The advance ruling system for tariff classification: the experience of Algerian Customs

18 June 2021

By Algerian CustomsEnsuring that the tariff classification of a good is correct is of paramount importance in several ways for any Customs administration. In particular, this provides good visibility of foreign trade through the collection of reliable statistics on volumes of trade in products, whether imported or exported, and means that the tax measures and other legislative or regulatory provisions governing the movement of these products can be properly applied.

The issues are no less crucial for economic operators. An inappropriate or incorrect classification can give rise to disputes, entailing delays and additional Customs clearance costs.

As part of its ongoing efforts to facilitate trade and in the awareness of the need to support economic operators and provide them with a degree of legal certainty in their import and export operations, on the one hand, and to simplify the work of the Customs personnel involved in goods control and verification, on the other, Algerian Customs recently introduced a mechanism whereby advance rulings on the classification of goods can be given at the request of an economic operator.

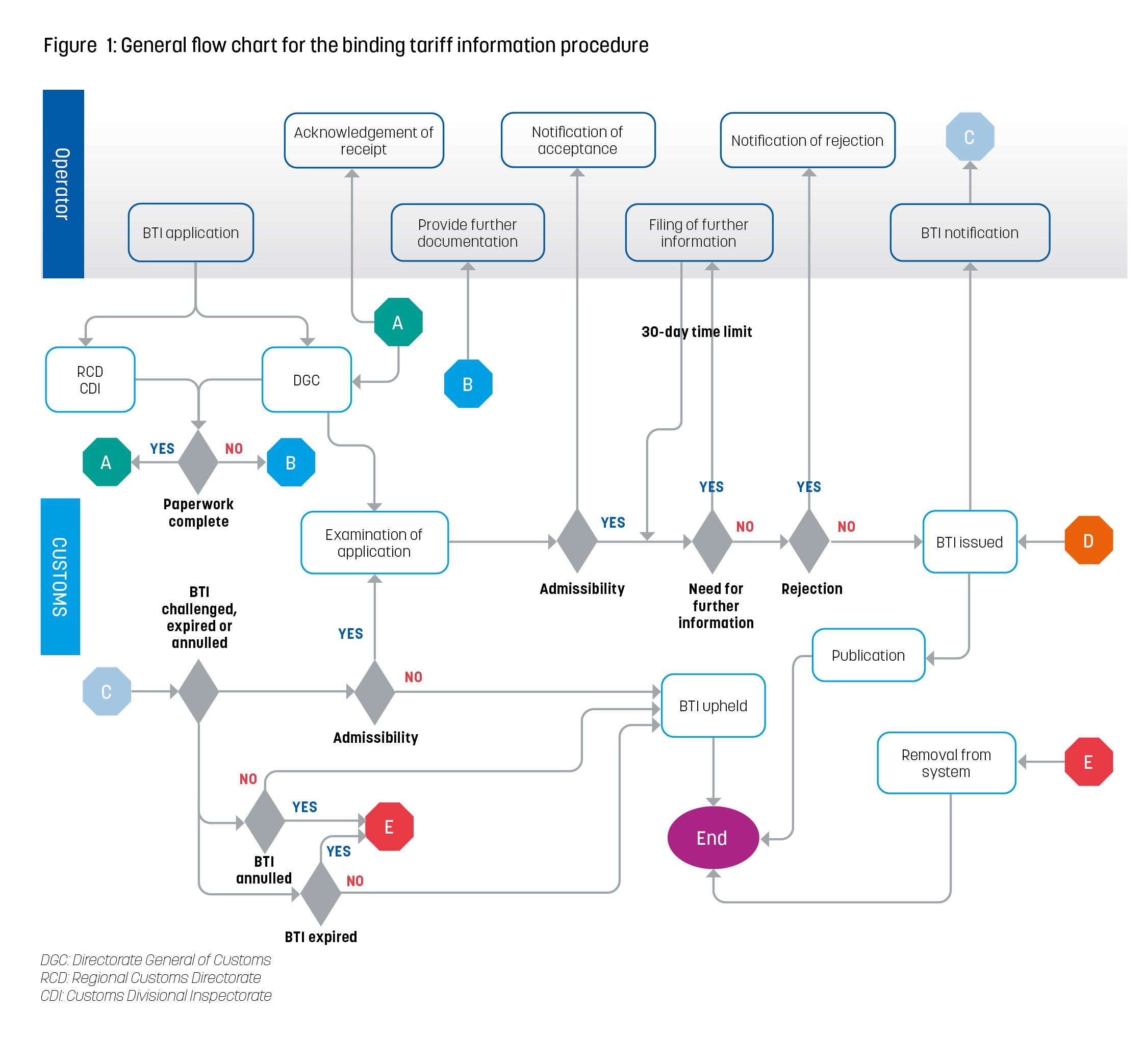

The various stages

An initial system was introduced in 1999 under the “Model D40” request for information on tariff classification procedure. However, this was a slow procedure, and the rulings given were not binding on Customs. Therefore, after some 20 years of implementation, it was abandoned and replaced by a fully-fledged system of advance rulings on tariff classifications, which came into force on 1 March 2020.

For this to take place, the principle of advance rulings had to be enshrined in the Algerian Customs Code when it was revised in 2017 (Article 50 ter of the Customs Code), and it had to be brought into line with international norms and standards, in particular the WCO’s Technical Guidelines on Advance Rulings for Classification, Origin and Valuation. Then, in 2018, an executive decree was published in the Official Gazette, laying down the arrangements for the delivery of advance rulings by the Customs Administration. Lastly, in 2020, the Customs Administration issued a circular on the implementation of this procedure.

In January 2020, before the procedure was brought into effect, Customs was given assistance by two experts from the WCO Secretariat, seconded to it as part of the European Union-funded programme called “Harmonizing the classification of goods based on WCO standards to enhance African Trade”, commonly known as the “HS Africa Programme”. These experts had the task of examining the arrangements for implementing advance rulings and their conformity with international standards. The experts concluded that the system established was, as a whole, in line with these standards.

As part of this experts’ mission, two briefing days were held for economic operators, Customs brokers and Customs officials, with a view to ensuring that this new procedure was widely disseminated and securing its successful implementation.

Once the conclusions of the experts had been delivered, on 26 January 2020, on International Customs Day, Algeria was able to send a letter to the WCO Secretary General giving official notification of its acceptance of the Council Recommendation on the introduction of programmes for binding pre-entry classification information (1996).

Under Article 2 of the aforementioned executive decree, rulings are called “décisions de renseignements tarifaires contraignants” (“binding tariff information rulings” or “BTI rulings”). These are described as being written decisions issued by the Customs Administration stating the treatment, in terms of tariff classification, that Customs will apply to the good upon clearance. They are delivered at the request of a third party and in advance of the relevant goods export and/or import operation.

Desired objectives

The system should allow the following objectives to be achieved:

- Provide security for import or export operations carried out by economic operators as regards the declared tariff subheading;

- Contribute to the facilitation, certainty and predictability of foreign trade and help the beneficiaries to assume commercial commitments;

- Ensure equal treatment among the economic operators;

- Reduce clearance times and the number of disputes between the Customs authorities and economic operators in relation to tariff classification matters;

- Provide advance knowledge of future imports for the purpose of risk management.

Detailed procedures

Binding nature and period of validity

A BTI ruling, the essential characteristic of which is its binding nature both for Customs and for the beneficiary, used to be valid for six months from the date of its notification, tacitly renewable for the same period, i.e. a maximum period of one year.

However, this period was extended to three years as from 1 January 2021, by means of the introduction of Article 94 of the 2021 Finance Act amending Article 50 ter of the Customs Code.

Application procedure

Separate applications for BTI rulings must be drawn up for each product, in writing and using a special standard form including boxes identifying the applicant and the good for which the application is being made.

This form, available from the Customs Administration’s website, must be properly completed, signed by the applicant and accompanied by supporting documents. When the paperwork is received, the applicant is informed as to whether the application has been accepted and may be asked to provide further documentation if necessary.

The application procedure for a BTI ruling will be fully digitized as part of the project for the new Customs information system, which is now in progress.

Issuance

In the interest of ensuring fair treatment and avoiding the issuance of diverging classification rulings for identical or similar products, BTI rulings are issued by the central department responsible for tariff classification within the Directorate General.

These rulings are issued according to a special model, within a maximum period of 90 days from the date of acceptance of the application.

In particular, they incorporate a detailed description of the good, its appropriate tariff classification and the grounds for the classification adopted in accordance with the rules of the Harmonized System. They are accompanied by illustrations and photos to aid understanding of the characteristics of the classified products.

Expiry and annulment

In the course of its validity, a BTI ruling may cease to be effective early and be subject to:

- expiry: when it is no longer compatible with the terms of the Customs tariff, following the latter’s amendment or modification;

- annulment: when it was given on the basis of false, inaccurate or incomplete information provided by the applicant.

Expiry is not retroactive and takes effect from the date of application of the aforementioned amendments or measures. As for annulment, this takes effect on the date of issuance of the BTI ruling.

Right of review and appeal

Domestic legislation and regulations offer any party in receipt of a BTI ruling the option to seek an administrative review within one month from its issuance, or an appeal to an independent committee (the Commission Nationale de Recours – National Appeal Board – chaired by a judge) within a maximum of two months. There is a 30-day response time limit in the case of an administrative review.

Digital platform

In the interest of transparency and ensuring the right of access to information, Algerian Customs has set up on its website www.douane.gov.dz, under “e‑services”, a digital platform set aside for publishing all the BTI rulings issued.

All information is included, apart from information of a confidential nature (name of holder, brand of product, etc.).

It has a multimodal search tool enabling searches by tariff code, key words, reference of ruling, etc. It also offers the user the option to save and print rulings.

Conclusion

From the introduction of the system on 1 March 2020 to the end of the first quarter of 2021, more than 250 applications were filed and 150 BTI rulings were issued. These figures would probably have been much higher if the public health restrictions imposed by COVID‑19 had not slowed down foreign trade activities (a drop of 18% in the volume of imports was recorded in 2020 compared with 2019).

The products concerned are varied, whether in terms of their constituent materials, how they work or their area of use. Foodstuffs, chemicals and products relating to technological development make up the majority.

The results achieved after one year of implementation of this new procedure are very satisfactory and encouraging, in so far as there has been a considerable drop (60%) in the number of administrative reviews regarding tariff classification in disputes between economic operators and Customs.

In the second half of 2021, Algerian Customs is preparing to launch a system of advance rulings on origin. This launch, originally planned to take place during the second half of 2020, had to be postponed because of the coronavirus pandemic. Once the system is in place, economic operators will have two essential tools to ensure the conformity of their transactions in terms of the two major aspects of Customs regulations, which are tariff classification and origin.

More information

fiscalite@douane.gov.dz