Building a classification infrastructure: the Ghanaian experience

20 June 2018

By Ena Blege, Head of Classification, Technical Services Bureau, Ghana CustomsIn January 2018, the Ghanaian government notified the WCO Secretariat that it had accepted seven Harmonized System (HS)-related WCO Council Recommendations, testimony to its strong commitment to implement objective, predictable and transparent classification practices as well as facilitate the collection of international trade statistics and the monitoring of global trade. This article presents the path that the Customs Division of the Ghana Revenue Authority has charted over the years in its quest to create a functional and workable classification infrastructure, touching on, among others, advance rulings, training challenges and capacity building needs, and more education to enhance the appeals process.

From 1970 to 2000, Ghana used a ‘pre-shipment inspection (PSI)’ regime for goods being imported into the country. Classification was done primarily by accredited testing agencies in the country of export before the goods arrived in Ghana. However, problems related to PSI activities became more and more pronounced over the years, forcing the authorities to begin licensing local companies from the year 2000 to undertake a ‘destination inspection (DI)’ regime instead. These companies were mandated to classify all goods that arrived in the country.

Teams of Customs officers were subsequently assigned to these DI companies on a regular basis to offer them technical assistance. However, the DI system also had its drawbacks. Therefore, in compliance with WCO Council Recommendations, Ghana Customs decided in September 2015 to set up a Harmonized System (HS) Unit to take over the work of these DI companies and assume the task of classification itself. This decision was preceded by a WCO National Workshop in Accra, Ghana in June 2015 during which HS experts from the WCO Secretariat were subsequently tasked to:

- review Customs’ current classification infrastructure;

- evaluate the local classification environment;

- evaluate the totality of Customs and its processes;

- help Customs develop a strategic plan with a view to executing the planned transition from the DI companies to a fully Customs-controlled operation;

- compare Customs’ classification methods with international best practice;

- quantify the expected gains or benefits that will arise from Customs assuming full responsibility for its classification processes;

- assess the risks that Customs may face in executing the takeover from the DI companies.

At the time of the effective takeover in September 2015, a new facility that would subsequently be known as the Customs Technical Services Bureau was already in place at Customs Headquarters, and, within it, a National Classification Centre. There was also a pool of experienced officers to man this classification unit. The aims and objectives of officers working at the Centre were to:

- ensure the implementation and correct application of the HS;

- establish and manage classification policy to ensure the uniform classification of all goods being imported;

- issue classification rulings for uniform application throughout the country;

- examine classification questions referred by regional and local Customs offices;

- periodically update the Common External Tariff (CET) of the Economic Community of West African States (ECOWAS), of which Ghana is a member country;

- publish binding tariff information for use by the trading community;

- serve as a link between the WCO and its HS Committee, and implement the Committee’s decisions;

- discuss classification issues with the Central Customs Laboratory, which also maintains a system of mobile laboratories;

- coordinate HS activities with Customs’ Training Branch.

-

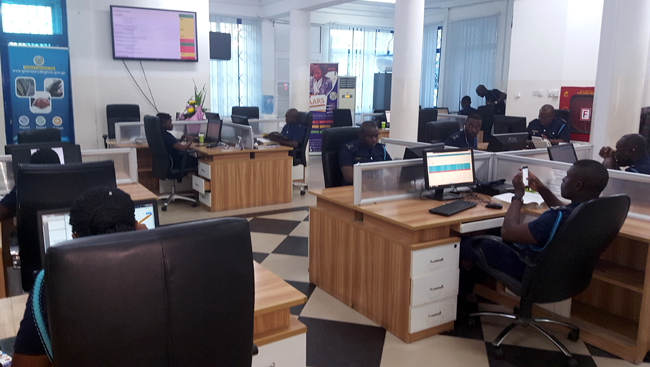

A view of Ghana’s National Classification Centre

Advance rulings

The objective of the WCO experts who supported Ghana Customs during that period was also to raise the awareness of the administration of the need for a modern classification infrastructure as the bedrock for an efficient and effective Customs administration. Such an infrastructure would enable the accurate collection of revenue, facilitate trade, assist in the combating of fraud and malfeasance, and make the accurate compilation of trade statistics possible.

Key among the recommendations proposed by the WCO experts was the need for Ghana Customs to implement a programme for binding pre-entry classification information. They made it clear that since tariff classification was quite technical in nature and required a fair amount of time to be spent in analysing technical literature, including asking for inputs from the Customs laboratory where necessary, it was important to adopt the WCO Recommendation on Advanced Tariff Rulings in order to minimize delays and facilitate international trade and investment. Thus, an effective pre-binding classification programme would help Ghana Customs to:

- ensure the uniform classification of goods;

- minimize revenue loss;

- coordinate all classification decisions within the administration;

- reduce Customs clearance delays;

- minimize classification disputes;

- reduce unnecessary costs in doing business.

Fortunately for Ghana, work had already started, in 2013, on laying the foundation of the legislative framework for the institution of a programme for binding pre-entry classification information. The new law (Act No. 891) was assented to on 18 May 2015. Excerpts on Customs advance rulings from Section 12 of the Act appear below:

(1) The Commissioner General may issue a written ruling applying the Customs law to a particular set of facts submitted by an interested party.

(2) An interested party in this section includes a person, or authorized agent of a person, who has a demonstrable interest in the questions presented in the request, and an importer or exporter […].

(5) The request for a Customs ruling shall be in writing and include a statement of all relevant facts, the names and addresses of interested parties, the name of the port where the goods are expected to arrive or depart, and a description of the transaction in sufficient detail to allow the application of the Customs laws […].

(9) A Customs advance ruling is binding until the ruling is overturned by the Commissioner General […].

(12) An interested party may request a review of the Customs advance ruling by the Commissioner General within thirty days of the publication or notification of the ruling; or a judicial review of the Customs advance ruling made by the Commissioner General within thirty days.

(13) The Commissioner General shall treat information submitted under this section as confidential, unless the parties agree otherwise.

It is interesting to note that the law does not give a timeline on binding tariff rulings. Section 12 (Subsection 9) of the Act specifies that such pre-binding classification rulings may be overturned at any time by the Commissioner General.

The law enjoins the Commissioner General to “treat information submitted under this section [Section 12 (Subsection 13) of the Act] as confidential, unless the parties agree otherwise.” So, although Ghana Customs could publish binding tariff information, no trader has yet given it permission to do so. However, Customs is actively encouraging local traders to allow such information to be published.

Moreover, it is worth mentioning that classification rulings are discussed with the regions in order to ensure that there is conformity with the work that is done at the National Classification Centre. Issues related to classification that emanate from the regions are relayed to the Centre for resolution as well.

Training challenges and capacity building needs

Ghana Customs has undertaken several training and capacity building activities for its officers over the years. They have undergone training on ECOWAS’ CET, the structure of the HS, and the principles of classification.

Experts from the WCO have also helped Ghana Customs to tackle and resolve various issues relating to the HS. Such issues include how to improve classification infrastructure, the role of the Customs laboratory and its relationship with classification work, and the use of various WCO tools (i.e. publications and Council Recommendations) that are related to capacity building and classification.

A Tariff and Classification Committee has been set up at Headquarters level. It meets once a week to review the work that is done at the National Classification Centre. However, Ghana Customs still encounters difficulties in trying to achieve a good classification work model. Key among these challenges is the lack of optimum resources required for Customs’ capacity building efforts. Not having enough competent personnel who are well schooled in the HS has been a perennial problem.

Not enough resources have been committed to enable officers to be trained in undertaking detailed analysis of all chapters of the HS and the CET, in developing case studies on classification, in taking on board HS Committee decisions, and in managing classification rulings as well as in identifying possible areas of classification fraud. Also, not enough specialized training on the HS has been organized for officers to address specific sections that are of importance to Ghana, such as the machinery and chemical chapters.

Another challenge facing Ghana Customs is the slow pace of work on the implementation of the programme for binding pre-entry classification information. The administration is still at the beginning of a national sensitization effort, aimed at educating the public and the officer corps about this very important instrument. So, as is to be expected, not many traders have been able to avail themselves of this dispensation thus far.

More education to enhance the appeals process

The appeal process has also not been as effective as Ghana Customs would want it to be. But, as indicated earlier, the law governing advanced tariff rulings allows any trader the right of appeal against any classification decision by the administration. At present, a trader is provided with the reasons for the administration’s decision in the shortest possible time. The decision is communicated during a formal meeting between the Appeal Committee and the trader.

However, the problem facing Ghana Customs is that the volume of disputes with traders is way too high. There has been a gradual attempt to raise awareness among traders and other stakeholders on the importance of classification and how it impacts their business activities. In addition, Ghana Customs has engaged its stakeholders, traders and clearing agents in various sensitization programmes at the start of every HS review cycle. However, more education is needed on the part of Customs to school traders on the rules governing classification in order to minimize disputes.

Conclusion

The Ghanaian experience is an indicator of the likely pitfalls and difficulties that could be encountered by a Customs administration that has resolved to revamp and restructure its classification infrastructure. Therefore, with the HS celebrating its 30th anniversary this year, Ghana Customs hopes that its experience will help other administrations that may be considering assessing their capacity, while inspiring them to reform their process if needed.

More information

eblege92@gmail.com

www.gra.gov.gh