Leaning forward: Singapore leverages digital data to help financial institutions augment trade finance compliance

22 June 2020

By Singapore CustomsSingapore Customs launched a Trade Finance Compliance Service on the country’s Networked Trade Platform to augment trade finance compliance efforts against money laundering and terrorist financing.

Banks and financial institutions offer multiple solutions to traders in order to facilitate the purchase and shipment of goods. The most common trade finance product is the Letter of Credit, a formal commitment issued by a bank on behalf of and at the request of a customer to pay a beneficiary a given amount of money upon presentation of documents as specified in the Letter. It should be mentioned that the WTO estimates that 80 to 90% of global trade is reliant on such short-term financing means.

Trade finance and trade-based money laundering

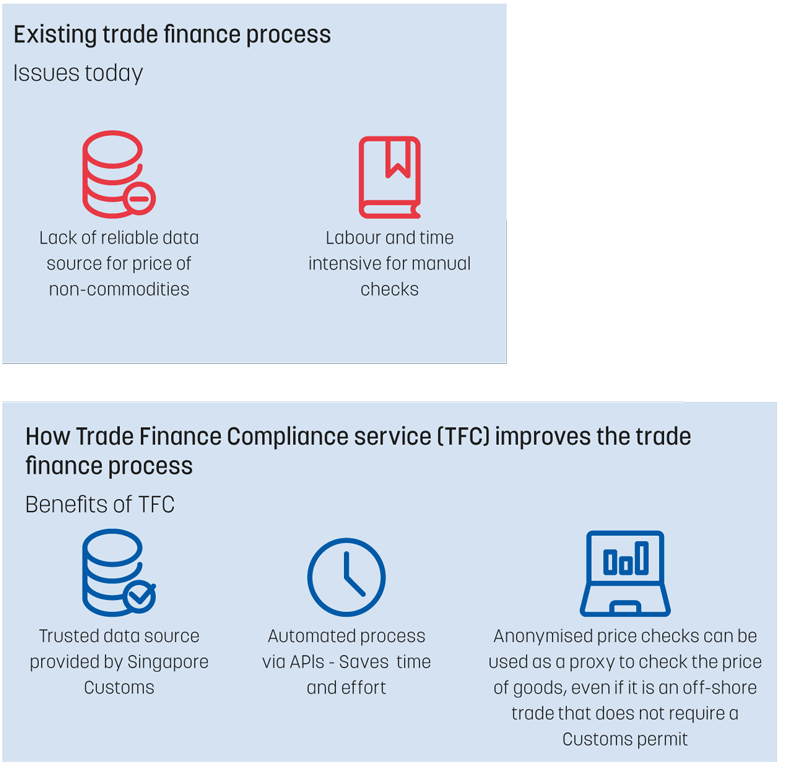

As part of their money laundering related monitoring and reporting obligations, banks and other financial institutions have to assess whether these trade transactions are legitimate or possibly being used to launder money or move illicit funds. The process known as trade-based money laundering (TBML) can be achieved notably through the misrepresentation of the price, as well as the quantity or quality of imports and/or exports.

When considering a client’s request, a bank’s credit team must be on the lookout for inconsistencies and anomalies in the provided documentation, which means not only understanding the companies involved (know your client), but also the goods, transportation, locations, and beneficiaries connected with the transaction. Since trade finance manipulations related to money laundering almost always involve undervaluing and overvaluing goods and services, banks must be able to check the general prices of goods.

Trade Finance Compliance Service

To enable financial institutions to improve their price checks for non-commodity goods (i.e. goods whose prices are determined at the exporter-importer level of commodity trade, not in the international market), and to validate the compliance of a credit request linked to a trade transaction, Singapore Customs launched an e-service on 5 September 2019 called the Trade Finance Compliance (TFC) Service.

The service supports compliance officers’ work related to:

- the detection of over/understatement when it comes to the prices of non-commodity goods being transacted, by providing anonymized data on the price of goods at the HS code level – mean, median and interquartile price data is available to reference the unit price of the underlying good;

- the detection of inflated revenue/income claims filed by new customers, by providing, with the trader’s consent to disclose the information to the financial institutions, the unit price at HS code level of goods previously exported or imported by the trader;

- the legitimacy of a transaction, by allowing checks on whether an invoice has an associated permit for import or export, if the trader consented to share the information with financial institutions.

The service is accessible via the Networked Trade Platform (NTP), Singapore’s one-stop trade and logistics ecosystem. It is the result of a joint government-industry partnership between Singapore Customs, the Monetary Authority of Singapore (MAS), and leading financial institutions in the country.

Currently, BNP Paribas, Commerzbank AG, DBS Bank, ICBC, MUFG Bank, OCBC Bank, and UOB have signed up to the TFC Service on the NTP. To ensure proper data governance, traders have to give consent on the NTP for their data to be shared directly with financial institutions of their choice.

The service will not only increase the efficiency and accuracy of the trade finance compliance checks carried out by the financial institutions, it will also enable traders to have their trade finance applications processed more rapidly. As such, the TFC service is part of the Singapore Customs transformation plan for easy, seamless, and integrated trade, travel, and cargo across borders.

More information

enquiry_ntp@customs.gov.sg

www.ntp.gov.sg

The NTP was launched on 26 September 2018, and is a one-stop trade and logistics ecosystem, which supports digitalization efforts and connects players across the trade value chain – in Singapore and abroad. It aims to provide the foundation for Singapore to be a leading trade, supply chain, and trade financing hub.

The NTP helps businesses improve productivity through digital exchange and the reuse of data with their business partners and the government. Businesses can streamline their work processes and reduce inefficiencies stemming from manual trade document exchange.

The NTP also serves as a key gateway for digital connections to cross-border platforms and other governments’ national Single Window systems.