Ecuador undertakes a mirror analysis

3 March 2015

By the National Customs Service of EcuadorHow do we discover new fraud? On what basis and on which data do we rely in deciding when to investigate certain commodities or trade flows rather than others? Chance, intuition, experience and intelligence are useful, but can we complement them using a more objective approach to detect new fraud trends? Ecuador Customs is one of several administrations that has given consideration to these questions by using ‘mirror analysis’ as a means of adapting and enhancing its risk analysis practices. In this article, Ecuador shares its experience in the use of this method.

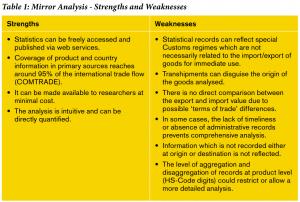

Mirror analysis is one of the most heavily used tools in analysing foreign trade gaps with respect to both exports and imports. Its approach and construction are widely known and well publicized, and the mechanism has consequently been further developed over time in the light of its strengths and weaknesses (see Table 1).

The method has been developed and used by economists for different purposes, including the re-building of the import data of a country when it is not fully available, showing that trade data provided by a country is not reliable, and looking for trade gaps in order to analyse the impact of trade policies.

From a practical perspective, the accuracy of economists is not crucial to a Customs administration. What is important for Customs purposes, however, is to find major gaps, where data “does not fit”, in order to unearth undetected fraud and prioritize in-depth risk analysis.

The core principle is simple:

- Comparing Country A’s imports to the exports of countries that trade with Country A.

- Finding gaps between Country A’s exports and imports.

- Making fraud hypotheses that can explain the gaps.

- Testing the hypotheses in the field through the application of Customs controls.

- Improving Customs’ risk assessment methods.

Ecuador’s experience

In order to use mirror analysis techniques as a means of enhancing its capacity to identify possible irregularities, such as undervaluation and misclassification, the National Customs Service of Ecuador (SENAE) requested the assistance of the WCO. In response to Ecuador’s request, the WCO undertook a study visit in December 2014.

The aim of the study visit was to support the Ecuador Customs’ Risk Management Unit by providing assistance in reviewing preliminary data on trade gaps in Ecuador using mirror statistics, making adjustments to them in line with detailed information from the electronic Customs clearance system (EcuaPass) database, and using the preliminary results to draft possible control strategies.

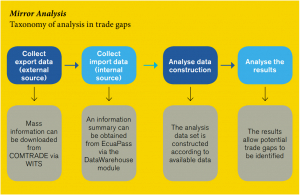

The following diagram summarizes the taxonomy established jointly by the WCO technical team and SENAE:

Collection of export information: the World Integrated Trade Solution (WITS) software – http://wits.worldbank.org – was used to extract export data provided by countries to the United Nations Commodity Trade Statistics Database (COMTRADE database). Export data is presented in terms of value (thousands of US dollars on a FOB basis), weight (in kilograms) and supplementary quantities.

Collection of import information: the EcuaPass DataWarehouse module provided import data at a much disaggregated level (10-digits). Since export data cannot be disaggregated beyond the 6-digit level, import data has been aggregated on a 6-digit basis. As the Customs database also provides more information, from more countries and in greater detail, additional adjustment is effected so that the data is comparable between both sources.

Construction of a data set for analysis: the data set to be analysed is defined. Certain points must be borne in mind when ensuring data consolidation prior to calculating the gaps. For example:

- Identification of transactions associated with tax suspension procedures: vehicles are one of the most important goods in tax terms, and their inclusion in Customs tax suspension procedures means that they do not become statistically ‘visible’ until they move to importation for home use. This time lag may give rise to significant distortions in some cases.

- Identification of transactions associated with processing procedures: as in the previous case, in this component it is important to point out that, in terms of comparative statistics, there will be no corresponding record of importation for home use for such imports intended for processing procedures. By way of example, in the case of Ecuador, an important component associated with import statistics for rolls of paper was identified and resolved at this stage of the analysis.

- Transactions originating in storage/transhipment centres: in some records, transactions originating in Panama tend to reflect the origin of the export incorrectly. Thus, in some cases, trade flows from China can be aggregated with flows from Panama. A similar case related to Andean Community transit declarations was detected and examined.

Analysis of the results: the initial analyses have already given rise to interesting results. One of the first gaps relates to goods which are sensitive to Customs fraud. Different categories of gaps were calculated: the gap in value (import vs export value); the gap in weight (import vs export weight); and the difference in density value (ratio of FOB value over weight). Value, weight and density value gaps unveil potential misclassification, undervaluation and smuggling. A gap in density value in the case of textiles was, for example, discovered, leading to an initial analysis of the variation and the potential for fraud.

Validation and outcomes

SENAE is currently validating the results obtained and will be sharing the outcomes of initial controls in the future. As a result of the methodology applied during the exercise, two facilitation and Customs control mechanisms are envisaged:

- Facilitation: check consistency in facilitation mechanisms used in cases in which the gaps are smaller.

- Control: gear controls towards the identified priority segments.

The use of mirror analysis is therefore not restricted solely to control objectives, but also seeks to strike the right balance between facilitation and fair trade.

More information

mrojas@aduana.gob.ec

engarcia@aduana.gob.ec