How Peru boosted its modernization process during the crisis

21 October 2020

By Marilú Llerena Aybar, Deputy National Superintendent of CustomsIn Peru, the COVID-19 pandemic led to a contraction of the volume of exports and imports, which has negatively impacted tax revenues. However, the crisis did not stop the supply of goods deemed critical to deal with the pandemic, nor did it stop the imports and exports vital to supporting the country’s economic activity. There was even an increase in exports of some non-traditional Peruvian products, such as fresh grapes, avocados, mangoes and ginger, among others, thanks to the efforts deployed to promote Peruvian products on international markets.

That Peru’s Customs Administration (SUNAT) has been able to remain fully operational is due mainly to the progress made over the years in terms of digitalization and simplification. With the pandemic pushing all of us further into a digital world, the Administration now works to expedite and strengthen IT developments in cooperation with public agencies and private-sector stakeholders, to consolidate itself as a digital Customs.

In this article, we present some of the operational and procedural changes we implemented to mitigate the impact of the crisis on economic operators, as well as the latest developments, and some future developments, that will bring us closer to the digitalization of all business processes, greater visibility of trade operations, and the development of interconnected systems capable of exchanging information.

Adjusting to a new reality

The measures aimed at supporting the continuity of foreign trade operations during the pandemic included:

- the suspension of deadlines related to the completion of Customs procedures, to preclude goods from being classed as legally abandoned, as well as the suspension of deadlines related to the execution of financial guarantees;

- the annulment of administrative infringements[1] and minor penalties, which reduced total infringements by 77%;

- the adjustment of 17 procedures, such as the dematerialization of all documents required in the suspensive, temporary, special and simplified regimes, which will eliminate a total of more than 1.2 million pages of paper per year;

- the establishment of a Virtual Reception Desk (VRD) to process business queries.

A legislative decree was also passed to facilitate the entry of donated goods, amending the requirements that have to be met by authorized public entities when receiving such goods from abroad. The Customs Administration provided 24/7 assistance in this domain, and proactively followed the cargo’s journey from the electronic submission of the manifest (and even earlier in some cases) to the arrival of the goods. In total, this facilitated the rapid clearance of over 1,600 tonnes of cargo, enabling it to reach the most vulnerable populations promptly.

Communication

These measures had to be communicated rapidly and efficiently, and so additional telephone lines were set up to respond to clients. Social media platforms were also extensively employed to announce new regulations and correspond directly with users.

The Administration also boosted its communication. Between June and July 2020 it organized three webinars which attracted 270,000 participants and more than 3,000 comments. A further 15 webinars were also held on specific topics such as VRD, pre-arrival clearance, Authorized Economic Operator (AEO), and the FAST Customs clearance system, attracting 2,200 people.

Videos were published on the Twitter account @SUNATOficial, which has over 670,000 followers. Last but not least, a Private Sector Consultative Group Whatsapp chat was created.

Recent and future developments

One of the challenges facing Peru’s Customs Administration is completing the digitalization process. The idea is not only to use electronic documents, but also to implement simpler processes and strengthen information exchange with all foreign trade operators.

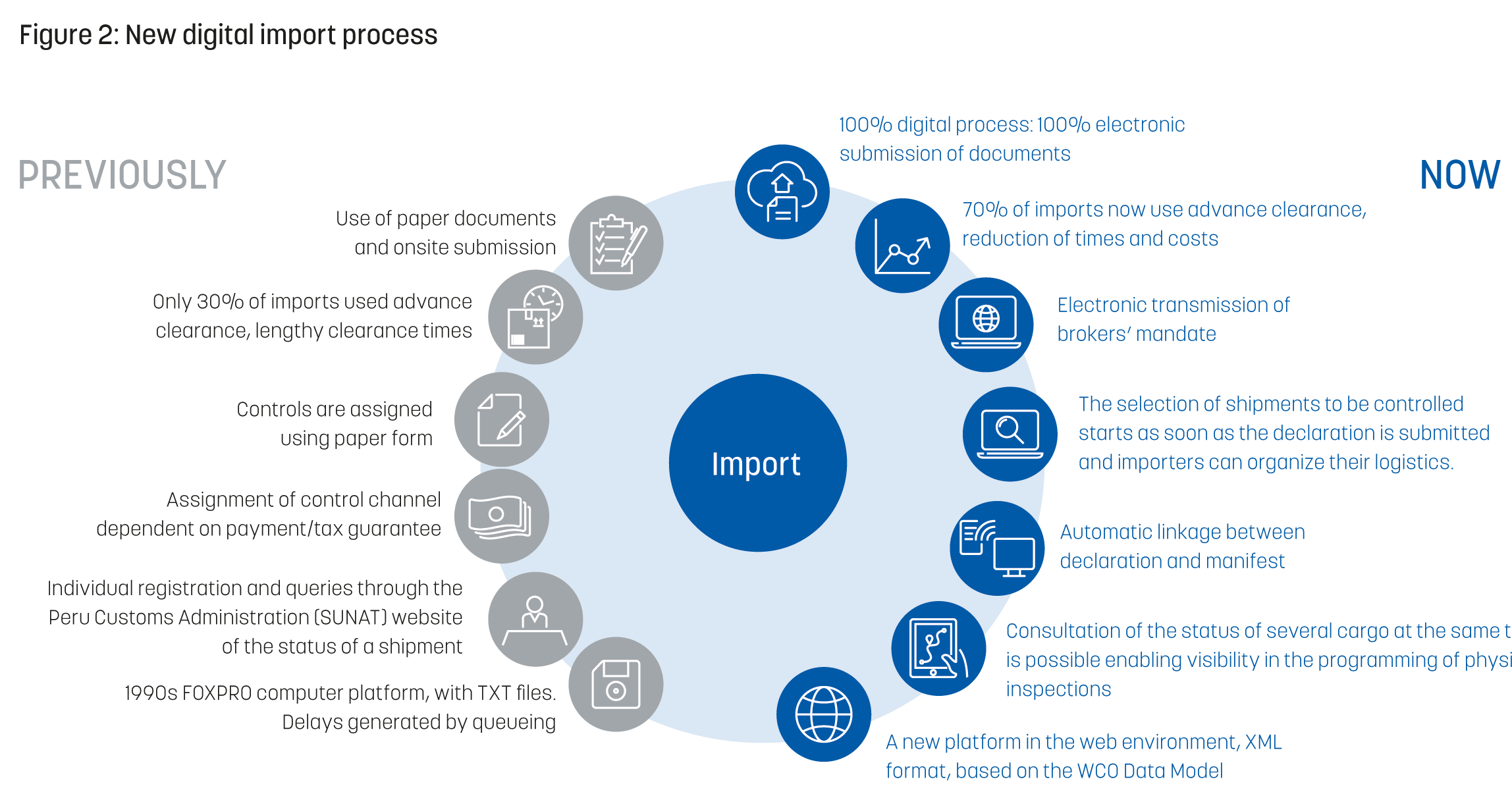

New export and import processes, eliminating all paper-based procedures, have been in use since 31 July and 31 August 2020 respectively (see figures 2 and 3). At import, the owner or consignee entrusting the Customs clearance of his/her goods to a Customs broker is able, among other things, to transmit the mandate electronically. In addition, the procedure to assign shipments to different control channels (red for physical inspection of goods, orange for documentation review and green for no controls), which was not previously triggered until the import taxes were guaranteed or paid, is now linked to the declaration submission process. A website for general enquiries has been developed, enabling temporary warehouse managers and Customs brokers to check the scheduling of physical inspections and release of goods under their charge. This reduces logistics times and costs related to cargo mobilization and withdrawal processes.

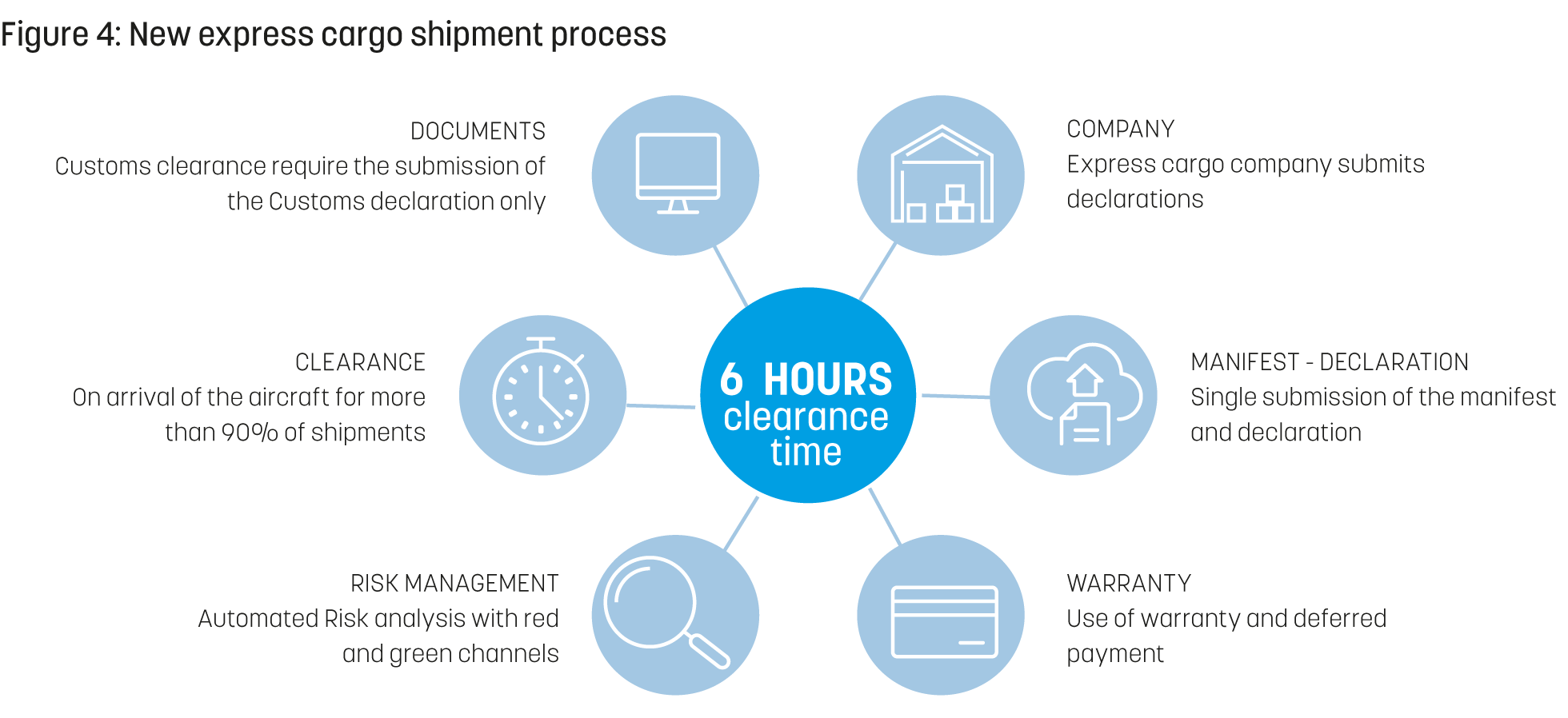

Lastly, the Express Cargo Shipments process (see figure 4) will be launched in late November 2020 to enable electronic submission of cargo data, pre-arrival clearance, single submission of the manifest and declaration, and use of the global guarantee for payment of taxes.

At export, high-security electronic seals offer comprehensive cargo tracking. Direct shipment, from the exporter’s premises to the port without the cargo being placed in temporary storage, is now possible. From now on, cargo can be transferred from a Primary Zone[2] to a Secondary Zone upon presentation of a QR code.

The Single Window of Foreign Trade (VUCE), an integrated system enabling the management of procedures required to allow entry, exit and transit of goods by electronic means, has also been enhanced to enable the system to interact with other IT systems. Beyond border clearance mechanisms and providing a more coordinated approach to incorporating trade processes, VUCE already enabled partner economies to exchange harmonized phytosanitary certificates and certificates of origin with other Pacific Alliance members (Chile, Colombia and Mexico). Now the Single Window allows connectivity with the IT systems of many stakeholders, such as importers, exporters, government agencies and trade service providers, as well as with the Single Windows or similar systems of other countries.

Strengthening human capital

The Administration is investing not only in technology but also in people. The recruitment process, which was temporarily put on hold, has started up again. Knowledge, skills, psychological aptitude and integrity are assessed using online platforms and virtual interviews. Since the declaration of the state of emergency on 15 March 2020, some 86 new junior Customs officers have been hired, including 25 junior data scientists who will enhance Customs’ data analysis and intelligence capacities.

The Administration is also encouraging experienced officers to follow the 24 online courses developed by its training centre. Over 2,000 officers (70% of Customs staff) have followed at least one course this year. Field officers forced to stay home during the pandemic, if they had an underlying medical condition increasing the risk of severe illness, have also been allowed to declare online training hours as working hours.

More information

mllerenaa@sunat.gob.pe

cvillarruel@sunat.gob.pe

[1] These include: incorrect declaration of the brand, value, model or condition of the goods, provided these errors do not lead to an increase in tax payments; failure to transmit the cargo manifest information within the established deadlines or errors in the goods description or identification of the owner; and failure to provide information or documentation in the manner and within the deadlines prescribed by the Customs Administration.

[2] A Primary Zone is an area under continuous Customs inspection and control, where goods awaiting Customs-approved treatment or which have already been assigned a Customs-approved treatment are stored under the duty suspension regime.

.