Leveraging AI for Customs classification purposes

18 October 2023

By Thibo Clicteur and Dries BertrandThere are many discussions about the efficiency of classification assistance tools. In this article, we argue that an AI-based tool, if well-built and properly used, can support classification experts, enabling them to focus their attention on unusual and difficult product classifications.

Since the early days of computer history, scientists have strived to make machines as intelligent as humans, developing what in 1956 were called Artificial Intelligence (AI) capacities. The AI “mainstream” systems which are in use today correspond to reactive AI systems, which have the ability neither to form memories nor to use past experiences to inform current decisions, and limited memory systems, which are able to use information about the past to improve their responses.

In 1997, a milestone was reached for AI, as the supercomputer Deep Blue beat the best chess player in the world, illustrating its numerous possibilities. From the autonomous car in 2005 to the Siri answering system in 2011 or the introduction of ChatGPT in 2022, AI technology has penetrated multiple facets of our society and is constantly being developed to reach greater heights.

The rise of AI has also had a profound impact on international trade and economic growth. The business world is developing a new understanding of what it means to trust machines, acknowledging that what will matter in the future is who will be able to use AI most effectively. This point represents an essential step in the implementation of AI tools and the legislation surrounding them.

Firms that use AI extensively throughout their operations perform at a higher level than those that do not, and they seem to be aware of it, with 73% of businesses stating that AI is critical to their success.[1] However, even though nearly three out of four organizations say that AI is critical to their business, almost half of them feel that their organization is behind in its AI journey.

This article focuses on the use of AI for product classification, which is a critical pillar of trade compliance for many companies.

Classification process

Countries or geographical entities use the WCO Harmonized System (HS) as a basis for their classification system. They develop their own classification scheme by further expanding the six-digit HS product categories into eight or more tariff lines for greater specificity.

Customs classification is the art of assigning a correct classification code to a product for Customs purposes. In order to do so, general classification rules have to be followed (the General Rules for the Interpretation of the HS), along with a plethora of other classification rules and sources on a country-level basis. The product portfolio requiring classification can be significant, especially for companies in certain industries, such as automotive companies, apparel companies, retailers, or e-commerce players. For example, if a car is composed of 30 000 parts and can be sold in 170 countries around the world, this could theoretically add up to a total of 5 100 000 classifications of spare parts.

In principle, classification experts carry out the Customs classification process, collecting as much information as possible that allows them to classify products, including product data sheets, product specifications, production methods, the use of the product, and so on. Based on this objective information, the product is classified, following the said classification rules and opinions. Often, these experts are supported by workflow tools, master data governance systems (master data recording all the materials bought, procured, produced, and kept in stock), global trade management solutions, decision trees, global delivery centres and the like.

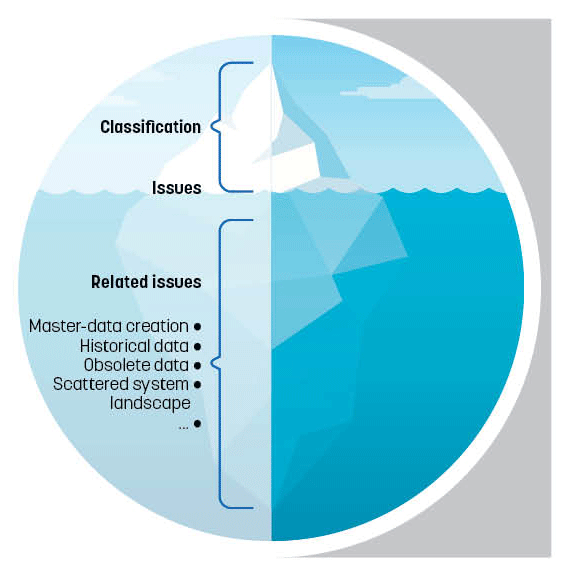

Nonetheless, in reality we notice that it is not uncommon for companies to face a variety of classification challenges. First, the availability of skilled classification experts may be a challenge. Second, the product information and product data for determining classification codes may be scattered within the company, its databases and systems. Finally, the master data for product classification may not be properly maintained, may be obsolete, or even be unavailable.

Incorrect Customs classification may lead to (financial) penalties, incorrectly calculated duties, and supply chain disruptions, and may have a knock-on effect on other trade and tax related areas. A variety of initiatives has been launched by Customs authorities that embed technologies such as predictive analytics and sophisticated analytical tools in the control of Customs declarations. It is therefore more vital than ever to put in place a solid process for product data governance, ensuring compliance with classification, trade and Customs regulations.

AI classification

In order to tackle the aforementioned challenges, which are inherently linked to high-volume classification, AI can be leveraged to support classification experts in the classification process, significantly increasing the latter’s accuracy and speed.

In recent years, we have gained experience in classifying goods using AI.[2] A typical classification trajectory starts with a preliminary data quality assessment, which may lead to the potential cleansing of product master data. Indeed, it is of utmost importance that the baseline is correct and that quality issues and classification inconsistencies across product clusters, jurisdictions and systems are solved.

In a subsequent step, a representative set of classified products, including product descriptions, master data product attributes, pictures, drawings, etc. is loaded into the AI solution for training purposes. Finally, after the AI solution has been trained properly, new products can be loaded into the solution, whereupon the AI will generate classification recommendations for the classification expert to analyse. The classification expert plays a crucial role in validating and/or correcting these classification recommendations, which will ultimately allow the AI solution to further fine-tune its future classification recommendations.

What we obtain through this process are algorithms which can support the classification expert by returning possible classification recommendations, including confidence levels, for a large range of products. In reality, the AI algorithms can assess and learn patterns from historical classification data, enabling the AI to produce HS code recommendations which are tailored to company-determined parameters.

Conclusion

AI can be seen as a supportive technology for classification experts, remedying multiple drawbacks of manual classification activities through automation. As the classification of large volumes of data is a time-consuming activity with high operational costs, the use of AI can lead to operational efficiencies, time savings, cost savings, reduced error rates, and risk mitigation. The AI allows the classification experts to focus their attention on unusual and difficult products, while adding value to the classification of other, easier product ranges.

More information

https://www2.deloitte.com/be/en/pages/tax/solutions/trade-classifier.html

dbertrand@deloitte.com

[1] Whitepaper-State-of-Ai-2020-Final (1).pdf (deloitte.com)

[2] TRADEclassifier, Deloitte, https://www2.deloitte.com/be/en/pages/tax/solutions/trade-classifier.html