Indonesia implements automated data exchange with e-commerce marketplaces

22 February 2024

By Oryza Septi Utami, Customs Analyst, Directorate of International AffairsIn Indonesia, the number of individuals purchasing goods online continues to rise annually, and it is estimated that 73% of the population made at least one transaction through a computer network in 2023. Bank of Indonesia has reported that, in 2022, e-commerce transactions reached USD 30.5 billion and the figure is to grow further in the coming years.

Part of this flow of goods crosses borders and consists of low-value items. These are defined as goods which have a value of USD 3 or less and which are exempt from import duties. For goods whose value is more than USD 3 and up to USD 1,500, a unified tariff rate of 7.5% is applied. For goods valued above USD 1,500, the MFN tariff is applied. All transactions are subject to Value Added Tax (VAT).

Two of the challenges facing the Customs Administration are revenue collection and the protection of domestic industries as some sellers try to avoid paying duties by splitting shipments or undervaluing goods and instigate unfair competition for domestic industries producing similar goods. Given the share of goods bought via marketplaces (the name given to online stores or platforms where sellers meet buyers and offer products and services), Indonesia Customs launched in 2019 the Delivery Duty Paid (DDP) scheme, an initiative targeting specifically those stakeholders.

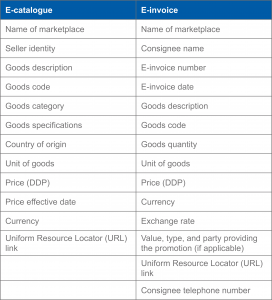

Under the DDP scheme, marketplaces must include and collect import duties and/or taxes in the price of goods. They must also connect their IT systems to Indonesia Customs Excise Information System and Automation (CEISA) to enable automatic exchange of data. Two categories of data are exchanged: that related to the catalogue of products, and that related to the invoice (see Table 1).

CEISA then automatically cross-references the data with that on the consignment note, the document that contains information about the carriage of goods and records the sender’s and receiver’s contact information, a Customs declaration form and the unique reference number for each shipment. If the data matches and no anomalies are identified, Customs will issue a billing code and collect import duties and taxes. In the case of irregularities, Customs officers conduct further examinations upon the shipment’s arrival.

The technical unit in charge of import procedures at Indonesia Customs started working on the DDP scheme in 2018. It consulted all Customs units, as well as the Directorate of Objection, Appeals and Regulations, to ensure the text was drafted according to the rules applying to legal documents. Prior to its publication, the DDP scheme regulation was shared with the public via a public hearing to gather additional input. After publication, Indonesia Customs organized webinars, put up posters at strategic premises, and developed infographics for social media, to reach out to as many people as possible so that both consumers and sellers were informed of the new rules.

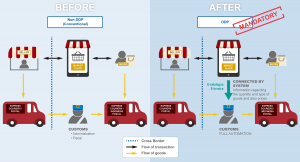

When it was introduced in 2020, participation in the DDP scheme was voluntary and Customs officers assessed the import duties and taxes to be paid. However, since October 2023, marketplaces conducting more than 1,000 shipments a year have been mandated to join and must determine the duties and taxes to be paid themselves. Indonesia Customs, through its computer system and officers, monitors all marketplace transaction volumes and, if the threshold is exceeded, issues a notification letter to the marketplace, requesting it to meet the DDP administrative requirements and connect its system with CEISA. A copy of this notification is also forwarded to the postal operator or to the express courier responsible for managing the delivery of the goods.

There is a significant difference in the time required to clear shipments, depending on whether the goods fall under the DDP scheme or not. The scheme clearly expedites the release of goods, with the process being up to fifteen times faster.

An evaluation of the scheme is conducted at least once a year with each participant. The Customs Administration examines the export and import transactions they have carried out. Marketplaces which are inactive for three consecutive months, are found to have engaged in Customs offences, or have been declared bankrupt, are automatically taken out of the scheme.

The DDP scheme is a testimony to Indonesia Customs’ engagement in implementing the WCO Framework of Standards on Cross-Border E-Commerce and, more specifically, Standard 12 (on public-private partnerships), and Standard 1 (on the exchange of advance electronic data among relevant parties in the e-commerce supply chain).

Since it was first launched in 2020, four marketplaces have joined (Shopee, Zalora, lazada, and Blibli) and this has stayed the same, even after the scheme became mandatory in November 2023 for marketplaces conducting more than 1,000 shipments a year. No major difficulties have been reported by participants, the only challenge being to integrate the IT system during the implementation phase.

In a few months’ time, Indonesia Customs will be able to evaluate the impact of the DDP scheme on revenue collection and the protection of domestic industries. There has been a modest increase in the amount of revenue secured from e-commerce transactions; however, the share of revenue collected through the DDP scheme is still much lower than that collected through the conventional scheme. For the time being, it would therefore appear that the real effectiveness of the DDP scheme lies in creating a level playing field between sellers.

More information

www.beacukai.go.id

info@customs.go.id