Africa has a long history of initiatives aiming at supporting regional economic cooperation. Let me give a few examples. The Southern African Customs Union (SACU) dates back to the 1889 Customs Union Convention between the British Colony of the Cape of Good Hope and the Orange Free State Boer Republic, which was expanded by a 1910 agreement to include the Union of South Africa and the then British High Commission territories of present-day Lesotho, Botswana, Eswatini and Namibia. The Mano River Union (MRU), which comprises Liberia, Sierra Leone, Cote d’Ivoire and Guinea, was formally established in 1973 but was preceded by the Kondo Confederacy which at its peak in the 19th Century had two-thirds of its area in present-day Sierra Leone and one-third in present day Liberia. The East African Community (EAC) was officially established by the Treaty for East African Cooperation (1967-1977); however, formal economic and social integration in the Eastern Africa region actually started with, among other things, the construction of the Kenya-Uganda Railway (1897) as well as the establishment of the Customs Collection Centre (1900) and the Customs Union (1919).

Over the years, many Regional Economic Communities (RECs) have been created. As for initiatives at the continent level, they started with the Treaty Establishing the African Economic Community (AEC) adopted in 1991 by Members of the Organization of African Unity (OAU) which had been created in 1963. It was envisaged that the AEC would be established by strengthening the existing RECs and by creating other economic groupings in other regions of Africa, so as to cover the continent as a whole. In other words, progress by RECs was seen as progress towards and a step closer to the AEC.

The OAU was succeeded by the African Union (AU) which envisaged deeper integration of the continent, beyond what was conceived by the OAU Charter, as can be seen from its establishment of a number of specialized technical committees. One of the committees is the Committee on Trade, Customs and Immigration Matters. In 2006, the AU Assembly of Heads of State and Government made a decision to suspend the recognition of new RECs. Today, eight RECs are recognized by the AU (see maps). In June 2015, the AU launched the negotiations for the Agreement Establishing the African Continental Free Trade Area (AfCFTA) which was signed on 21 March 2018.

This long introduction is aimed at demonstrating that the AfCFTA is the latest of many regional integration initiatives that go back to the years prior to the colonization of Africa, of integration efforts by the colonial powers, and of initiatives by independent African States under the auspices of the OAU and the AU.

The Agreement creates a single continental market for goods (Article 3 of the Agreement), which will be achieved through the progressive elimination of tariffs and non-tariff barriers to trade in goods (Article 4). Some of the negotiating principles made provision for (a) the negotiations to be driven by Member States of the AU; (b) the RECs’ Free Trade Areas (FTAs) as building blocks of the AfCFTA; (c) variable geometry; (d) flexibility and special and differential treatment; (e) transparency and disclosure of information; and (f) preservation of the acquis. In effect, this meant that the negotiations would lead to substantial liberalization of intra-African trade, building upon the achievements that had been made within the RECs without replacing them.

Architecture of the AfCFTA Agreement

Article 6 provides that “the Agreement shall cover trade in goods, trade in services, investment, intellectual property rights (IPR) and competition policy.” The Agreement is complex in that it is being negotiated in several phases, and even within each phase there are aspects where consensus has been achieved as well as outstanding issues.

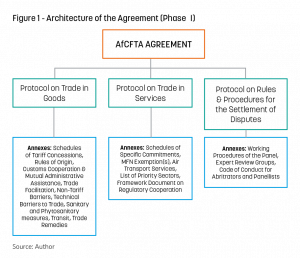

Phase I of the Agreement covers trade in goods, trade in services, and rules and procedures for the settlement of disputes (see Figure 1). Negotiations on the Schedules of Tariff Concessions (Annex 1 to the Protocol on Trade in Goods), and on some aspects of Rules of Origin (Annex 2) are ongoing and expected to conclude by the end of 2021. This means that, currently, it is possible to trade some goods under the AfCFTA preferential terms.

Phase II of the negotiations, which is ongoing, covers investment, IPR and competition policy. At the 33rd AU Summit in February 2020, Members made a decision to negotiate a Protocol on e-Commerce as part of Phase III immediately after the end of the Phase II negotiations. Moreover, in December 2020, AU Members directed the AfCFTA Secretariat to commence work towards developing the AfCFTA Protocol on Women in Trade. The Phase III negotiations, while not explicitly provided for in the Agreement, are in accordance with one of its objectives, namely to “cooperate in all trade-related areas” (Article 4).

As provided in Article 8 of the Agreement, the Protocols, Annexes and associated Appendices shall, upon adoption, form an integral part of the Agreement, as well as part of the single undertaking, subject to entry into force. The Agreement does not allow any reservations (Article 25).

Customs in the AfCFTA Agreement

The Customs administrations of AU Member States have been active in Phase I of the negotiations, primarily through participation in the Technical Working Groups (TWGs) on Rules of Origin, and on Customs Cooperation, Trade Facilitation and Transit. One of the general objectives of the Agreement is “to lay the foundation for the establishment of a Continental Customs Union at a later stage” (Article 3), where the State Parties will apply a Common External Tariff. This is ambitious: out of the eight (8) RECs that are recognized by the AU, only two (EAC and Economic Community of West African States (ECOWAS)) are operational Customs unions with a common external tariff (CET). The Common Market for Eastern and Southern Africa (COMESA) and the Southern African Development Community (SADC) have operational FTAs without a CET, while the Arab Maghreb Union (AMU), the Community of Sahel-Saharan States (CEN-SAD), the Economic Community of Central African States (ECCAS) and the Intergovernmental Authority on Development (IGAD) have not made significant progress towards integration. As for SACU, it is not an REC recognized by the AU.

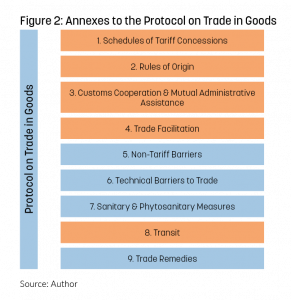

Specific objectives of the Agreement include “to cooperate on Customs matters and the implementation of trade facilitation measures” (Article 4). Most of the provisions of the Agreement relevant to Customs are found in the Protocol on Trade in Goods (see Figure 2). Five (5) out of the nine (9) Annexes to the Protocol are of specific relevance to Customs. These are (a) Annex 1: Schedules of Tariff Concessions; (b) Annex 2: Rules of Origin; (c) Annex 3: Customs Cooperation and Mutual Administrative Assistance (d); Annex 4: Trade Facilitation; and (e) Annex 8: Transit.

Schedules of Tariff Concessions

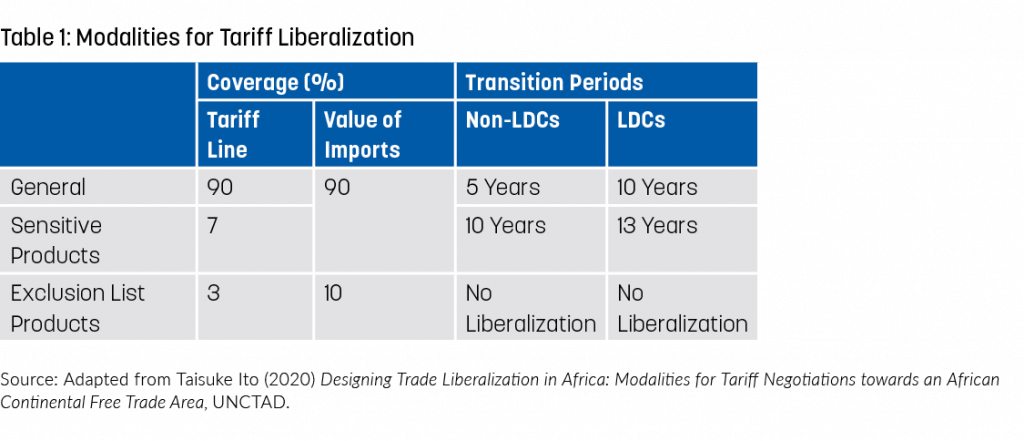

The term “Schedules of Tariff Concessions” is defined in Article 1 of the Protocol as “a list of negotiated specific tariff concessions and commitments by each State Party” which “sets out, transparently, the terms, conditions and qualifications under which goods may be imported under the AfCFTA.” The AU has adopted modalities for tariff liberalization with a level of ambition of 90% of tariff lines, over a period of five (5) years for non-least developed countries (non-LDCs) and 10 years for least developed countries (LDCs). For products in the sensitive list, non-LDCs have a transition period of 10 years, while LDCs have 13 years, with effect from 1 January 2021 when liberalization started (Table 1). The exclusion list is subject to review every five (5) years. These negotiations are supported by the AfCFTA Tariff Negotiations online portal where Member States upload their tariff offers. The negotiations have not yet been concluded. Article 42, paragraph 3 of the Protocol on Trade in Goods provides that “pending the adoption of the outstanding provisions, State Parties agree that the Rules of Origin in existing trade regimes shall be applicable.”

As indicated above, the AfCFTA Rules of Origin are found in Annex 2 to the Protocol on Trade in Goods. Annex 2 provides the general criteria for determination of the originating status of goods (“wholly obtained” and “substantial transformation”). In addition, there are product-specific rules, contained in Appendix 4, providing the minimum conditions required for some products to be considered as sufficiently worked or processed.

Determination of origin requires, first of all, classification of the product in the World Customs Organization (WCO) Harmonized System (HS) as the requirements for determination of origin for specific products are indicated in the tariff schedules which are based on the WCO Nomenclature. Secondly, it is necessary to identify the export market destination. The AfCFTA Rules of Origin shall only apply to trade between AfCFTA Contracting Parties that do not already trade with one another on a preferential basis within an existing regional economic community. Indeed, Article 19 of the Agreement provides that in case of any inconsistency between the Agreement and any regional agreement, “this Agreement shall prevail to the extent of the specific inconsistency” (paragraph 1), but that “State Parties that are members of other regional economic communities, regional trading arrangements and Customs unions, which have attained among themselves higher levels of regional integration than under this Agreement, shall maintain such levels among themselves” (paragraph 2).

Thirdly, one must ensure that goods are wholly obtained or produced in a State Party (Article 5 of Annex 2 to the Protocol on Trade in Goods). If the product contains any imported materials from non-AfCFTA third countries, it is necessary to determine whether those materials have been substantially transformed in accordance with the sufficient processing requirements. Moreover, there are processes that do not confer origin, specified in Article 7 of Annex 2, which must be taken account of, even if the product in question may have met the requirements of the “wholly obtained” or “substantially transformed” criteria.

Finally, there is a provision for cumulation of origin within the State Parties (Article 8 of Annex 2), which allows all the State Parties to the AfCFTA to be considered a single territory for origin purposes. This means that goods can be wholly produced in one State Party, then undergo processing in one or more State Parties before the finished products are exported to another State Party. Such goods will be considered as originating in the last country of processing for the purpose of issuance of the Certificate of Origin, using the criterion of cumulation.

Some 16 out of the world’s 32 landlocked developing countries are in Africa. There are 55 AU Member States, separated by numerous borders that constrain movement of goods, people and capital. Even within RECs, bottlenecks remain. Speaking at a forum organized by the Manufacturers Association of Nigeria in early September 2021, Mr. Aliko Dangote, President of the Dangote Group that has investments across many African countries, indicated that the opportunities in the AfCFTA had the potential to increase business income substantially, but that this was not possible when a lorry from Lagos to Lomé (a distance of 270 kilometres) took 10 days, while moving goods from Nigeria to Ghana took two weeks. For this reason, some commentators have said that the biggest benefit of the AfCFTA will not be from tariff liberalization, but rather from reduction in non-tariff barriers to trade.

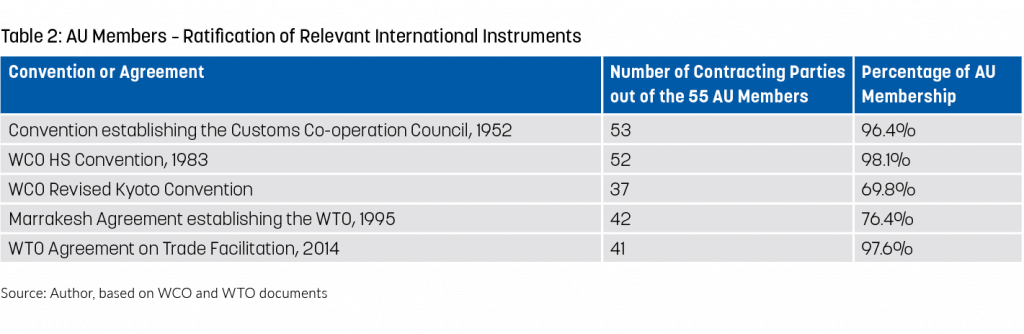

AU Member States are overwhelmingly supportive of the multilateral trading system. Most of them are Members of the WCO (96.4%) and the World Trade Organization (WTO) (76.4%). Nine of those which are non-WTO Members are negotiating accession to it (Algeria, Comoros, Equatorial Guinea, Ethiopia, Libya, Sao Tome and Principe, Somalia, South Sudan and Sudan).

The provisions in Annexes 3 (Customs Cooperation), 4 (Trade Facilitation) and 8 (Transit) of the Protocol on Trade in Goods are generally in line with WCO and WTO trade facilitation instruments, consistent with the principle that the AfCFTA shall be governed by, among other things, best practices in international conventions binding the African Union (see table 2). Under the AfCFTA, African Customs administrations therefore have to abide by norms and procedures which are not, or should not be, new to them.

A comparison between the provisions of the WTO TFA and the AfCFTA Protocol on Trade in Goods shows similar (and in some cases identical) provisions relating to Publication and Availability of Information (TFA Article 1), Advance Rulings (TFA Article 3), Procedures for Appeal or Review (TFA Article 4), Disciplines on Fees and Charges Imposed on or in Connection with Importation and Exportation and Penalties (TFA Article 6) and Release and Clearance of Goods including Pre-Arrival Processing, Risk Management, Post-Clearance Audit and Authorized Operators (TFA Article 7). However, there are also important provisions in the TFA that have not been included in the AfCFTA, such as providing traders and other interested parties with an opportunity to comment on new or amended legislation before its entry into force (TFA Article 2), notifications for enhanced controls and inspections, and other measures to enhance impartiality, non-discrimination and transparency (TFA Article 5) and provisions for temporary admission of goods and inward and outward processing (TFA Article 10, paragraph 9).

The apparent shortcomings in the AfCFTA Agreement do not mean that the Agreement is “TFA-lite”. There are cases where the AfCFTA goes beyond the provisions in the TFA. For example, it seeks deeper harmonization of the legal framework in AU Member States, including harmonization of Customs tariff nomenclatures using the WCO HS Nomenclature (Article 3 of Annex 3 to the Protocol on Trade in Goods), of valuation systems and practices (Article 4), and the simplification and harmonization of Customs procedures, using the WCO Revised Kyoto Convention and the TFA (Article 5). Furthermore, while Article 12 of the TFA provides a framework for Customs cooperation in the exchange and sharing of information for the purpose of enhancing compliance, and protection of confidentiality, State Parties to the AfCFTA undertake to establish and continually upgrade modern data processing systems to facilitate effective and efficient Customs operations and transmission of data amongst themselves (Article 6 of Annex 3 to the Protocol on Trade in Goods) and cooperate in the prevention, investigation and suppression of Customs offences (Article 8).

In spite of the impressive legal commitments that AU Member States have made at the international level, we have not seen a matching commitment to implementation of these obligations at the national level. It is hoped that the AfCFTA Secretariat will be able to give new impetus to this process, such as by monitoring border procedures and the use of trade preferences on the African continent.

Let us take the WCO HS as an example. Even though most African countries are Contracting Parties to the HS Convention and thus have an obligation to use the latest version of the HS, they still do not all do so. With the advent of the African Continental Free Trade Area, this obligation has been further reinforced. Indeed, under the AfCFTA, State Parties undertake to adopt Customs tariff nomenclatures and statistical nomenclatures which are in conformity with the latest applicable version of the HS.

Many projects have been rolled out to assist African Customs administrations, RECs and Customs Union secretariats in implementing international standards, harmonizing procedures, applying modern working practices, exchanging information and deploying IT tools. For example, the EU-WCO Programme for the Harmonized System in Africa involves 49 AU Member States and six RECs/Customs Unions (Central African Economic and Monetary Community (CEMAC), EAC, ECCAS, ECOWAS, SACU and the West African Economic and Monetary Union (UEMOA)).

The more difficult work entails addressing non-tariff trade barriers (NTBs), and the Agreement provides for a governance structure to tackle the problem. In this regard, the United Nations Conference on Trade and Development (UNCTAD) has assisted the AU in developing and implementing the online continental NTBs Reporting, Monitoring and Elimination Mechanism which has been in operation since January 2020. Among other features, this Mechanism allows traders to log in and register NTBs that they face in the course of doing business, and enables National Focal Points to take action to resolve NTBs and report within given deadlines (https://tradebarriers.africa/).

From negotiation to implementation

The World Bank estimates that the AfCFTA has the potential to take up to 30 million Africans out of extreme poverty and increase the incomes of 68 million Africans who live on less than USD 5.50 a day.

The AU is banking on technology to deliver this promise. One of the “operational instruments” of the AfCFTA is the Pan African Payments and Settlement System (PAPSS) which will be the first centralized payment market infrastructure for processing, clearing and settling intra-African trade and commerce payments. PAPSS is an arm of the African Export Import Bank (Afreximbank), which is a Pan-African multilateral financial institution established in 1993 for the purpose of financing and promoting intra and extra African trade. It will make it possible for African companies to clear and settle intra-African trade transactions in their local currencies.

However, one should not forget the fundamental role of Customs administrations here. They are expected to participate actively in implementing the Agreement at the national level, and in the structures established at the continental level to monitor implementation of the Agreement, including in the Sub-Committee on Customs Cooperation, Trade Facilitation and Transit, and in the Sub-Committee on elimination of Non-Tariff Barriers. They will also have to provide sound data to enable an assessment of the impact of the Agreement in terms of regional integration of trade flows.

More information

creckbuyonge@gmail.com