The COVID-19 pandemic presented many challenges to the international trade community. Many of these were new to the officers working for the Central Board of Indirect Taxes and Customs (CBIC), the Government of India’s nodal body responsible for formulation and implementation of policy relating to all matters of indirect taxation. Among other things, they realized that they had to examine some of the IT systems being used, to ensure that they still meet the requirements of the Administration. One such system was the National Customs Offence Management System, known as “DIGIT”, which is used for collecting and managing data related to all Customs offences detected in India, and which is comparable to the National Customs Enforcement Network (nCEN) developed by the WCO. The review resulted in substantial enhancements being made to DIGIT, which are presented in this article.

India’s National Customs Offence Management System (DIGIT) was created many years ago to help India’s apex anti-smuggling body, the Directorate of Revenue Intelligence (DRI), identify transactions involving persons engaged in smuggling activities. At the beginning, only officers of the DRI were to enter data in the system. This changed a few years ago and frontline Customs officers in charge of Customs clearance are now also requested to feed the database so that DIGIT can be used to detect a wider range of offences. It is worth noting that capturing records of offenders and offences represented additional work for those officers who have to clear passengers and cargo to tight deadlines. While there were teething issues initially, they gradually got used to entering data in DIGIT.

Thanks to the DRI and fields units, a fair bit of data was recorded in DIGIT by early 2019. The following information was collected for every case:

- details related to the detection of the offence (modus operandi of offenders);

- persons involved and their roles;

- goods involved;

- the amount of duties recovered (where offence involved Customs duty evasion);

- the Show Cause Notice, a formal document issued to one party in a dispute which sets out details of an alleged offence and gives the receiving party the chance to explain itself or otherwise face some further consequences;

- the adjudication, in other words, the legal ruling.

At the beginning of the COVID-19 pandemic, the DIGIT team decided it was time to look again at the system to ensure it was still fit for purpose and to identify ways to enhance it. They first focused on analysing the quality of the data captured in the application and identifying areas of improvement. Among other things, they conducted the following activities:

- mapping the data entry process flow;

- verifying that the system was up-to-date with the current legal provisions dealing with Customs offences;

- analysing the veracity of data entered and, specifically, data related to goods seized and offenders (for example quantity may seem odd or details may differ from those reported via other channels);

- discussing matters on a regular basis with frequent users of the application;

- developing ways to simplify the data entry process and minimize errors;

- generating periodic reports;

- analysing data with the aim of enhancing policy formulation and targeting capacities;

- publishing documents, such as newsletters, to familiarize users with the application;

- developing and conducting training to motivate staff and improve data entry.

The analysis of the application was hugely informative and many of the application features that could be improved were identified. The main proposed changes included:

- creating a new data field related to the category of goods seized, in addition to the specific commodity involved, such as flora and fauna, hazardous material, medicine and pharmaceutical products, and commercial goods;

- adding a separate category of offences for narcotics;

- harmonizing data entry related to the Unique Quantity Code (UQC): officers were using different UQCs for the same commodity. For instance, quantity of gold seized was reported in grams, units, cartons, bundles, carats, etc.;

- facilitating data reporting by enabling officers to see all data fields on one screen: reporting data such as the place of seizure, the Customs Tariff Item or the country of origin required opening a different screen in the app and was not always done systematically;

- listing categories of offenders and presenting them in a vertical drilldown menu: the data field related to the function played by the offender was in a free text format and was often not properly filled. Although investigations mentioned, for example, the involvement of airline staff, airport contractors or public agencies operating at airports, the information was not easily accessible in the app;

- creating a new data field related to the type of alleged offence: the issuance of a Show Cause Notice is a critical event in the investigation lifecycle that is captured in DIGIT, but information related to specific provisions under which the Notice was issued was not easily available;

- creating a new field related to the type of location where goods were seized, such as airports, sea ports, inland container depots, courier/cargo terminals and land borders.

Attracting stakeholder interest

To support the review process, and in association with the National Academy of Customs, Indirect Taxes and Narcotics, the DIGIT team decided to organize webinars with the app users to remind them of its existing features and to get their feedback on the tool. More than 600 officers from across the length and breadth of the country participated in these meetings. Next, a series of newsletters was prepared. Released on a monthly basis, they enabled readers to delve deep into the various modules of DIGIT. Each newsletter focused on a particular module of the app and included a set of frequently asked questions. Finally, as and when new features were rolled out, detailed communications were sent to all users, explaining which feature had been introduced, the background to this change and what to keep in mind while entering data.

This comprehensive review of DIGIT was not only supported but also driven by the highest echelons of the Indian Customs Department, ultimately culminating in the development of a dashboard for the Finance Minister of India, which enabled her to visualize Customs offences based on the data fed into DIGIT. Throughout 2020 and 2021, letters were written by the Chairman of Indian Customs and the Head of the Compliance Management Department, exhorting field officers to report data related to Customs offences regularly and accurately. This greatly contributed to spreading awareness about DIGIT and the importance of timely and accurate data reporting.

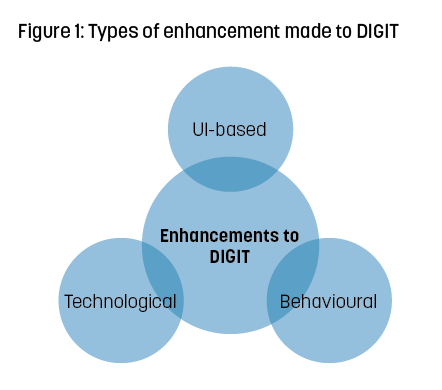

Once improvements were identified, the DIGIT team set about making the required changes to the backend of the application in a phased manner. The changes can be broadly categorized into three types.

The first category of changes relates to the user interface (UI), the point of human-computer interaction and communication in a device:

- shifting to a drop-down based system for various fields, such as quantity of goods, place of seizure and type of goods, to ensure data accuracy;

- adding pre-populated categories related to the role of offenders;

- eliminating redundant fields pertaining to offenders;

- adding a category called “Critical Cases” to facilitate the identification of cases requiring close monitoring;

- redesigning the dashboard page to show, at a glance, figures such as the number of investigations which are pending or which have been completed, or the number of cases pending adjudication;

- streamlining terms used throughout the application – for instance, “accused” and “offender” were being used interchangeably;

- simplifying the “prosecution module” to facilitate follow-up of the developments of cases.

The second category of changes aims at changing users’ practices:

- imposing a time-lock on entry of seizure details to ensure timely entry;

- making all the data fields of the module related to goods accessible on a single screen to facilitate data reporting;

- issuing instructions and guidelines for smooth data entry;

- nudging users to rely on DIGIT data for reporting purposes – ultimately, quality of data will improve as users realize the convenience of automated reporting;

- creating fields to capture specific provisions invoked in Show Cause Notices to encourage officers to take into consideration such data in their analysis, including when studying trends and patterns;

- creating fields related to the languages known by the offenders to ensure more comprehensive profiling.

Technological changes

The third category of changes is purely technical:

- inclusion of category of seizures dedicated to narcotic drugs and psychotropic substances;

- standardization of UQC for major commodities:

- gold – grams

- silver – kilograms

- cigarettes – no. of sticks

- red sanders – metric tonnes

- narcotics – kilograms, litres or tablets

- foreign currency – amount in the given currency and equivalent amount in Indian rupees

- inclusion of data related to the specific provision under which a Show Cause Notice is issued;

- option to upload documents in certain cases for easy retrieval;

- ability to generate customized reports;

- restricting users to enter only certain types of values to ensure data accuracy – e.g. disabling text in numerical fields, or limiting the HSN Code field to 8 digits.

The result was a comprehensive transformation of DIGIT into an agile, robust, intuitive, user-friendly application that not only made data entry easier, but is also more aligned to the legal and administrative requirements of the Administration. The data capturing methodology has been improved and the application has received support not only from officers involved in the detection of offences and data entry, but also in policy formulation.

Indian Customs is an active Member of the WCO and regularly reports national seizure data into the WCO Customs Enforcement Network (CEN), which aims at being a central global depository of enforcement-related information, enabling Customs administrations and the WCO Secretariat to produce valuable analysis on illicit trade.

When reviewing DIGIT, Indian Customs took measures to ensure that the changes made were aligned with the CEN data structure and would allow automatic data exchange if the two systems were to be connected. The creation of broad categories for goods (such as narcotics, precious metals and precious stones, tobacco products and hazardous waste) was partly driven by this imperative, and the names of the categories match those of the CEN with very few differences.

In the meantime, Indian Customs will continue to report data into the CEN and to support initiatives aimed at enhancing the system. As an example, during the 19th Customs Enforcement Network Management Team meeting held in 2021, it shared its practices aimed at improving data quality, endorsed the creation of a WCO Charter of Data Quantity and Quality Enhancement in the CEN, and supported the creation of a Task Force on Data Collection to review the data entered so far in the CEN. At the 42nd Meeting of the WCO Enforcement Committee held in 2022, Indian Customs also strongly supported the proposal of the WCO Secretariat to launch a CEN Data Visualization Project which would enable users to easily gain information from the data recorded in the system.

In 2022, the WCO Secretary General encouraged Customs administrations when it comes to “Scaling up Customs Digital Transformation by Embracing a Data Culture and Building a Data Ecosystem”. By conducting the review of DIGIT, Indian Customs has shown its commitment to doing so.

India has the advantage of being a technology powerhouse and the Customs Administration has no problem in hiring talented IT specialists. However, the system upgrade was made possible thanks not only to the DIGIT team, but also to the active involvement of the Administration’s top management and of the main users of the application.

With such all-round support, the DIGIT team is now equipped to work on:

- the calculation of the average time taken for completion of an investigation;

- the analysis of pending cases;

- the development of risk profiles for entities;

- the analysis of modus operandi;

- tracking post-investigation decisions and procedures;

- conducting predictive analysis based on past offences, to understand the future and answer the question: “What is likely to happen?”.

Technology, combined with a relentless passion for systemic improvement, has resulted in positive outcomes, with more in the pipeline. DIGIT holds immense potential for enhancing the monitoring of Customs investigations in India and driving policy based on data.

More information

rajeshpandey@nic.in

kaushik.tg@gov.in

About the authors

Rajesh Pandey was posted as Principal Additional Director General, Directorate of Revenue Intelligence – Mumbai Zonal Unit at the time of authoring this paper.

Kaushik Thinnaneri Ganesan was posted as Deputy Director, Directorate of Revenue Intelligence – Mumbai Zonal Unit and was National Nodal Officer – DIGIT at the time of authoring this paper.