Dubai Customs launches the UAE’s innovative AEO programme

26 June 2016

By Eman Badr Al-Suwaidy, Director, Customs Declaration Management & Owner, AEO Programme Project, Dubai CustomsThe United Arab Emirates (UAE) is one of the world’s largest and fastest growing trading hubs, as a result of its accelerated and extensive modernization initiatives in recent years, the quality of its infrastructure, the intellectual power of its workforce, and a genuine drive to achieve its goals. Against this background, the UAE has officially rolled out its authorized economic operator (AEO) programme.

Approximately 20 million containers are processed by the UAE seaports every year. In fact, the Port of Jebel Ali in Dubai is the largest port in the Middle East and North of Africa (MENA) region and the 9th largest globally, while Dubai Airport is the busiest international airport in the world with 75 million passengers. In addition, the UAE manages four million tons of airfreight annually.

Managing this increasing flow of goods requires smart working methods to achieve more results with the same or even less resources. An AEO programme provides Customs with a new control strategy based on a strong partnership with legitimate and compliant stakeholders in the global supply chain, marking a shift from transaction-based controls to system-based controls.

Dubai Customs kicked off the implementation project of its AEO programme in September 2015, with the programme being officially launched in October 2016. This rather short implementation time, compared to other AEO programmes around the world, has been made possible by utilizing international standards contained in the WCO SAFE Framework of Standards, taking into account best practices from other AEO programmes, and benefiting from international experiences – all backed by an efficient in-house business model which takes on board the accumulated expertise of Dubai Customs officials and their fine-cut know-how of the ins and outs of the supply chain.

AEOs in the UAE and the GCC

The UAE consists of seven Emirates, each with a separate Customs administration collectively governed by the Federal Customs Authority (FCA). Within the UAE, a national AEO Committee, chaired by the FCA, has been established to coordinate AEO implementation in all seven Emirates. Dubai is the first to implement the programme, which will be implemented by the other Emirates.

As the UAE is part of the Gulf Cooperation Council (GCC), the Customs authorities of each Emirate are responsible for applying the GCC Common Customs Law and the Unified Guide for Customs Procedures. The UAE AEO programme has been designed and prepared for regional implementation at the GCC level. The objective is to have the programme implemented by all the GCC countries – a scheme which can be compared to the AEO model used in the European Union (EU), where all 28 EU Member States operate under the same Customs legislation and the same AEO programme.

A GCC AEO model that enables the harmonization of AEO programme characteristics, common AEO status recognition, Customs-to-Customs information exchange between GCC countries on trader identification codes, AEO status, and any changes in the risk profile of a company can facilitate and create opportunities for a strong AEO programme in the Middle East region.

A holistic approach

The UAE AEO programme takes a modern and holistic approach by including both compliance and security, along with all modes of transport and Customs procedures. Any actor in the supply chain that has a relationship with Customs may apply for AEO status. Small and medium-sized enterprises (SMEs) are especially targeted, as their development is crucial to the national economy.

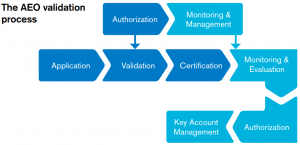

There are no tiers or levels in the UAE AEO programme, as is the case with some of the established AEO programmes that, among other things, differentiate between traders with differing security compliance levels, thereby offering different baskets of facilitation measures. Dubai Customs believes that in a modern AEO model, the distinct circumstances and operational environment of each AEO need to be addressed individually. Companies applying for AEO status will be thoroughly validated and assessed to ensure that their level of compliance and security meet AEO requirements. There are two main components in the AEO validation process:

- An “authorization process” component;

- A “monitoring & management” component, which includes the concept of Key Account Management and continuous, system-based, monitoring and evaluation of the client, as well as re-validation.

The AEO Authorization starts when the company electronically submits an application for the AEO programme. Customs ensures that the company is eligible and meets the basic eligibility criteria. If it does, the process continues with a tailor-made Self-Assessment Questionnaire (SAQ) being filled in by the applicant in order to provide Customs with detailed information about the entity’s overall status and “under the hood” operations.

Dubai Customs performs an analysis and risk assessment based on the SAQ and additional available information. Then, a detailed and thorough examination of the applicant is performed, validating its compliance, financial viability, record keeping, and security measures and practices. Several onsite visits are carried out by Customs, including several meetings and discussions with the applicant.

Depending on the outcome of the validation, a decision is taken by Customs whether the applicant meets the eligibility criteria or if any further actions or measures need to be taken. This is a collaborative process with the purpose to foster compliance and enhance security. If it is deemed that the applicant does not meet the requirements, the request for AEO status will be denied. Otherwise, an AEO certificate will be issued which gives right to extensive and tailored benefits. The certified company will, for example, be provided with a dedicated Key Account Manager who will assist it with any issues related to Customs.

As AEOs need to be continuously monitored and evaluated while ensuring that each AEO gets the benefits, Dubai Customs has developed an individual control plan for each AEO that defines when and how control measures should be taken. A thorough re-validation will occur within three years to ensure sustained levels of compliance and security.

The whole AEO process is electronic and supported by information technology (IT) solutions for managing applications, validations and certifications. The Customs IT systems have also been updated to enable the differentiation of AEOs and non-AEOs, the former benefitting from a lower risk score, faster clearance, and given the highest priority status by Customs and other government agencies.

Extensive benefits package

Forty-seven benefits will be provided in different phases to AEO-certified companies. These benefits are intended to motivate companies to join the programme and maintain the status. Without clear and tangible benefits, and a demonstrable positive return on investment (ROI), companies will be reluctant to join the AEO programme, and, once in it, may elect to withdraw due to the fact that the additional costs sustained by them in meeting prescribed AEO requirements may become greater than the benefits realized.

The direct benefits (benefits with explicit/direct government/Customs participation) include:

- faster clearance through prioritization and lower risks, etc;

- enhanced administrative management through dedicated Key Account Managers;

- financial benefits, such as the provision of self- guarantees and possible penalty mitigation;

- better coordination with partnering government agencies – the Key Account Manager will assist the company with other government agencies’ requirements, such as pre-approvals and permits related to a Customs clearance.

Indirect benefits (benefits without explicit/direct government/Customs participation) include:

- increased marketing opportunities, as companies may choose to rather buy products and services from AEO-certified parties;

- decreased number of negative incidents and disruptions in the supply chain, thanks to an adequate set of security measures.

Mutual recognition

The UAE aims to sign mutual recognition arrangements (MRAs) with a significant number of national and regional AEO programmes as a way of promoting trade and providing benefits to local and foreign AEO traders. To achieve this goal, an MRA strategy and a national MRA model have been developed using a comprehensive set of criteria (e.g. trade volume, diplomatic relations, and more) to methodologically prioritize prospective MRA partners.

Measuring success

During the positioning phase and the extensive research that accompanied it, it became clear to Dubai Customs that an efficient AEO programme should ensure that businesses can receive genuine and tangible benefits, while avoiding an arduous validation process, aggregated onsite validations, unclear guidelines, and complex certification criteria.

Measuring the outcome of any projects is a requirement of the Dubai Government. Key Performance Indicators (KPIs) have, therefore, been developed to enable compliance, speed, predictability, and cost savings in the clearance of goods to be measured. Customs expects that an AEO will save 25% in operational costs.

An AEO Centre of Excellence (CoE) will be established with the aim of undertaking research in the AEO area, in cooperation with leading academic institutions. The CoE will also be responsible for KPI measurement, as well as for marketing the programme and further developing it. The idea is to ensure that the foreseen benefits are actually delivered, and to develop new benefits in the future. The results of the KPIs will be made public.

Way forward

As mentioned earlier, Dubai Customs is determined to develop the AEO concept to new levels using innovative solutions. Transshipments, free zones, Customs-to-Customs integration, and “single or pan government” AEO status are some of the areas that will be addressed in the future.

Let’s take for example transshipments, a regime applied to a significant number of consignments flowing through Dubai and the UAE. The Customs administrations of the UAE have a great opportunity to enhance the visibility and security of the transshipment regime even further by efficiently using the AEO programme, along with innovative solutions. Actors that are AEOs and involved in the transshipment process, such as exporters, forwarders, carriers and cargo terminal operators (CTOs), will benefit from a secure transshipment lane. This Secure Transshipment Hub scheme and solution are still concepts subject to further development.

Feedback and research reaching Customs forecasts a considerable bundle of benefits to businesses engaged in international trade activities in the UAE and Dubai, which will surely secure a measurable contribution to the enhancement of supply chain security, and facilitate Customs transactions in the UAE. The AEO programme will definitely result in a rather unique and unmatched Customs service for businesses, by saving them costs and efforts, while incentivizing trade activities in the UAE.

More information

www.aeo.ae