What the example of Montenegro’s new pre-arrival processing capabilities tell us about Customs performance measurement

24 February 2021

By Andrew Grainger, Karl Bartels, Tanja Boskovic, Stojanka Milosevic, Maja Rackovic, Cezary Sowinski and Steven Pope** The views expressed in this article are the authors’ own and do not necessarily represent those of their organisations

In June 2019, the Montenegro Customs Administration (MCA) implemented a new Customs clearance procedure that uses pre-arrival data to fast-track Customs clearance of express cargo. Within just a few months, this pre-arrival processing (PAP) system enabled the MCA to improve its capability significantly, allowing it to clear parcels within one hour of arrival. Inspired by the project’s success, stakeholders wanted to gain a deeper understanding of how the improvements in performance had been achieved. They also wanted to find out whether any general lessons could be drawn for the purpose of assessing Customs performance. The findings of the ensuing impact assessment, conducted from April to October 2020, were recently presented at the WCO PICARD Conference 2020. This article provides a brief summary of those findings.

Highlights

⇒ The impact assessment identified several useful quantitative key performance indicators (KPIs). Apart from the faster clearance rate, other useful KPIs analysed during the assessment included efficiency gains and Customs’ increased hit rate, as well as cost savings and the express operator’s ability to make improvements to its service guarantees to the benefit of shippers.

⇒ The structured analysis of stakeholder needs yielded further insights in terms of assessing individual stakeholders’ strategic objectives and subsequent expectations regarding the procedure being implemented. The methodology of the assessment consisted, to a large extent, in learning and in building trust among the key stakeholders, which in turn achieves a greater impact and helps ensure a positive trajectory for the future.

⇒ The new methodology developed during the assessment could potentially be applied to other trade facilitation measures as well. Key elements include mapping stakeholders’ needs, clustering these needs into main themes and identifying corresponding KPIs.

⇒ The assessment’s results and methodology could potentially make a contribution to the ongoing work on Customs performance measurement.

The new PAP procedure

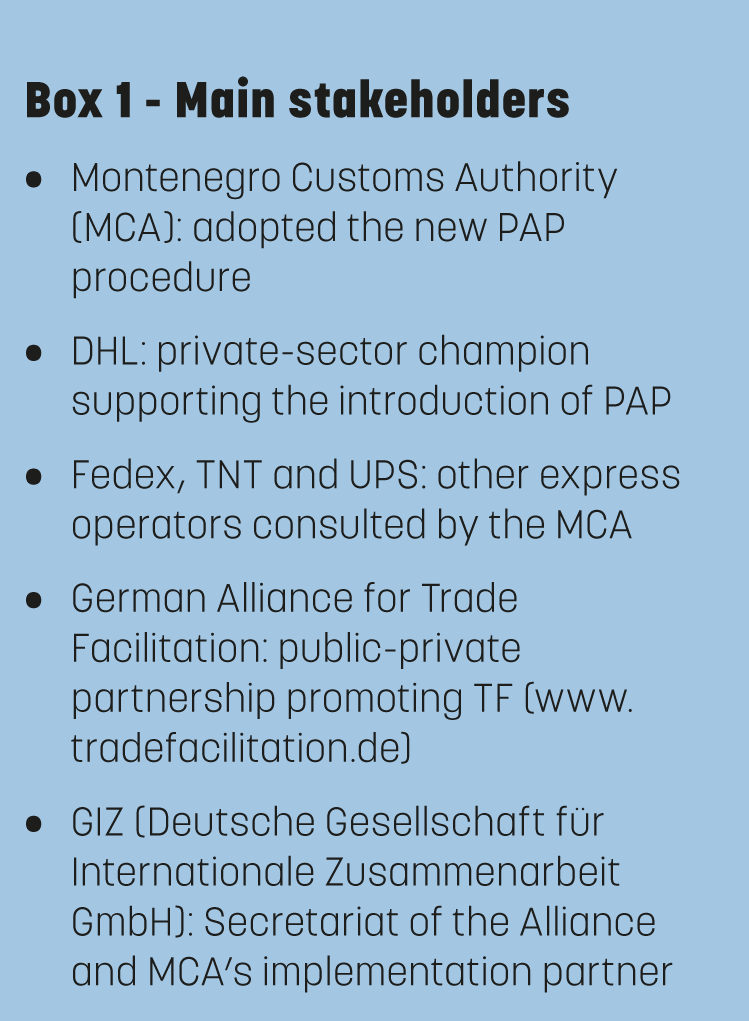

Montenegro’s pre-arrival processing procedure was developed as a project with the German Alliance for Trade Facilitation and piloted in collaboration with DHL (see Box 1). It currently allows authorized express parcel operators to submit an electronic import declaration in advance, prior to the arrival of the aircraft. The data is declared in a consolidated format and is used by Customs for risk assessment and Customs clearance. At present, the PAP procedure cannot be used to clear goods whose import requires licensing before or after arrival in the country.

Below is a step-by-step description of the procedure:

- Prior to loading:

- Company receives shipment instructions (booking details) from its customers along with standard information about the goods. The customer also provides additional documents necessary for import clearance (e.g. commercial invoice, proof of origin documents, etc.).

- Supporting documents are scanned and stored electronically by the company. Copies of supporting documents are also affixed to the relevant parcels.

- Company analyses all relevant data to make sure that the correct amount of import duties is paid (thus avoiding any penalties or additional fees on behalf of its customers).

- On or immediately after loading:

- Company prepares a consolidated electronic manifest (e-manifest) that, in addition to standard master air waybill data, includes details about the Customs value and the requested Customs clearance procedure.

- Prior to landing:

- Company notifies Customs and declares the shipped goods by using the consolidated e-manifest.

- Customs draws on the information provided in the consolidated e-manifest to conduct a risk assessment.

- Based on this assessment, Customs decides whether to ask for electronic copies of additional supporting documents, whether the parcels need to be inspected or whether they can be released upon arrival.

- Upon landing

- The company is responsible for ensuring that goods do not leave its premises without Customs clearance. With this responsibility comes a requirement for the company to provide a financial guarantee.

- Parcels not declared on the consolidated e-manifest (e.g. because they are subject to import licencing requirements or were loaded at the last minute without being added to the consolidated e-manifest) must be declared using: (a) a full Customs declaration; or (b) a simplified declaration (under special arrangements for authorized operators).

- Parcels that have been selected by Customs for inspection are presented to Customs. Upon satisfactory inspection, goods are released by Customs.

- Upon Customs release, the company delivers the goods to their recipients.

The implemented PAP procedure is a significant departure from the pre-existing paper-based control system. At the time of concluding the assessment, 7% of all of the country’s imports were handled using this procedure. Data from DHL show that the rate at which parcels are cleared within 1 hour of landing has improved from 25% in 2015 to 53% in 2019.[1]

The implemented PAP procedure is a significant departure from the pre-existing paper-based control system. At the time of concluding the assessment, 7% of all of the country’s imports were handled using this procedure. Data from DHL show that the rate at which parcels are cleared within 1 hour of landing has improved from 25% in 2015 to 53% in 2019.[1]

Impact assessment

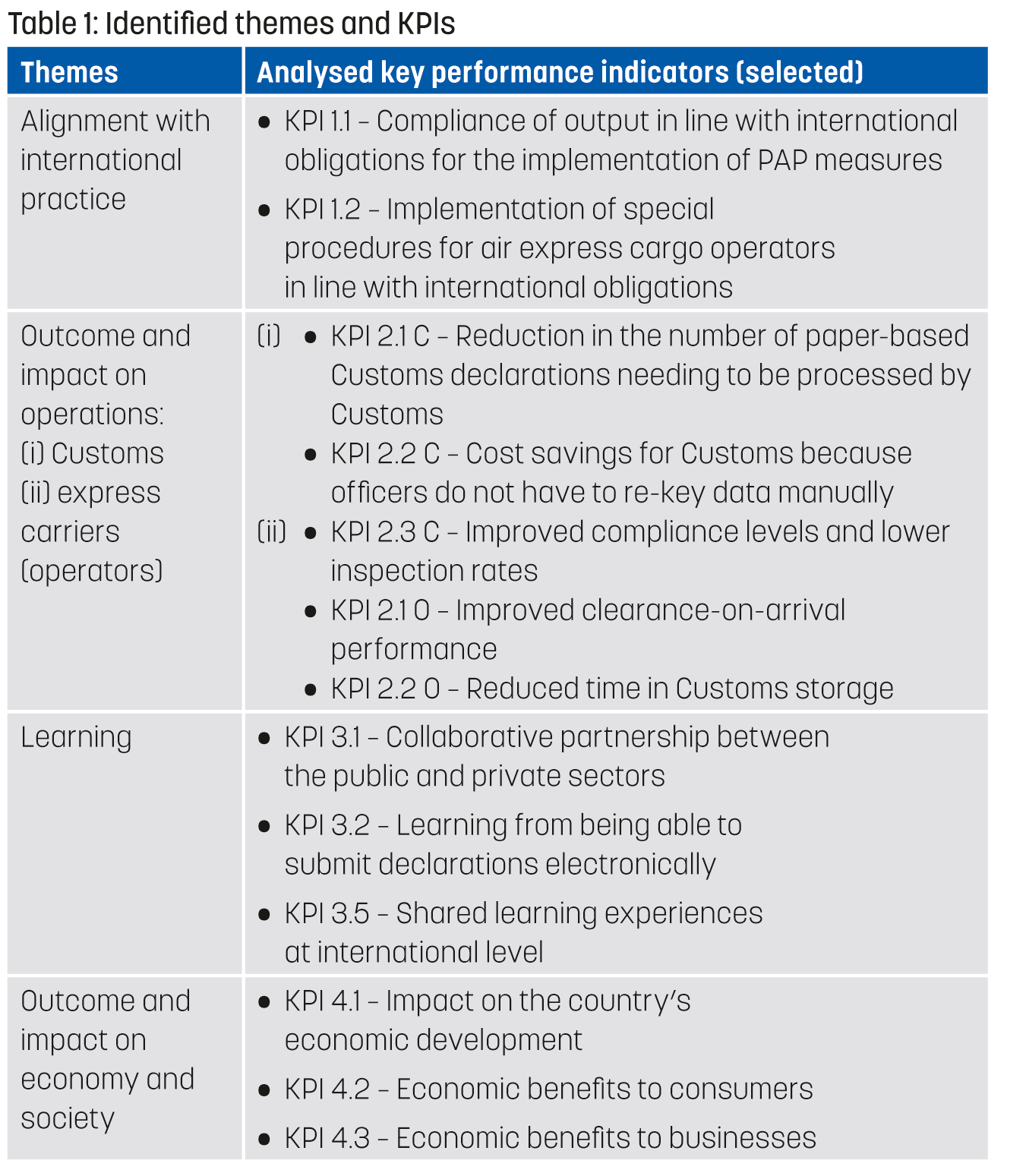

The focus of the impact assessment was on analysing the various stakeholders’ needs and available data (both quantitative and qualitative) as well as identifying any useful performance indicators that lend themselves particularly well for application elsewhere. It thus served a dual purpose: acquiring a broader and deeper understanding of the results and developing a methodology that could have other applications. Multiple iterative evaluation cycles with key project partners revealed four main themes and a corresponding set of key performance indicators (Table 1).

Results of the impact assessment

The impact assessment identified additional quantitative KPIs, in addition to the clearance-on-arrival rate, as follows:

- Inspection rate declined from 11% to 8%, and, in parallel, the hit rate rose from 1% to about 8.5%.

- Customs had an efficiency gain of 212 person-days per year.

- Reduction in express operator’s costs of about 10%.

Insights into the MCA’s more strategic objectives based on the four main themes identified can be summarized as follows:

- (i) Alignment with international practice: Being compliant with the WTO Trade Facilitation Agreement (Article 7.1 on Pre-arrival Processing and Article 7.8 on Expedited Shipments[2]), meeting policy demands arising from European Union membership aspirations (Union Customs Code Article 171 entitled “Lodging a customs declaration prior to the presentation of the goods”[3]) and implementing the WCO’s Revised Kyoto Convention pre-arrival standard (3.25[4]) were highly relevant for setting MCA priorities and developing motivation. Implementing the new PAP procedure does not yet enable the MCA to implement all these provisions, but is a significant step in the right direction. For DHL, motivation was largely driven by guiding corporate social responsibility (CSR) ambitions and support for trade facilitation-related initiatives.[5]

- (ii) Operational outcomes and impact: This theme overlaps with the quantitative KPIs mentioned above. A key outcome for the MCA was that a significant volume of import declarations can now be handled electronically without the need to process paper documents manually. For express operators, the procedure that has been implemented has led to a significant improvement in service capabilities. However, there is still scope for further improvements. The additional application of PAP to goods that are subject to import licencing requirements would, for example, yield substantial additional gains.

- (iii) Learning: All key stakeholders highlighted the importance of learning as an outcome of the project. For the MCA, it not only helped to build trust, it crucially also demonstrated the value of cooperation with the private sector and of digitizing Customs procedures. For DHL, much of the motivation was about developing an illustrative case study that could serve as a successful model for other countries to follow. For GIZ, gaining insights into the effectiveness of the project approach was extremely valuable.

- (iv) Outcome and impact on the economy and society: There was some anecdotal evidence of benefits for consumers and businesses in Montenegro (e.g. the ability to deliver critical spare parts without delay). Evidence of economic benefits on a macro level could not be found. Given that Montenegro’s economy is largely focused on services and tourism, and the country has a relatively low volume of imports (one flight per day), this is hardly surprising.

What was observed, however, was that the demonstration and learning effects have an impact that reaches far beyond the new PAP capabilities. The illustrative utility of such a system encourages support for trade facilitation efforts worldwide. The approach has already been emulated by four countries in the region and is being implemented on a larger scale worldwide.

Implications for Customs performance measurement?

Drawing on a methodology first presented at PICARD 2017,[6] the approach of the impact assessment complements prevailing evaluation methodologies in trade facilitation where the focus often tends to be limited to factors such as time and costs[7] or remain fixed on more extensive macro-economic modelling.[8]

The results show that taking a closer look at the needs of stakeholders can yield additional insights that may be used to inform the debate on Customs performance measurement. Two related considerations that could be explored further are:

- Selecting and calibrating the relevant sets of quantitative KPIs for Customs performance may benefit from a structured analysis of stakeholder needs.

- Interpreting Customs performance in relation to sustainability and broader economic development may require subtle forms of analysis. Results that are grounded in stakeholder needs analysis may provide the “best possible” insights for this, particularly if quantitative data are limited or largely confidential.

In the case of Montenegro, the iterative approach, using stakeholder needs analysis from which to derive KPIs and the dialogue that emerged as a result of identifying these KPIs, was highly effective, mainly due to the openness and supportiveness of the stakeholders involved.

More information

grainger@tradefacilitation.co.uk

karl.bartels@giz.de

s.pope@dpdhl.com

[1] MCA indicated a rate of 65% in 2019 (probably calculated by excluding goods subject to import requirements that are not eligible for the PAP procedure).

[2] https://www.tfafacility.org/article-7

[3] https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:32013R0952

[4] http://www.wcoomd.org/en/topics/facilitation/instrument-and-tools/conventions/pf_revised_kyoto_conv/kyoto_new/gach3.aspx

[5] DPDHL, Sustainability Report: “Connecting people, improving lives”. 2019, Deutsche Post DHL Group: Bonn.

[6] Grainger, A. and D. Shaw, A method for measuring trade facilitation. WCO News, 2018(85): pp. 21-23, https://mag.wcoomd.org/magazine/wco-news-85/method-measuring-trade-facilitation

[7] For example: MCA, Montenegro Time Release Study 2016, Ministry of Finance and Customs Administration, 2016, Government of Montenegro.

[8] For example: Sourdin, P. and R. Pomfret, Trade Facilitation: Defining, Measuring, Explaining and Reducing the Cost of International Trade. 2012, Cheltenham: Edward Elgar.