WCO’s development of draft “Practical Guidance on Free Zones”

22 June 2020

By Satoko Kagawa and Kenji Omi, WCO SecretariatWCO Members have been drawing and sharing lessons from their experiences in combating illicit trade associated with Free Zones (FZs) for decades now. One lesson is that there is a need for effective or better monitoring and control by Customs over these zones. However, changing existing FZ regimes requires action by policymakers, and convincing them to do so has been rather difficult at times.

This article introduces the key elements embedded in the recently published WCO research paper on FZs and the draft “Practical Guidance on Free Zones”, which both aim to support administrations wishing to build or enhance their control capacities over FZs and ensure their competitiveness and sustainability.

WCO research paper

Many papers, such as those produced by the Financial Action Task Force (2010), the International Chamber of Commerce (2013), INTERPOL (2013), Viski et al. (2016), The Economist (2018), the Organisation for Economic Co-operation and Development (2018), and McKinsey & Company (2019), have called for high levels of control over goods and activities inside FZs. Some have also specifically named Customs as one of the agencies that needs to be empowered to do so.

Since 2018, the WCO Secretariat has been researching the topic: reviewing existing literature, conducting a survey, organizing workshops, and undertaking field studies. These activities resulted in the publication, in September 2019, of a WCO Research Paper entitled “Extraterritoriality of Free Zones: The Necessity for Enhanced Customs Involvement”.

The FZ research paper presents the definitions, characteristics, and economic benefits of FZs as well as the risks they pose; describes the perceived “extraterritoriality” of FZs; and highlights Customs’ limited involvement and insufficient authority in the establishment and operation of FZs.

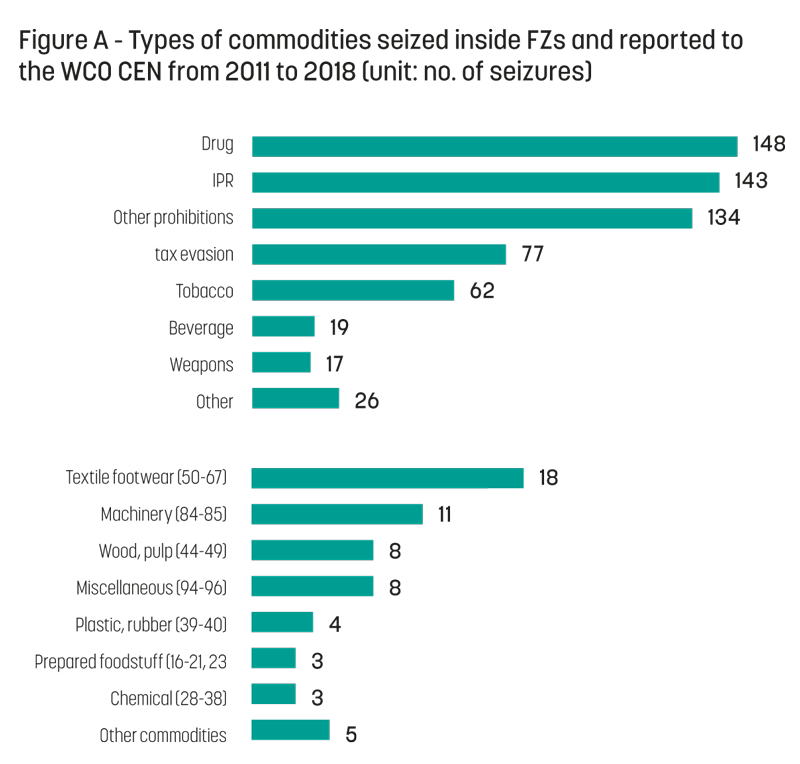

The global nature and the variety of illicit trade activities related to FZs are stressed, ranging from tax evasion to smuggling of IPR-infringing goods, tobacco, drugs, and weapons. As there is limited global data available on illicit trade, no statistics can be drawn from the analysis of seizures reported to the WCO Customs Enforcement Network (CEN).

However, the research paper highlights some seizures including cases of ‘missing cargo’ inside FZs, cases where three or more countries were involved in the chain of transit/transhipment operations, cases involving the manufacture of illicit goods, cases involving the exploitation of the FZ’s ‘unlimited duration for cargo’ feature, cases involving the smuggling of stolen cultural objects, and links to money laundering.

Practical Guidance

The draft Practical Guidance on FZs (FZ Guidance) was developed by the WCO Secretariat to help Customs administrations who wish to enhance their control over FZs, while effectively supporting their healthy development and competitiveness. It will be discussed by the WCO’s Permanent Technical Committee in autumn 2020 for finalization. The draft consists of seven core elements, briefly summarized below.

Territoriality

The territorial definition of FZs is the core issue to be resolved. Indeed, Chapter 2 (“Free zones”) of Specific Annex D of the Revised Kyoto Convention (RKC) provides a definition of a FZ which indicates that a FZ itself fall within the Customs territory.

However, some countries regard FZs as “being outside the Customs territory”, leading to the idea that such zones are “extraterritorial areas” that are free from the usual Customs control. It is essential that FZs be regarded as inside the Customs territory, or as special areas where all non-tariff Customs activities are properly enforced.

Involvement

Customs should be a crucial player in the general development of national policies related to FZs, the establishment of each new FZ, and the approval of FZ tenant companies, including their admissible activities.

Company approval process and AEO concept

Customs’ involvement in due diligence and compliance record checks at the company approval stage is critical to maintaining the safety and security of a FZ. Customs should conduct risk-based background checks on FZ applicant companies, their key employees, and compliance records. Furthermore, Customs could decide to open and adapt existing AEO programmes to tenant companies.

Reporting to Customs and the use of IT systems

In some countries, requirements on goods declarations and reporting are relaxed, and Customs sometimes has limited access to the cargo management system of the FZ operating body. It is necessary to establish proper reporting obligations, and to give Customs full access to the data stored electronically in the FZ operating body’s systems.

Customs audit

Considering that in many FZs, tenants can store goods for an unlimited period, a Customs audit of companies operating in FZs is one of the most suitable and important tools for Customs to supervise activities there.

Customs control and surveillance

In order to combat illegal activities in FZs, Customs should have the competence to enter FZs to inspect goods, as well as to detect and seize goods, regardless of whether the intended transactions are storage, manufacturing, transit/transhipment, or domestic consumption. It is essential that Customs control not only the movement of cargo at entry and exit points, but also during the storage and processing stages, via periodic onsite visits or visits at any time which they consider necessary.

Cooperation

Cooperation mechanisms with operators and companies, such as periodic dialogue and reporting, and the provision of adequate training, are necessary alongside the company approval process. Such periodic dialogue and sharing of information would enable Customs and the private sector to work together to solve any issues and challenges in FZs.

Furthermore, WCO Members’ national experience indicates that being a formal member of an FZ governmental board would provide greater opportunities for Customs administrations to play a part in all decisions related to FZs, and would also ensure smoother communication with all relevant bodies.

Conclusion

Compared to the 1980s and 90s, when FZs became popular, Customs procedures have been substantially simplified through the use of technology. Moreover, FZs offer a variety of non-Customs related economic incentives. Today, arguing for relaxed Customs procedures and controls in FZs under the guise of promoting economic development seems rather outdated. Benefits can be provided without sacrificing the safety and security of trade.

Furthermore, ensuring effective controls in FZs contributes to improving the business environment at the national and international level. Lack of oversight over FZs impacts not only the country where the FZ is located, but also a country’s trading partners.

Customs administrations are, therefore, encouraged to review or argue in favour of a revision the legal framework around FZs when needed, in line with the guidance provided by the WCO and in coordination with all public and private FZ-related authorities, with the objective of enhancing their compliance with the law and building a safe and sustainable global trade ecosystem.

More information

facilitation@wcoomd.org