Control measures, paperless procedures, openness and transparency: Overview of the Customs Anti-Corruption Strategy in Morocco

21 June 2022

By Moroccan CustomsIn 2015, the Kingdom of Morocco adopted a National Anti‑Corruption Strategy, the implementation of which is overseen by a steering committee chaired by the Prime Minister. This article sets out the approach adopted by Moroccan Customs in this area, an approach fully in line with this Strategy and consistent with the guidelines and practices recommended by the WCO, and in particular the Revised Arusha Declaration.

Central and regional audit and inspection units

Since 2012, Moroccan Customs has had its own Code of Conduct, to which all Customs staff members are required to adhere. It has set up central and regional audit and inspection units which perform prevention and control functions comprising audit, inspection and investigation tasks.

The work undertaken by those units has led to the mapping of corruption risks. This has involved analysing all key stages underpinning the Customs processes, irrespective of the Customs office concerned (whether maritime or airport, land border or inland):

- Customs clearance at import;

- Customs clearance at export and management of suspensive regimes;

- tallying and monitoring;

- deferred inspection, investigations and post-clearance audit;

- litigation;

- Customs control of passengers and users of border services;

- sales by public auction;

- guarantee for precious metals.

For each operational process, risk indicators and sensitive stages have been identified. Risks associated with the import process include:

- tardiness in the processing of a Customs declaration;

- the physical inspection of the goods;

- the re-selection of declarations for a full physical inspection;

- the waiver or reduction of duties and taxes;

- the closing times of Customs offices during which the risk of goods being removed without a declaration or compliance certificate is greater.

To improve management of the risks identified, an internal control system has been established; it defines the minimum periodical checks to be carried out by the regional or local officers responsible. A cascade control system relies on basic resources available to the officers responsible: use of data taken from the Moroccan Customs information system, actual presence on the ground, spot checks, verification of records and registers held by the Customs service and use of video surveillance which provides data on the conduct of operations in real time.

To harmonize the control methods and their frequency, a matrix setting out the different control measures to be conducted was made available to the various hierarchical levels depending on the activity and operations within their remit.

The control mechanism established is based on a reporting system which entails registering, in a dedicated computer application, the results of measures conducted in the course of each check, as well as other information such as the type of check carried out, the date of the intervention and the measures taken. The objective is to monitor and assess, adopting the cascade approach, the quality of the checks so that any shortcomings can be detected and rectified in real time.

Simplifying procedures and going paperless

A further safeguard for improving management of the risks identified is to simplify and harmonize procedures as well as to reduce contact with Customs service users by making procedures paperless and automating the core operational processes.

For several years now, Moroccan Customs has been committed to an ongoing process of streamlining its procedures with a view to making them more transparent and less cumbersome. The aim is for them to evolve in line with international standards and for administrative formalities that are burdensome, or indeed pointless or capable of fostering corruption, to be eliminated.

In parallel, Moroccan Customs has turned paperless Customs procedures into a way of promoting trade facilitation as well as an effective means of limiting opportunities for contact with customers/users and the resulting risks of abuses. This process, undertaken as part of a step-by-step approach, reached its culmination on 1 January 2019 with the entire Customs clearance circuit going paperless. (see article featured in the 94th edition of WCO News in February 2021).

In specific terms, these days economic operators can access a whole range of digitized services in relation to:

- the filing of the Customs declaration;

- the option to establish an estimate of duties and taxes;

- consultation of the integrated tariff;

- the issuing of the Customs duty assessment document (invoice);

- the electronic payment of duties and taxes;

- the issuing of the payment receipt;

- the issuing of the certificate of discharge, thereby enabling the bank to release the operator from its liabilities up to the value discharged;

- the real-time tracking of progress in the declaration circuit.

Access to information and documentation

Another way to curtail the discretionary powers of Customs officers is to guarantee the transparency and predictability of procedures by facilitating easy access to information for users. The policy of openness and transparency favoured by Moroccan Customs is evident from the fact that it posts all Customs information online on its web portal. Fully aware that acquiring an understanding of the rules and regulations is no easy task generally, Moroccan Customs is seeking to remove most of the ambiguities that can give rise to problems in Customs operations and thereby promote compliance.

The web portal covers the following topics:

- an outline of current Customs laws and regulations;

- information on the authorizations granted by the Customs Administration, the conditions governing their issue and the officers empowered to grant them; and

- making the contact details of the Administration available to customers/users.

It also offers online and application services:

- assisting business managers, without an intermediary, to monitor their Customs operations closely through each stage of the process (via the “Diw@nati” web and mobile platform);

- providing the ADIL (Assistance au Dédouanement des Marchandises à l’Importation en Ligne) Customs tariff determination system, giving full details of the duties and taxes payable, both based on preferential regimes and under ordinary law, and furnishing information about particular regulations applying to imports and exports;

- explaining, by means of diagrams, the process relating to each operation and Customs regime, and describing clearly and succinctly the administrative procedures to be undertaken by the Customs services;

- allowing individuals to estimate the duties and charges to be paid for the Customs clearance of a vehicle.

Lastly, the portal streamlines communication between Customs and the users by allowing the latter to:

- submit their requests for information, applications, grievances or correspondence and track their progress/status instantly;

- access written and official responses on the information forwarded by Customs as well as any decisions that may have been debated.

A responsive telephone helpline

A telephone helpline has also been available to the public since 1999. Telephone operators field all requests for information or assistance with completing formalities; they also process and follow up on any complaints or grievances lodged.

Trust

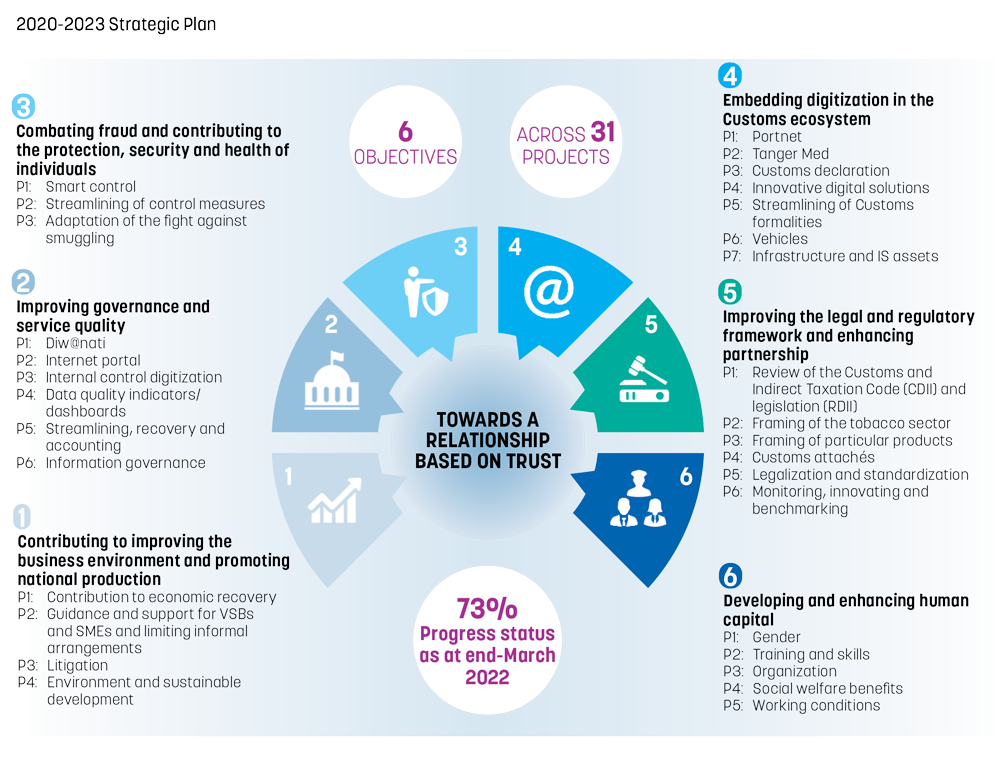

Many other measures are envisaged in the 2022-2023 Strategic Plan, which bears the slogan “Towards a relationship based on trust” (see chart). The plan provides for six strategic objectives across 31 projects dedicated mainly to consolidating transparency and bolstering the climate of trust between economic operators and Customs. One final aspect that we would like particularly to highlight is the enhancement of human capital: a priority area in this new strategy involving five projects which focus on gender equality, training opportunities, the organization of work, social welfare benefits and working conditions.

More information

a.benabdellah@douane.gov.ma