5,665,605 DIRs).

In 2020, 5.31% of shipments had registered declarations but, by 2022, this figure had decreased to 3.17%. Express service providers and postal operators were requested to submit a declaration for each parcel via Brazil Customs’ IT system (Siscomex Remessa). However, Brazil’s postal operator, in charge of more than 95% of all e-commerce shipments, lacked information on parcels, although it had entered into agreements with other postal operators in order to receive advance information on inbound parcels and to send data on outbound parcels. Data quality and reliability was also an issue, including tax identification information relating to the consumer/importer.

There was a flat 60% duty for all goods imported by the postal operator and express couriers through the Simplified Customs Clearance process, as well as a value-added tax (Imposto sobre Operações relativas à Circulação de Mercadorias – ICMS), whose rate varied depending on the state of residence of the consignee. Gifts whose value was less than US$ 50.00 were exempt and only two States were effectively collecting ICMS. It was estimated that over US$ 4.2 billion (R$ 21.1 billion) in ICMS and import duties had not been collected during the 2020-2022 period. This situation not only jeopardized fiscal revenue and market integrity, but also accentuated the issue of underpricing.

Partnership

Brazil’s legislation, crafted over two decades ago, proved inadequate for the volume of trade. In 2020, the Procomex Institute, the operational arm of the Procomex Alliance – a coalition of over 130 business associations in Brazil – created the Procomex E-Commerce Study Group, spearheading a transformative initiative in reshaping the Brazilian e-commerce landscape through collaborative partnerships between key private and regulatory stakeholders.

The group, comprising 28 organizations representing more than 80% of the market, actively engaged key stakeholders, such as e-commerce platforms, postal services, express shipping companies, and payment intermediaries, ensuring a comprehensive representation of industry dynamics. Leveraging the extensive network, track record and reputation of Procomex, it orchestrated from November 2021 to October 2023 a series of 31 meetings – 13 of which involved the vital participation of the Receita Federal do Brasil (RFB) and, more specifically, its Customs Department. The group’s multifaceted objectives included crafting a blueprint for secure market expansion, ensuring compliance with international best practices, and harnessing e-commerce opportunities to bolster Brazilian exports.

A new voluntary compliance programme

The outcomes of this collaborative effort are groundbreaking, encompassing the meticulous design of AS IS and TO BE maps, a comprehensive report delivered to the RFB in November 2022, and the strategic design of the returns process flow.

Most importantly, in August 2023, a new voluntary compliance programme took effect: the Programa Remessa Conforme (PRC). The programme is open to national and foreign companies using e-commerce platforms, websites or digital tools to sell their products. The criteria to participate in the programme encompass a spectrum of issues, ranging from basic regulatory compliance, to a firm commitment to anti-smuggling efforts and the monitoring of registered sellers.

Certified companies must provide advance accurate information regarding international shipments before their arrival in Brazil. Key to the PRC success is the emphasis on reliable and qualified data throughout the entire process, encompassing essential elements such as seller identification, invoicing, product classification, transaction data, transportation details, and insurance information.

To be certified, companies must have signed a contract with Brazil’s postal operator or with a courier company, laying down the obligations to:

- a) provide in a timely manner all the information necessary for the registration of the Shipment Import Declaration (DIR) in advance of the arrival in the country of the vehicle transporting the shipment; and

- b) transfer the amounts of taxes collected from the recipient to the person responsible for registering the DIR in Siscomex Remessa.

They must also display to the buyer on their website or on a third-party website:

- the information that the goods come from abroad and will be imported, and must be recorded in the import declaration and are subject to federal and state taxation; and

- the values of the commodity, international freight, insurance, postal tariff, other costs, import duty, ICMS and total to be paid.

They must also display in a visible manner their brand and trade name on the sender’s label that accompanies the goods, commit to tax and Customs compliance, and to the fight against embezzlement and smuggling, and maintain a policy of admission and monitoring of sellers.

In return, the RFB offers them tax and Customs benefits which include a zero percent import duty for shipments valued up to US$ 50 sold to non-commercial consumers, prioritized Customs clearance, and a reduced selection rate for Customs inspection.

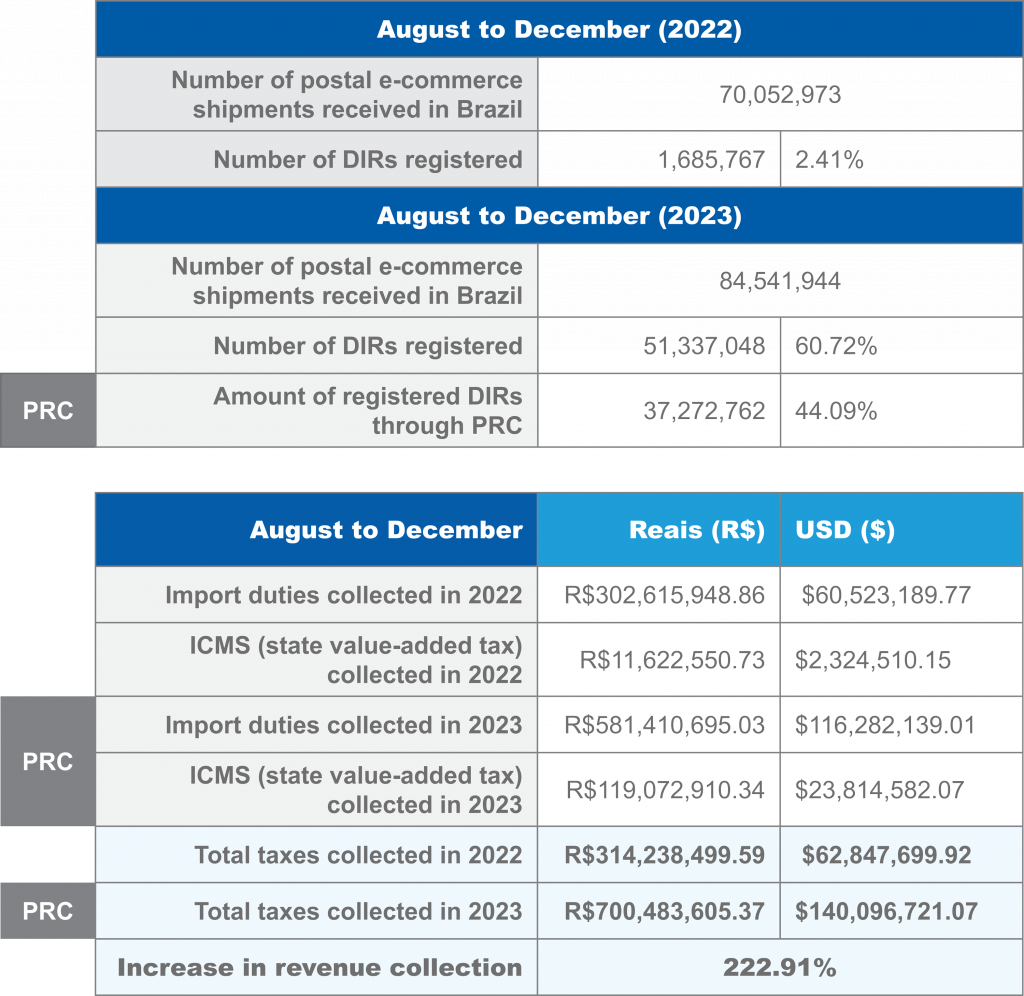

A few companies, responsible for a major portion of shipments, are certified in the PRC[3] and the initial results of the PRC are remarkably promising. The first international shipments covered by the programme began arriving in Brazil by the end of September 2023. Despite the programme offering a tax waiver on federal taxes for shipments valued up to US$ 50, there was a practical increase in revenue due to a higher number of registered declarations. Additionally, the programme facilitated the collection of ICMS. By the end of 2023, the total collected during the programme’s operational period (from August to December) was 222.91% higher than the corresponding period in the previous year, resulting in a substantial revenue increase of approximately R$ 386 million (US$ 77 million).

It is worth noting that during this period, 99.05% of all e-commerce shipments received in Brazil were made through postal deliveries. Furthermore, specifically within the domain of PRC Import Declarations (DIR PRC), postal shipments accounted for an even higher percentage, reaching 99.47%. The following table presents a comparative analysis of postal delivery data for 2022 and 2023, illustrating figures both before and after PRC implementation from August to December. It provides a comprehensive examination of postal deliveries in Brazil for the respective periods, specifically emphasizing Registered DIRs. Shipments processed through express shipping or courier services are not considered in this table.

A programme worth replicating

Brazil’s experience with the PRC demonstrates that the collaborative efforts of the public and private sectors can lead to a robust solution for managing the complexities of cross-border e-commerce. The integration of private sector stakeholders ensures a practical understanding of the industry’s dynamics, fostering a programme that is both effective and adaptable. The emphasis on compliance, data reliability, and transparency not only mitigates risks, but also creates an environment conducive to sustainable and secure international trade.

Whilst Programa Remessa Conforme provides a compelling model for other countries grappling with the challenges of cross-border e-commerce, implementing and sustaining such programmes poses challenges. Firstly, there is the need for widespread participation and adherence, and secondly, for reliable technological infrastructure. Nevertheless, the reality is that the benefits far outweigh the challenges.

As countries grapple with the increasing volume of cross-border e-commerce, they should consider adopting a similar compliance programme. By learning from Brazil’s experience, nations can not only better address e-commerce challenges, but also unlock the full potential of a seamless and secure global trade ecosystem.

The WCO may also consider developing an international standard based on the programme. It would go a long way to addressing the needs of Customs in dealing with e-commerce.

More information

https://www.gov.br/pt-br/servicos/obter-certificacao-no-programa-remessa-conforme-da-receita-federal

[1] The WCO Private Sector Consultative Group is formed for the purpose of informing and advising the WCO Secretary General, the Policy Commission and WCO Members on Customs and international trade matters from the perspective of the private sector. See https://www.wcoomd.org/en/topics/key-issues/private-sector-consultative-group/terms-of-reference-for-the-private-sector-consultative-group.aspx.

[2] The white paper was submitted to the WCO on behalf of the International Summitt on Borders, a private sector group which brought together former international Customs senior officials and who met annually in Washington, DC.

[3] https://www.gov.br/receitafederal/pt-br/assuntos/aduana-e-comercio-exterior/manuais/remessas-postal-e-expressa/empresas-certificadas-no-programa-remessa-conforme