SACU Members make progress in enhancing the uniform application of their Common External Tariff

25 October 2021

By the SACU and the WCO SecretariatsThe Southern African Customs Union (SACU) consists of five Member States – Botswana, Eswatini, Lesotho, Namibia and South Africa – with a combined population of over 63 million people and a combined GDP in excess of 300 billion US dollars. It is the oldest functioning Customs Union in the world, dating back to 1910.

SACU Member States form a Common Customs Area (CCA), having eliminated Customs duties on trade in goods among themselves and agreed on a Common External Tariff (CET) schedule for goods imported from outside the CCA. In accordance with Article 22 of the SACU Agreement 2002, as amended, the Member States are required to apply similar legislation with regard to Customs and excise duties. However, Article 26 of the Agreement allows the Governments of Botswana, Eswatini, Lesotho and Namibia to temporarily levy additional duties on goods imported into their areas, to enable infant industries to meet competition from other producers or manufacturers in the CCA. This is on condition that such duties are levied equally on goods grown, produced or manufactured in other parts of the CCA and on products imported from outside such areas. The rule applies irrespective of whether those goods are imported directly from outside the CCA or from another SACU Member State.

Improving management of HS-related matters

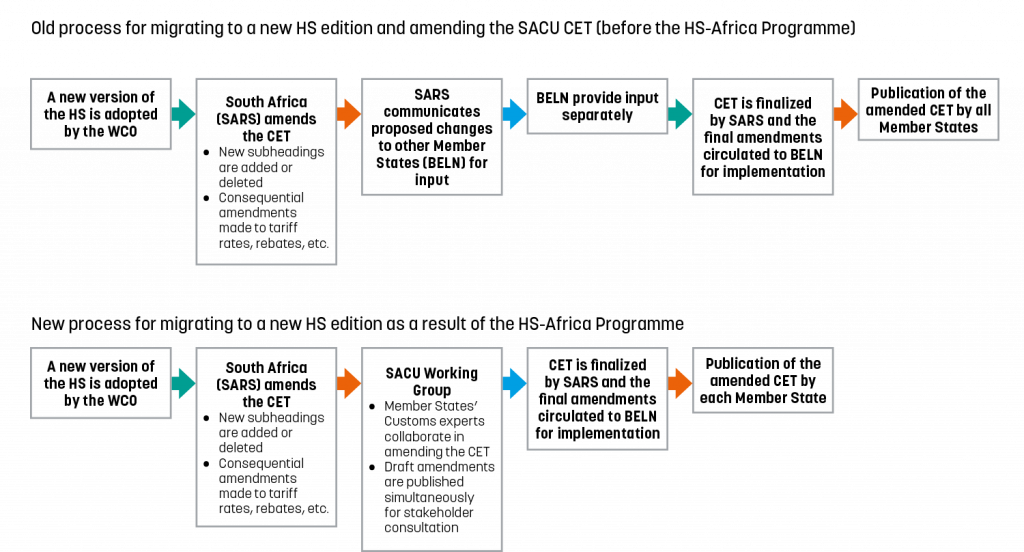

South Africa has been assigned as champion for the management of the CET, in terms of carrying out the technical work on behalf of other SACU Members. This work is undertaken by the South African Revenue Service (SARS): once decisions have been made on the changes to the CET, SARS prepares the amendments in consultation with the Customs Administrations of Botswana, Eswatini, Lesotho and Namibia (BELN) and circulates the final amendments for implementation by all Member States. Each of the Member States is then responsible for implementation of the final amendments in its own territory, including any necessary national and administrative procedures.

The CET comprises two elements: a goods nomenclature and a list of tariff rates. It is based on the WCO Harmonized System (HS) and is therefore updated every time that a new HS edition enters into force.

In order to promote uniform classification of goods within the Customs Union and contribute to the overall management of the CET, the SACU Secretariat has in recent years been working with the WCO Secretariat as part of a specific capacity building programme funded by the European Union (EU): the “EU-WCO Programme for the Harmonized System in Africa” (HS-Africa Programme). Launched in 2019, the Programme aims at delivering assistance to Regional Economic Communities (RECs) and Customs administrations in Africa in implementing the 2022 Edition of the HS and, in the longer term, in building organizational capacities and resources to apply future HS versions in a timely and coordinated manner.

Discussions on the topic started in November 2019 between WCO Secretariat experts and representatives from the Lesotho Revenue Authority (LRA) during a diagnostic mission on the implementation of the HS and advance rulings on the classification of goods in Lesotho. The need for a regionally coordinated process of migrating to new editions of the HS and of managing advance rulings had been identified, and the experts had recommended organizing a meeting between SACU Members to collect everyone’s views.

The regional meeting took place in January 2020, with the objective of taking stock of various issues: (i) the preparations made for the implementation of HS 2022 in each SACU Member; (ii) the management of HS matters within the Union in general; and (iii) the implementation and management of advance rulings relating to the determination of tariff classification.

Participants agreed on an Activity Plan incorporating various activities, including:

- development of a Migration Framework and a Roadmap for Migration from HS 2017 to HS 2022;

- establishment of a SACU Working Group to coordinate the implementation of HS 2022 and to work on amending the CET in future;

- national information campaigns to promote awareness;

- ensuring availability of relevant HS tools; and

- establishment of advance ruling systems for tariff classification.

Progress to date and outlook to January 2022

Since the COVID-19 outbreak, discussions have been held virtually. The SACU and the WCO Secretariats facilitated three more meetings, one in July 2020 and two others in April and August 2021, to take stock of progress made on the implementation of the Activity Plan and, more specifically, of the SACU 2017-2022 Roadmap for Migration.

SACU Members are on track, with the following milestones already achieved:

- the HS Migration Framework has been developed, as well as a specific Roadmap for Migration from HS 2017 to HS 2022, with 1 January 2022 as a completion target;

- following the publication in February 2021 of a first set of HS 2022-related draft tariff amendments for public consultation, initial comments have been received from the private sector and duly considered, both at national and regional levels;

- a second set of draft amendments for public consultation has been published, the consultation period having ended on 31 July 2021;

- the work on HS migration has been incorporated into the broader SACU Trade Facilitation Programme, and a SACU Working Group on HS, Tariff, Origin and Valuation has been established, with responsibility, among other things, for ensuring successful migration from HS 2017 to HS 2022; and

- national advance ruling systems have become operational in some Member States.

Looking ahead to the rest of 2021 and to January 2022, an intensive work programme lies in store for the SACU. It is expected that, by October 2021, most of the work on the preparation of amendments for implementation of HS 2022 will be complete. After October, further activities will take place at the national level as Member States will be undertaking final legislative and administrative processes to meet the January 2022 target. Another meeting is anticipated before January 2022 to make a final assessment of the Member States’ readiness.

A regional framework for advance rulings

Thanks to the assistance received under the EU-WCO HS-Africa Programme, SACU Member States are on track to migrate successfully to HS 2022 and to adopt a new system for amending the CET which will facilitate uniformity in goods classification within the Union. As part of the Activity Plan under the Programme, Member States are planning to develop a regional framework on advance rulings. Issues for consideration under the regional framework could include the recognition of rulings across the SACU, whereby a ruling issued by one Member State would be binding on all national Customs authorities when the same holder uses the ruling to import the goods. The framework will enable a Customs officer from one Member State to refer to existing rulings issued by all Member States, and to consult an officer from another Member State should he find inconsistencies in the rulings previously issued. Together with regular meetings of the Working Group on the HS, Tariff, Origin and Valuation, the framework will enable SACU Customs administrations to enhance uniformity in the interpretation of the HS throughout the Customs Union.

More information

capacity.building@wcoomd.org

wcoHSAfrica@wcoomd.org