Global warming, international trade, and the quantification of carbon emissions: production-based and consumption-based accounting

26 June 2016

By Robert Ireland, Head of the WCO Research UnitGlobal warming is on a dangerous trajectory. Human-induced carbon dioxide pollution and deforestation are steadily increasing levels of atmospheric CO2 concentration which is resulting in, among other things, higher global average temperatures and extreme weather events. This article opines on the latest global warming data, mitigation policies, and the two major methods of carbon emissions quantification (production-based and consumption-based), particularly the synergies between consumption-based accounting and international trade.

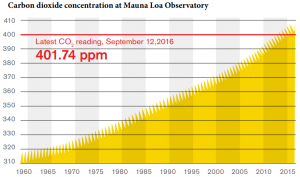

CO2 atmospheric accumulation

Dr. Charles Keeling of the Scripps Institution of Oceanography at the Mauna Loa Observatory in Hawaii began to measure the atmospheric CO2 concentration in 1958. On 12 September 2016, the concentration of CO2 was 401.74 parts per million (ppm) in the sky above Hawaii; the chart below from Scripps reflects the rise in average annual atmospheric CO2 concentration from 1958 to 2016. The current levels of atmospheric CO2 concentration have increased by 43% from the approximate rate of 280 ppm in the 1880s (evidenced by carbon isotope analysis) when the inexorable escalation caused by human industrial activity began. The last time the Earth’s atmospheric carbon concentration was over 400 ppm was at least two million years ago – before humans existed!

Global warming

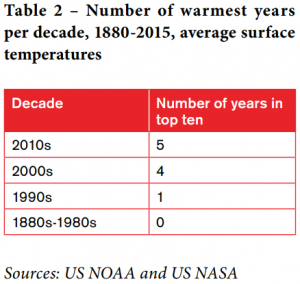

The United States (US) National Aeronautics and Space Administration (NASA) recently announced that in early 2016, global average temperatures reached a point approximately 1.3 degrees Celsius higher than pre-industrial levels. As reflected in Tables 1 and 2, nine of the top ten warmest years since at least 1880 have occurred in the 21st century. 2015 is currently the warmest year on record, and 2016 is on track to become the warmest.

Extreme weather events

While scientific models predict that global warming will increase the number of extreme weather events, peer-reviewed research indicates this is already happening and intensifying. In its 2014 report, the Intergovernmental Panel on Climate Change (IPCC) summarized that “changes in many extreme weather and climate events have been observed since about 1950. Some of these changes have been linked to human influences, including a decrease in cold temperature extremes, an increase in warm temperature extremes, an increase in extreme high sea levels, and an increase in the number of heavy precipitation events in a number of regions.”

Policies to mitigate global warming

Carbon emissions and atmospheric carbon accumulation will not diminish significantly without government intervention. In particular, public policies must shift energy sources from coal and petroleum to renewable energies (solar, wind, geothermal, and hydropower) and nuclear power. To support this, governments should implement a combination of strategies. Although no individual policy will comprehensively and adequately reduce carbon emissions, there are several that in combination could make significant contributions, including:

- infrastructure development (such as renewable energy transmission lines);

- strengthened carbon pollution regulations (such as vehicle emission standards);

- public investments and subsidies in low-carbon technologies;

- reducing or eliminating fossil fuel subsidies;

- international trade policies (such as lower tariffs on low-carbon technologies);

- reforestation;

- carbon pricing.

While it should be only one of several global warming mitigation policies, governments of major emitters should signal a CO2 price so that carbon pollution becomes more expensive, and thus incentivizes conservation and transitions to low-carbon energies. The two general policy options for carbon pricing are a ‘carbon tax,’ and an ‘emissions trading system’ (ETS) which is also known as a ‘cap-and-trade’ system.

In evaluating carbon pricing under both an ‘effectiveness’ and ‘efficiency’ criteria, a carbon tax is probably preferable to an ETS because it likely results in more consistent carbon prices that can be increased more easily when necessary. Under a ‘political feasibility’ criterion, however, an ETS is probably more acceptable to politicians and constituents, which is why most governments are choosing ETS.

The performance of the largest ETS has been discouraging. The European Union’s (EU’s) ETS has experienced sharp volatility and sizable price declines. The extremely low price (4.38 euro per carbon ton on 1 August 2016) has largely been attributed to an oversupply of carbon allowances. More recently, this has been exacerbated by the long-term weakness of the EU’s economy, and fears concerning Brexit (the referendum of 23 June 2016, whereby British citizens voted to exit the EU). Accordingly, the EU ETS is failing to signal a potent and predictable carbon price to incentivize lower CO2 emissions.

Production-based and consumption-based accounting of C02

The traditional way to measure a nation’s carbon emissions is by calculating the total generated from within its national territory. Under this methodology, the carbon emissions from the production of goods that will become exports are allocated to the exporter country not the importer country where the goods are ultimately consumed or used. The United Nations Framework Convention on Climate Change (UNFCCC) and the IPCC have largely used this production-based accounting.

Consumption-based accounting takes a different approach. Goods that are consumed but not produced in Country ‘A’ are allocated to Country A’s account, not Country ‘B’ where the goods were produced. Thus, the carbon emissions generated by the manufacture of goods in Country B but imported by Country A would be considered to be Country A’s carbon emissions. In other words, the carbon emissions resulting from the production of goods intended for international trade are allocated to the importing country not the exporting country.

CO2 under this delineation is sometimes called ‘embodied carbon,’ which has been defined by Kejun, Cosbey, and Murphy (2008) as “carbon dioxide emitted at all stages of a good’s manufacturing process, from the mining of raw materials through the distribution process, to the final product provided to the consumer.” Consumption-based accounting and its implications are gaining prominence in academic fields too. Economist Christian Lininger’s 2015 book ‘Consumption-Based Approaches in International Climate Policy’ is a classic reference manual on this topic, and brings together the many strands of consumption-based accounting.

The implications of consumption-based accounting of C02

Consumption-based accounting introduces an alternate method of quantifying carbon emissions by specifically incorporating international trade into the calculation. Moreover, it can reduce the ‘carbon emissions score’ of some large export-heavy nations, and increase the carbon emissions score of some large import-heavy nations. If an export-heavy nation is not credited with the carbon emissions triggered by their manufacture of goods that are purely intended for export, their carbon emissions score is lower.

In parallel, countries that have experienced reductions in domestic industrial manufacturing (such as cement, chemicals, steel, and paper) and simply import such goods would have their carbon emissions score increase because their consumption becomes part of the assessment. Some critics contend, however, that the implications of using consumption-based accounting are deleterious for emerging economies, particularly if worries concerning ‘carbon leakage’ are dealt with by ‘carbon tariffs.’

Carbon leakage

Carbon leakage is the concept that if a country adopts robust carbon mitigation policies (such as a carbon tax) unilaterally, industries with high-carbon emissions will then shift to countries that do not have similarly strong carbon pricing mechanisms. For instance, a steelmaker may shift its production from an abating (the one that is purposely and successfully reducing its CO2 emissions) country to a non-abating country, in order to enjoy more lax environmental laws and lower costs. Consequently, there would be no global reduction in carbon emissions; the volume has merely switched countries.

Carbon leakage also raises several issues, including business competitiveness and climate mitigation policy. Regarding business competitiveness, carbon leakage could mean that high-carbon businesses will fail in an abating country, and similar businesses will thrive in a non-abating country. As for climate mitigation policy, global carbon emissions may not decrease because they have merely shifted from an abating country to a non-abating country.

Thus, even if an abating country reduces its carbon footprint, a non-abating country will experience carbon emission increases. Accordingly, the gains made by an abating country are canceled out, and result in no climate mitigation globally. Christian Lininger has described carbon leakage as “an effect that may occur if not all regions of the world abate: emissions may not be reduced on a global scale, but merely shifted from abating to non-abating regions.”

The government of an abating country may subsequently decide to act to dilute carbon leakage in order to keep certain manufacturers in their country, and ostensibly to lower global carbon emissions. Conceptually, although it has not happened yet, this could be pursued with carbon tariffs.

Carbon tariffs

In combination with carbon pricing, some countries might opt to implement carbon tariffs to reduce carbon leakage. Carbon tariffs predominantly, but not exclusively, entail a tax on the embodied carbon of imports. Partially because these actions could face World Trade Organization (WTO) adjudication, proponents frequently call them ‘border tax adjustments’ (BTAs), which are an acceptable equivalence mechanism under WTO law.

The WTO has described BTAs as consisting of “two situations: (i) the imposition of a tax on imported products, corresponding to a tax borne by similar domestic products (i.e. BTA on imports); and (ii) the refund of domestic taxes when the products are exported (i.e. BTA on exports).”

Discernibly, carbon tariffs are controversial. Advocates contend that they will be necessary to incentivize countries with high carbon pollution and weak climate policies to change their ways, and that domestically they will be necessary to inoculate against accusations of harm to business competitiveness. Conversely, critics assert that they are merely another form of eco-protectionism.

Conclusion

Some policy analysts are raising the profile of the still-unconventional notion of measuring CO2 emissions with consumption-based accounting rather than production-based accounting. Advocates suggest that it is a more accurate system, and would better incentivize CO2 abatement.

Such an approach also draws from the perspective that international trade is both a contributor to global warming, and an intrinsic component in the many solutions that exist. Consequently, regardless of what policies are being adopted, and by whom, international trade and border management are being incorporated into the global warming policy framework.

More information

Research@wcoomd.org