Peru develops new processes and services to facilitate and secure cross-border e commerce

24 October 2021

By the National Superintendency of Customs and Tax Administration (SUNAT), PeruIn Peru, the importation of goods purchased online has increased by 23% annually over the past five years. Consumers and companies buy products through marketplaces such as AliExpress, Amazon, eBay and Wish from sellers mostly located in Asia, the United States and Europe. Products are mainly transported by air via express courier delivery services called Empresas de Servicio de Entrega Rápida (ESERs).

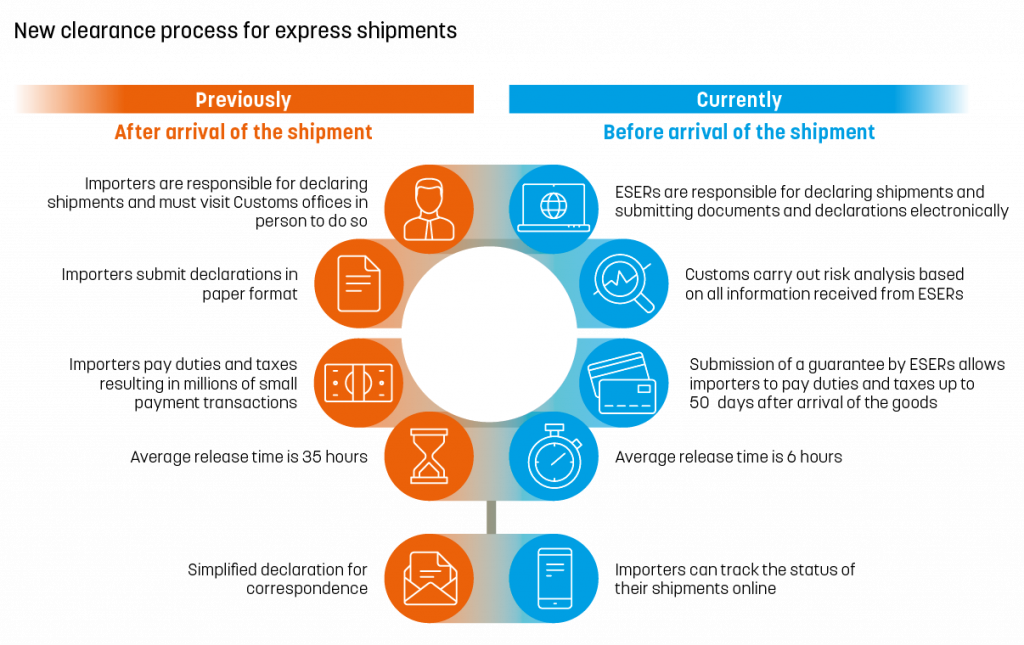

A number of years ago as part of its digital transformation efforts, SUNAT began reviewing the way it processes goods transported by ESERs. The Covid-19 pandemic gave renewed impetus to the reform process in that it became a matter of urgency to minimize physical contact and the unnecessary movement of people. Indeed, until 2020, importers of goods shipped internationally by express couriers were required, in certain circumstances, to handle the clearance process themselves and to visit a Customs office or warehouse in person in order to submit the documents required by Customs and to pay any duties and taxes.

All this changed at the end of 2020 when SUNAT implemented a new clearance process for express shipments that allows ESERs to transmit advance declarations and submit advance deferred payment guarantees, and SUNAT to perform risk analysis and release small packages upon arrival. As additional services, the Administration launched a web platform and a mobile application enabling importers to track the status of their shipments and pay duties and taxes at authorized banking institutions.

A new clearance process for express shipments

In Peru, some 1.3 million shipments are imported every year by express air carriers. Since the end of 2020, ESERs are responsible for declaring shipments and must transmit all data required by Customs electronically in a consolidated format via an online platform.

About 80% of the shipments they carry contain goods whose total FOB value does not exceed USD 200, the de minimis threshold under which no duties and taxes are collected. Such shipments are usually released on arrival of the carrier for immediate delivery directly to the end consumer.

Shipments whose value is above the de minimis threshold but below USD 2,000 are subject to taxes and must be declared by the ESERs using a courier import declaration. ESERs may submit a bank guarantee to the Customs office to facilitate the clearance process and ask the importers for payment of the duties and taxes which they then redistribute to SUNAT.

Finally, shipments exceeding USD 2,000 in value and/or 50 kg in weight must be cleared via a broker. In this instance, the ESERs’ role is limited to the storage of express shipments.

New services enhance communication with importers

To enable importers to track the status of their shipments, SUNAT launched a web platform and a mobile application. Importers can query the system by entering the air waybill number or the Customs declaration number. They are then informed in real time of the location of their shipment and receive notifications from ESERs either to an e‑mail address or via the app installed on their phone.

Risk management capacity has improved

The new process has enabled SUNAT to improve its risk management procedures in two ways. First, data related to shipments are now received in advance, before the arrival of the goods in the Customs territory (download the list of data collected by Peru Customs compared with the WCO Reference Data Elements for Cross-Border E-Commerce). Second, the quality of the data has improved, as ESERs have professional teams who handle Customs declarations.

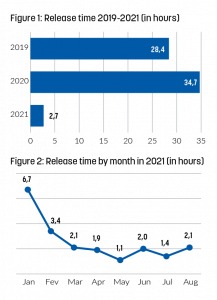

Time required for the release of goods has been reduced

The average time required for the release of goods was gradually and significantly reduced to 2.1 hours in August 2021 (see Figures 1 and 2).

SUNAT’s achievements did not go unnoticed. The Administration received the Best Practices Award in Public Management 2021 which is awarded by Ciudadanos al Día, a non-governmental organization, and the School of Public Management of the Universidad del Pacífico in recognition of the efforts of public servants in providing quality services to consumers and companies.

More information

rmallea@sunat.gob.pe

cvillarruel@sunat.gob.pe