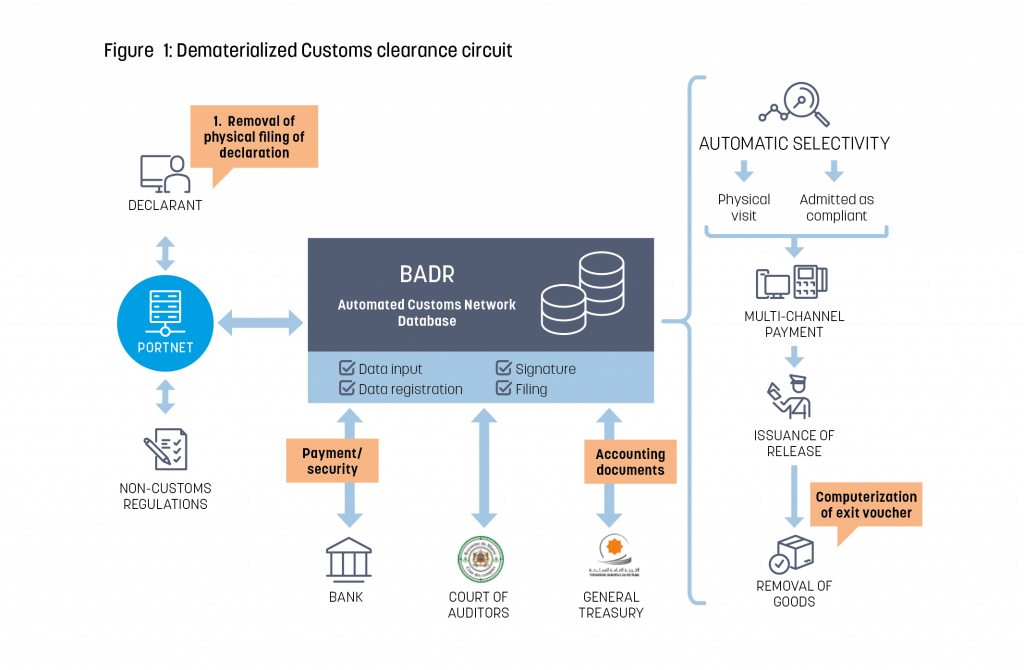

Complete dematerialization of the Customs clearance circuit

The launch of “paperless” Customs clearance was preceded by the gradual rollout of legal, procedural and technical prerequisites, which called for a commitment from all the Customs services. Some of the key objectives of the digital transformation strategy adopted include time and cost optimization, the streamlining of control measures, faster and simplified communication between stakeholders, improved working conditions and complete transparency of clearance operations.

In effect, the Customs clearance circuit of which the Customs declaration forms a part, regardless of the nature of the Customs regime concerned, has been completely reengineered. Once signed electronically, the declaration together with any annexes required by the Customs authority are submitted online and registered automatically in the Automated Customs Network Database (BADR). The computer system sends registration confirmation to the declarant. The control phase is subsequently initiated: the data from the declaration is analysed and cross-checked, litigation proceedings might be lodged, electronic payment is made and removal of the goods takes place. This phase is also activated in the case of occasional declarations. Those operations conducted on an occasional basis and formerly processed manually will henceforth be registered on the Customs information system.

Gone are the days of queueing in person at Customs counters. The agents responsible for manual processing no longer need to look for and archive paper declaration records. Everything can be found on the system. Operational managers can complete all their work activities from their screens: documentary checks, valuation control, payment of duties and taxes, litigation proceedings, etc.

Inspectors have two screens at their disposal for viewing all the information essential for inspection and payment purposes. They may call on the services of central and regional teams to assist them in Customs clearance operations, including in the use of the hardware and software tools available to them.

A package of online services

As regards external users, a number of meetings were organized for the benefit of the forwarding agents and economic operators. The benefits for those parties are well documented. Some of the services available online include consultation of the declaration circuit, access to the cost estimate for the Customs duties arising, notification of the release issued and auditing of Customs procedures with economic impact.

The online availability of these services has facilitated:

- reduced contact with customers: procedures governing declaration, control, payment and release all take place remotely, except in the event of physical verification;

- the easing of non-Customs formalities: initiation of non-Customs control measures is notified and their results shared electronically with the authorities responsible for auditing, either from system to system or by means of the Virtual Single Window for Foreign Trade if the authority concerned is connected to it;

- the availability of real-time information via the mechanisms for logging histories, alerts and electronic notifications;

- the transformation, on an organizational level, of Customs clearance offices into remote monitoring offices;

- the objective of minimizing human intervention: some tasks relating to data consistency verification, tasks involving assistance with entering declarations and checks relating to mandatory documentation or to the management of Customs privileges and concessions are fully automated;

- the streamlining of control: the enforcement and inspection services have at their disposal, in real time, all data and documentation relating to Customs clearance operations.

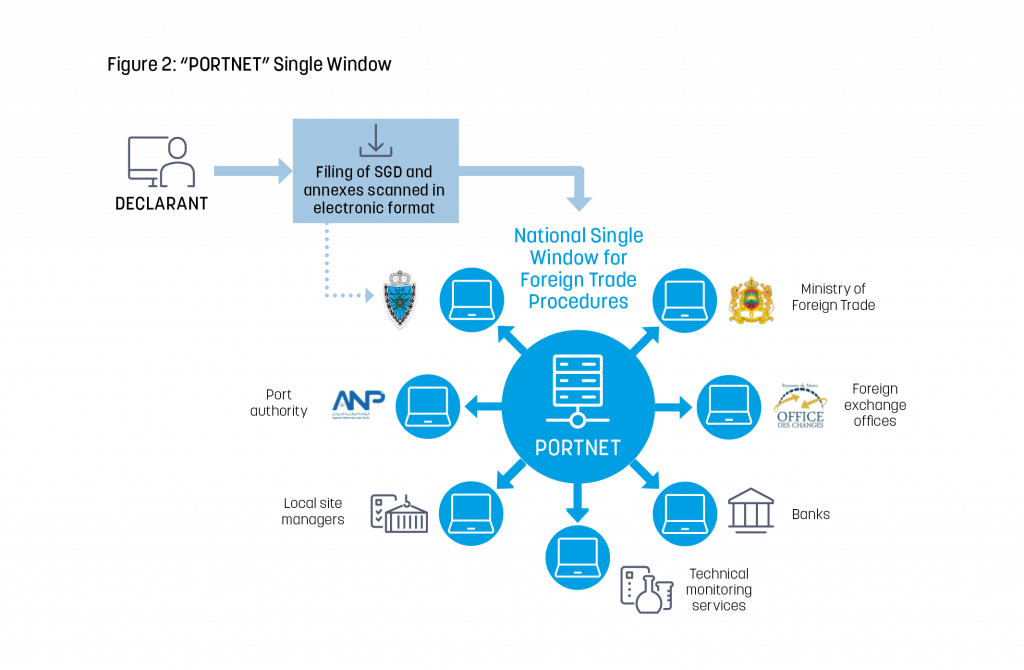

PORTNET National Single Window

Functioning as an electronic platform for integrating the information systems of all foreign trade operators at national and regional level (Customs, port authorities, port operators, shipping agents, freight forwarding agents, importers/exporters, oversight bodies, banks, etc.), this Single Window operates with a view to “going paperless” in foreign trade operations.

Software tools interconnected with the BADR Customs clearance system

Software tools have been developed which, together with the clearance system, shape an ecosystem in which it is possible:

- to provide Customs officers with all the devices needed for mobile working, that is to say, for completing tasks outside the office, in order to facilitate better organization of work and a reduction in the time needed for processing operations; Customs officers have all the tools they need for their work when they are equipped with a tablet;

- to establish a risk management approach based on effective systems for the collection and analysis of information; one current study is focusing on the prospect of fine-tuning this approach by incorporating predictive analysis and additional data;

- to make available to the customers/users a digital channel for submitting their complaints and requests for information; this new method of communication, which forms part of the governmental plan for a national claims portal, facilitates increased traceability and monitoring of customers’/users’ queries and the responses provided;

- for economic operators (business leaders initially) to monitor their Customs activities and operations closely, on a daily basis and in real time, via a digital platform known as “Diw@nati”; the platform will provide access to operations history, to the electronic documents associated with those operations (SGD, release, clearance certificate, authorization, receipt, etc.), to various online services (settlement of Customs debts, application for a particular authorization, filing of a complaint), to Customs notifications, and to a service for messaging a Customs adviser;

- to make available to the general public an application known as “Bayyan Liy@”, which gives consumers the opportunity to ascertain for themselves that certain products put up for sale are genuine by verifying a number of details (for instance, the trade name, producer/importer, or the date of production/import); one particular bonus of this application is its effectiveness in combating smuggling and counterfeiting.

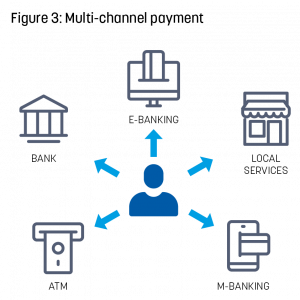

Multi-channel payment solutions

Customers/users can settle their outstanding Customs debts by various simple, swift and secure payment methods. In addition to the online method of payment by bank card, other methods are proposed, including payment by online banking (e-banking), by mobile phone (m-banking), by automated teller machine or even through bank branches and money transfer agencies (local service points).

Irrespective of the payment method chosen, the process remains the same:

- the operator selects the outstanding amounts that it wishes to pay and creates a shopping cart to that end;

- a payment code is automatically allocated to the relevant shopping basket;

- the code is used by the operator to proceed to payment;

- as soon as the payment transaction has been confirmed, notification of the release is issued;

- on receipt of the debit notice from the bank account, the transaction is recorded;

- a receipt, generated automatically by the system, is sent via e‑mail to the payer’s messaging address.

Dematerialization of bank security documentation

The automated management of payments, rolled out since October 2017, translates into a time saving for economic operators relying on bank security documents. At their request, banks input the bank security directly into the BADR system without the need to issue the operators with a document which would then be handed to the Customs services.

An electronic signature solution, certification for which is provided by the company Barid Al Maghrib, ascribes to documents bearing an electronic signature on the online BADR clearance system the same legal value as the equivalent physical documents signed by hand.

Using this solution makes it possible to guarantee:

- the identity of the signatory (identification/authentication of the signatory);

- the non-repudiation of the signed document by the signatory (by this mechanism, challenges regarding the effectiveness of dispatch of digitally signed documents can be avoided);

- the integrity of the signed document (impossible to alter it).

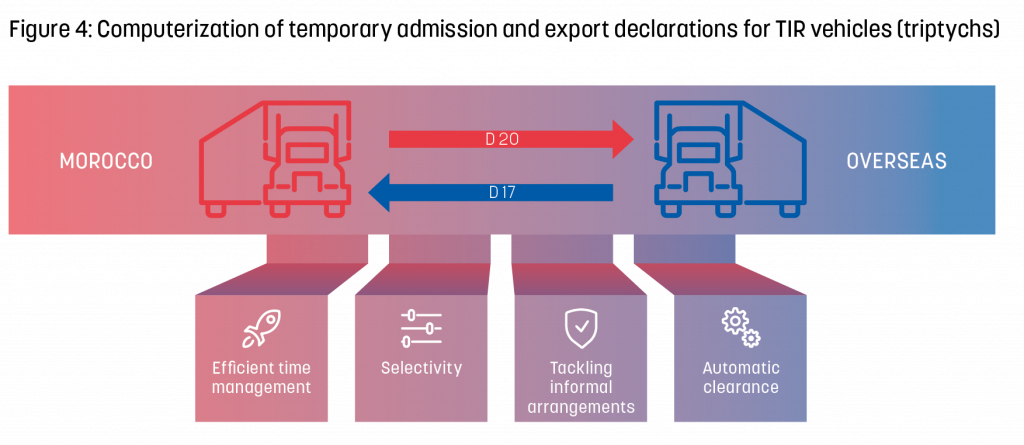

Cessation of manual processing in respect of temporary admission and export declarations for hauliers’ vehicles

Since 1 October 2019, an electronic procedure has replaced the paper-based system used for a long time by hauliers to obtain simplified temporary admission and export declarations for their commercial use vehicles (known as “D17”s and “D20”s). The paper versions of these declarations, previously supplied exclusively by the Association Marocaine du Transport Routier International (Moroccan Association of International Road Transport), are therefore no longer in use.

Those simplified declarations can be used only by those International Road Transport (TIR) operators that are established in Morocco in relation to their operations involving:

- temporary export of their commercial use vehicles registered in Morocco;

- temporary admission of commercial use vehicles registered overseas and belonging to foreign transport operators, on the basis of a partnership contract.

They are still required to submit the relevant application (supported by an unsecured commitment) and obtain Customs approval.

The approved TIR operator is required to enter into and electronically sign these declarations for every operation involving temporary admission or export of commercial use vehicles. Their decision to participate in this arrangement is expedited by the advantages presented by the process’ dematerialization in terms of cost, time and operational traceability.

Similarly, the computerization of the “D17” and “D20” declaration documents presents its share of advantages for the Customs services inasmuch as it has made it easy for them to identify those road hauliers operating internationally, to have oversight of their fleet of vehicles and drivers as well as of their movements, to ramp up checks through risk analysis, and ultimately to ensure greater compliance with the regulatory deadlines granted by Customs and better management of the discharging of declarations.

Vehicles registered overseas

Management of temporary admissions of vehicles registered overseas has been completely overhauled. Its integration into the BADR system has resulted in better oversight as well as simpler formalities for travellers, whether they are Moroccan nationals residing overseas or foreign tourists.

Computerized management of litigation proceedings

The process of litigation management, from the initial lodging of proceedings to their definitive resolution (drafting of reports, settlements, judicial proceedings, recovery proceedings and administrative proceedings), has also undergone computerization.

New data-related requirements

As part of the drive to establish a global control mechanism aimed at anticipating the Customs clearance of goods and thereby expediting their exit from Customs premises, hauliers have been required, since 1 October 2019, to give specific details in their summary declarations, including the four-digit tariff heading for the goods concerned.

Moreover, Customs now has access to export declarations for goods from the countries signatories to the Agadir Agreement (namely, Egypt, Jordan, Tunisia and Morocco). It can, as a result, enhance its management of risk by comparing the data on the import and export declarations.

Dematerialization of certificates of origin

In Morocco, certificates of origin are issued by the Customs Administration. Exporters simply apply for a certificate when drawing up the export declaration. The computer system then collects the data already entered on the declaration and requests that the exporter input only the outstanding information needed for it to process the application. This process reduces the risk of error.

The electronic certificate created in this way is registered on the Internet portal of Moroccan Customs. Any administration seeking to verify the authenticity of a certificate issued by Morocco therefore has only to consult the Customs website.

This procedure was phased in and completed in January 2021 against a backdrop of important discussions and intense negotiations between the teams at Moroccan Customs and their counterparts in the other countries parties to bilateral or multilateral agreements. The objective has been to bring those partner countries on board this project and to remove any obstacle to its successful conclusion (whether technical, procedural or agreement-related). At the same time, major IT-development work has commenced. One application has been developed to facilitate the remote authentication of certificates of origin, providing assurances to the operator that those certificates would not be rejected for reasons still connected with such authentication.

Electronic commerce and blockchain technology

In 2020, Moroccan Customs launched a cooperation project with DHL and the German International Cooperation Agency (GIZ Morocco) with a view to developing a platform relying on blockchain technology for collecting the data of each party to an international transaction (traders, express mail service, Customs, other stakeholders) and sharing it. Rooted in this ecosystem, procedures will be open to simplification and risk management will be enhanced, in particular as regards Customs valuation.

Becoming an indispensable logistics hub for the region

By means of the projects for dematerializing the foreign trade procedures, Morocco is setting its sights on becoming an indispensable logistics hub for the region, especially as regards the North-South flows of goods. In that connection, a number of partnership agreements promoting the Kingdom’s maritime, air and land transport have been concluded between the main public and private stakeholders concerned.

As a key player in these projects, Moroccan Customs, in conjunction with professionals in the relevant sectors, has introduced a procedure for the Customs clearance of goods that is appropriate for all logistics arrangements. The essential focus is to proceed with dematerialization and simplification of Customs procedures, thereby nurturing the emergence of multimodal transport solutions, that is to say, combining transport by land, sea and air.

In 2019, the key performance indicators highlighted a significant improvement in the performance of services. The revenues collected have, in particular, risen by 2.88% in comparison with 2018. The current objective is to take advantage of the transformation to improve performance indicators in the areas of facilitation and control.

It can already be stated that litigation management capacity has broadly improved. One of the reasons for the increased pace of proceedings is the fact that all stages of litigation proceedings are now registered on the Customs information system.

The radical overhaul of the system by Moroccan Customs in terms of its dematerialization has also profoundly altered the relationship between the Customs officer and the economic operator or its representative. That relationship, which used to be a physical one, has, to all intents and purposes, become a virtual one. These new management methods have unburdened operators of any costly and needless trips, but have also provided the means for Customs officers to work in a better environment. This does not mean that the communication channels have been muted. On the contrary, they are stronger and more effective.

COVID-19 has acted as a catalyst, increasing the pace of change of stakeholders’ procedures and conduct in the international trade system. It has also allowed us to take full stock of the changes introduced. In the midst of a health crisis, Morocco has encountered no problems in continuing to source supplies of essential products and basic necessities (such as food products, healthcare products, medicines and hydrocarbons); and the effective transition from a management of flows to a teleworking arrangement, facilitated by an efficient computing ecosystem, has had a significant and positive impact on the situation.

More information

a.zdaik@douane.gov.ma