Trade in minerals: Ghana, Liberia and Sierra Leone launch a Customs verification portal

20 June 2018

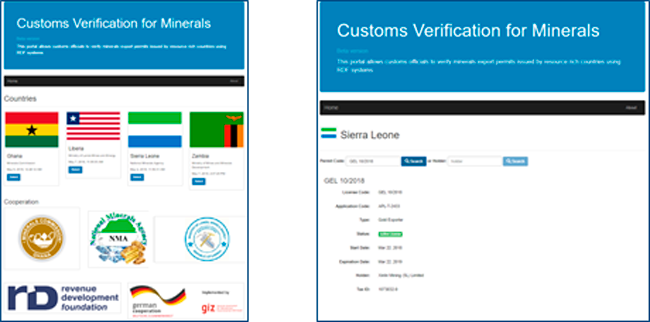

By Aasmund Andersen, Revenue Development Foundation, and Janne Kaiser-Tedesco, German Development Agency (GIZ), and Louis Marechal, Organisation for Economic Co-operation and DevelopmentThree West African countries announced the publication of a joint portal for Customs verification of minerals at this year’s Organisation for Economic Co-operation and Development (OECD) Forum for Responsible Mineral Supply Chains[1]. The portal allows Customs officers around the world to look up and verify mineral export permits issued by Ghana, Liberia and Sierra Leone. With more countries set to join, the portal will become an essential tool in addressing the smuggling of minerals such as gold and related illicit financial flows.

Mineral trade and illicit financial flows

Countries in Africa that export minerals generate a substantial part of their national revenue from this trade. But the smuggling or false declaration of such commodities poses a major threat to domestic resource mobilization in resource-rich African countries. The export of minerals requires a specific permit to be issued by an authority in the exporting country. When making an enquiry about a suspicious transaction, Customs officers trying to verify an exporter’s documents at the point of import have to wait for the relevant information to reach them, or are sometimes left to take decisions based on incomplete information.

To remedy the situation, the German Federal Ministry for Economic Cooperation and Development (BMZ) through the German Development Agency (GIZ) decided to fund a web-based portal designed to serve Customs officers’ need to verify export licences swiftly, and to replace a time-consuming and often delay-prone system of enquiry via email. The project falls within the Ministry’s Marshall Plan with Africa developed in 2017, in which it commits itself to support African countries in implementing the United Nations 2030 Agenda for Sustainable Development and the new framework for financing and implementing sustainable development – the Addis Ababa Action Agenda. Among other things, the Action Agenda commits countries to redouble efforts to substantially reduce illicit financial flows (IFFs) by 2030, with a view to eliminating them over time.

A scalable solution

Forged documents typically contain falsified signatures, stamps no longer in use, and permit codes that are not valid. While the manual verification of these documents has often been successful in uncovering fraud, it is inefficient and has limited scalability. Customs officers need to sign up to multiple exporting country systems and to contact mineral agency staff who have to invest substantial resources in answering up to five verification requests per day on average, and who are only available during office hours.

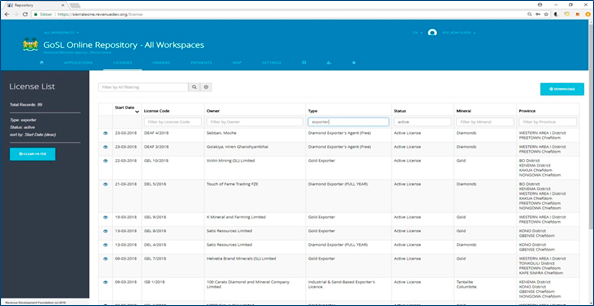

What the Customs verification portal does is draw data directly from a system called the Mining Cadastre Administration System (MCAS) currently used by nine African countries for their licensing management, including the issue of mineral export permits. This portal provides all the information needed to verify an export permit against information directly from the exporting country’s system. Simply put, if it is not in the portal, it is not legitimate. The information on the portal is no older than a day, and the portal is meant for Customs officers who want to verify a specific export permit, to look up the permit’s code, or check the exporter’s name. Other users, such as companies and buyers, may access similar information through their respective national online repository portals, linked to the Ministry’s websites.

The governments of Ghana, Liberia and Sierra Leone, as early adopters of the portal, are driving the pilot phase of the project. Other MCAS countries are expected to join the portal. As for developing countries not using the MCAS yet, a specific version of the system is in the making, which will allow them to issue export permits and join the portal without costs.

Impact

The MCAS system and the Customs verification portal have been developed by the Revenue Development Foundation (RDF) – an international non-profit consultancy. System implementations are mostly funded by donors (Australia, Germany, the European Union and the United Nations). Each new implementation project contributes to improving the system, and new releases are provided without cost to developing countries.

The MCAS system has been in use for over a decade in some developing countries. It has matured and proven its positive impact on governance by changing public administration processes around licences and permits. Using information technology (IT) systems to reduce discretionary behaviour works, and efficient processes become permanent.

As for the Customs verification portal, when the RDF presented it at the OECD Forum on Responsible Mineral Supply Chains in April 2018, representatives from the Governments of Ghana and Sierra Leone explained how valuable the portal is, and how instrumental it has been in decreasing the number of verification enquiries they receive every day.

Current discussions

Consumers and buyers around the world are putting pressure on jewellery stores and gold refineries to certify that their gold is sourced responsibly. As a minimum, such certification should prove that no forced labour, child labour or human rights violations are taking place in the mine it is extracted from. Since 2009, the OECD has gathered all mineral supply chain stakeholders, defining guidelines[2] for companies to have in place systems that allow them to identify the risks of contributing to conflict financing, serious abuses of human rights, money laundering, and corruption. These guidelines are applicable to all mineral extracting industries, and cover gold, tin, tantalum, tungsten, and increasingly precious stones, cobalt, coal and mica.

From a company’s perspective, carrying out due diligence implies the collection of relevant and verified information on the provenance and legality of an exported commodity. In this regard, the MCAS and its associated portals can, and for some companies already do, play a key role in supporting private sector due diligence, and in enhancing the transparency and integrity of global mineral supply chains. For some gold refineries, consulting national online repository portals, which draw data from the MCAS system, is already an instrumental part of their verification process to implement OECD guidance.

One of the issues that came up during the OECD Forum was how to follow up on confiscated gold, for example gold that is exported without a valid permit. A specific provision of Sierra Leone’s law which says that “anyone who identifies illicitly traded gold is entitled to 40% of the value when returning it to the government,” triggered much discussion. In addition, some participants felt that African exporting countries may want importing countries to return the value of confiscated gold. This would enable developing countries to get additional revenue, which could be spent on strengthening their enforcement capacities.

Going Forward

The Customs verification portal and the underlying MCAS system, like all systems from RDF, are continuously being improved, based on stakeholder feedback. The feedback provided during the OECD Forum was, for example, extremely useful. It helped to inform a new release of the MCAS system, which will include a stronger due diligence process and more detailed licence ownership details. In addition, a functionality will enable mine inspectors using MCAS mobile devices in the field to inform users whether any violation has been identified.

To increase awareness of the portal, the RDF and the three governments who are currently piloting the project are planning to send letters to Customs administrations as well as to the biggest refineries. We hope that this article will also play its part and trigger the interest of the global Customs community. Should any Customs administration need more information about the Customs verification portal, they are invited to email either Aasmund Andersen or Janne Kaiser, whose contact details appear below.

More information

aandersen@revenuedevelopment.org

janne.kaiser@giz.de

[1] http://mneguidelines.oecd.org/forum-responsible-mineral-supply-chains.htm

[2] OECD (2016), OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: Third Edition, OECD Publishing, Paris