Mauritius, a small island economy on the move

21 February 2019

By Vivekanand Ramburun, Director Customs and Excise, Mauritius Revenue Authority, and his Capacity Building Team

Small island states and the various issues that they face, from whatever perspective one looks at them, are a priority for the global community as a whole. This article explains the challenges and peculiarities of Customs administrations of small island economies by looking at the specificities of the Mauritian economy and its trade flows, identified areas of change, and the measures and initiatives undertaken to increase efficiency and reduce trade costs.

Located off the southeast coast of Africa, Mauritius is an island state of approximately 1.3 million inhabitants and is categorized as a Small Island Developing State (SIDS). These States were recognized as a distinct group of developing countries, facing specific social, economic and environmental vulnerabilities, at the United Nations Conference on Environment and Development (UNCED) that took place in Brazil in 1992.

Moreover, the World Trade Organization (WTO) also categorized such small, vulnerable economies (SVEs) as those that account for only a small fraction of world trade and face specific challenges in participating in the global economy due to a lack of economies of scale and limited natural resources, among others.

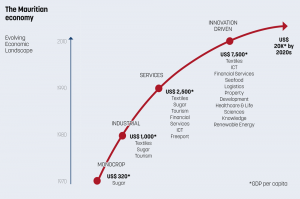

The Mauritian economy

Over the past 50 years since achieving independence, Mauritius has witnessed considerable economic progress, moving from a GDP of 841 million Mauritian rupees to over 406 billion in 2017. In fact, the country has been growing at an average rate of 5.4% since 1968, while undergoing constant transformation in its economic structure, from a mono-crop economy with a high reliance on sugar to a well-diversified economic model based on services and innovation.

The country has also demonstrated exceptional performance and dynamism, through a combination of forward-looking policies from the Mauritian Government and the pro-activeness of the island’s private sector (Source: Mauritius Chamber of Commerce and Industry – Economic &Trade Review 2017).

Mauritius is a politically stable country with a strong institutional framework, a favourable regulatory environment and low levels of corruption, which act as a foundation for economic growth. Its open trade policies have also been key in sustaining the country’s development. Moreover, its financial sector is well developed and, as such, Mauritius has begun to position itself as a platform for investment, linking East Africa with India and China.

However, Mauritius imports more than it exports, resulting in a trade deficit. In the third quarter of 2018, total exports from Mauritius stood at 20,936 million rupees, while imports rose to 50,476 million. Hence, the trade deficit for the third quarter of 2018 stands at 29,540 million rupees (Source: Statistics Mauritius).

On the plus side, Mauritius is ranked 20 among 190 economies in the ease of doing business, according to the latest World Bank annual ratings, accentuating its lead as number one in Africa. Mauritius’ rank improved to 20 in 2018 from 25 in 2017. This good score is a testimony of the Government’s sustained efforts to build a robust and resilient economy.

Major challenges

Below is a list of constraints and challenges that face Mauritius, and which could face other small island economies:

- Geographical remoteness, leading to high freight costs when transacting with main markets.

- Low economies of scale, due to low volumes and limited access to international markets.

- Gradual erosion of competitiveness against emerging and low cost/high volume economies – South East Asia in textiles, Brazil and Thailand in sugar production, and Scandinavian countries in seafood.

- Little resilience to natural disasters and climate change impacts costs – during sea swells, most container ships cannot berth at the port and instead discharge inbound containers at other ports, while outbound containers remain in port at the risk of missing important deadlines and even losing contracts.

- Shipping companies building bigger ships to reap economies of scale, and the inability of small economies to accommodate such big ships in ports.

- Threats from the activities of Somalian pirates, leading to an increase in the cost of trading across borders.

- Tourism industry exposed to the danger of coastal seashore erosion, due to global warming.

- International markets requiring more and more compliance with stringent quality standards – both international and private standards.

- High volatility in economic growth, due to various exogenous factors.

- Limited opportunities for the private sector.

- Not qualifying for the WTO’s Special and Differential Treatment (S+DT) as a country finding itself in the “developing country” category.

All these indigenous and exogenous factors contribute to driving up the costs of trading across borders for small economies, resulting in major disadvantages for Mauritius’ economic development.

Potential solutions

Against such a background, SVEs should seek to integrate into the global economy by tackling issues like trade and food security standards, capacity constraints, and structural handicaps and vulnerabilities. Small economies need to reaffirm their commitment to trade liberalization and ensure that trade plays its full part in promoting economic growth, employment and development. In addition, they should:

- continue to develop comprehensive adjustment and mitigation policies for the rise in sea-levels, in the context of integrated coastal area management;

- conduct a study on their specific comparative advantages in sectors such as the pharmaceutical industry, the “blue ocean economy,” “deep ocean water application,” or hydrocarbon fuels, for example;

- concentrate on niche markets and identify and develop facilities to meet specific niche markets, particularly in eco-tourism, nature, and cultural tourism;

- use targeted support measures to develop specific sectors – for example, tax breaks, freight rebates, and cash payments for international trade fairs;

- open their market to SVEs;

- build capacity in order to comply with international standards, such as those related to sanitary and phytosanitary issues as well as health, and make use of existing tests, regional certification bodies and laboratories;

- implement breakwater structures that allow for continuous operations in adverse conditions as well as tsunami alarm systems, among other measures, to address sea swells, which negatively impact on port operations (2 billion rupees foregone in Mauritius in the 1st Quarter of 2018).

Main Customs reforms

Below are some milestones in the Mauritius Revenue Authority’s (MRA) Customs reform process:

| 1994 |

Electronic data interchange (EDI) with a tailor-made Customs management system (CMS) – TRADENET concept from Singapore to open Mauritius up to global trade, improved dwell time, and use of EDI and UN/EDIFACT for document flow. |

| 2005 |

Use of non-intrusive inspection (NII) equipment in line with the best practices contained in the WCO’s Revised Kyoto Convention (RKC) and the SAFE Framework of Standards. Customs introduced x-ray scanners in 2006 at the port and airport to scan containers and palletized cargo respectively. To date, the MRA has a total of 11 scanners installed at the port and airport. |

| 2006 |

Electronic certificate of origin for preferential entry of Mauritian originating goods being exported to certain countries or Customs Unions (Turkey, Pakistan, the European Union (EU), the Southern African Development Community (SADC), the Indian Ocean Commission (COI), and the Common Market for Eastern and Southern Africa (COMESA). Exporters apply for a certificate online through the Customs CMS. Approval/rejection of the application is also carried out electronically. |

| 2010 |

Electronic payment system (EPS) allows traders to pay duties and taxes electronically via their banks (98% of payments are made electronically). |

| 2012 |

E-Customs. The online submission of Customs declarations/paperless Customs was implemented in order to facilitate trade by reducing the cost of doing business and reducing cargo dwell time. |

| 2016 |

National Single Window (Mauritius Trade Link). A Single Window platform that aims to provide an online, web-based facility to submit applications for import/export licences, and permits clearance from government agencies without replication of data entry. |

| 2017 |

Deferred payment scheme. Applicable to registered compliant importers who may defer the payment of duties and taxes. |

| 2018 |

Deferred payment of value-added tax (VAT) on capital goods. A VAT-registered person is not required to pay VAT on importation of capital goods, being plant, machinery or equipment, in cases where the VAT payable is 150,000 rupees or more. |

Measures taken to facilitate trade

The following initiatives and measures have been taken during recent years by the Government and key organizations with a view to facilitating trade.

Business Facilitation Act 2017

The Business Facilitation Act 2017 instituted a number of legislative amendments to eliminate regulatory and administrative bottlenecks to investment, and to facilitate trade. A host of measures has also been taken to streamline processes and procedures in the logistics supply chain, reducing both the cost and time for imports and exports.

The business processes for the administration of permits and authorizations have been re-engineered to allow clearance of permits and authorizations in an efficient manner. As a result, the cost and dwell time for applications for permits/authorizations have decreased for importers/declarants. There has also been a positive impact on Customs clearance times.

Consignments requiring clearance from the agencies involved are cleared within 30 minutes by Customs. Moreover, as of 14 August 2017, only six out of 14 items are subject to export permits.

A trade promotion agency – the Economic Development Board – has been set up to re-engineer trade processes and facilitate business. The Board is complemented by the National Trade Facilitation Committee that ensures smooth implementation of the WTO Trade Facilitation Agreement (TFA).

A Trade Obstacle Alert Platform enables trade operators to report any obstacles that they face. The authorities concerned are also able to respond to these operators via the Platform. All reports are publicly available online.

Port infrastructure

Several measures have been implemented to increase the efficiency of the port and the handling of goods. The quay apron has been extended from 560 metres to 800, with a dredge depth of 16 metres, thereby allowing the quay to accommodate two large vessels of 367 metres at the same time.

Additional cranes have been acquired – the port is now equipped with seven shore cranes and 14 rubber tyred gantry (RTG) cranes to facilitate yard operations.

Port performance has increased in terms of the number of containers discharged per hour and reduced operating costs, with an average productivity of 22.5 moves per hour. It is projected that around one million containers will be handled by the end of 2019 or the beginning of 2020.

Risk-based clearance of goods

Customs has implemented a risk management system, allowing clearance and release of goods based on risk criteria. This measure expedites the clearance of legitimate consignments, while enabling Customs officials to focus on high-risk consignments. Both Customs and economic operators gain in terms of cost and time, due to the expedited clearance of goods.

National Single Window

The Mauritius Trade Link (Other Government Agencies – OGA Portal) provides an online, web-based facility to submit applications for import/export licences, and permits clearance from government agencies without replication of data entry.

The tool is aligned to the WCO Data Model and fully automates the application and payment process for a trade permit, while providing traders with the facility to track the progress of applications in real time. It also reduces the time and cost of doing business in Mauritius, and provides more transparency at both other government agency and Customs level.

Amendments to Customs laws for trade facilitation

Amendments to Customs laws have been made with a view to facilitating trade and the clearance of goods by border control authorities:

- Legislation concerning the documents required by Customs has been amended – only two documents, an invoice and a bill of lading, are now mandatory for the processing of a bill of entry.

- Clearance of goods for home consumption subject to the requirements of other agencies – if there is full compliance with the necessary Customs formalities, goods may be released under seal to the relevant government agencies for onward clearance.

- Inward processing – goods are imported free of duty and taxes under conditions approved by the Director General, and economic operators using the procedure benefit from fast-track clearance by Customs due to the low-risk involved.

- Outward processing – this measure allows goods to be exported and re-imported within a specific time-frame, and duties and taxes are wholly or partially waved on re-importation under conditions approved by the Director General.

Advanced cargo information, partial manifest, and pre-arrival clearance

Forty-five percent of import declarations are cleared within 30 minutes, and around 6.32% of import declarations are physically examined. Much emphasis is laid on risk management and post clearance control.

Implementation of the TFA

Mauritius was among the first five countries to ratify the TFA in March 2015, and has also already submitted its Category A, B and C commitments. As of now, all measures in the B and C categories have been upgraded to Category A, except for Article 5.3 Test Procedures, Article 7.4 Risk Management and Article 10.4 Single Window.

Advance tariff and origin rulings

A key trade facilitation measure, advance rulings on tariff and origin came into operation in 2013. Since then, the MRA has issued some 2,433 advance rulings. As a result, the number of disputes between Customs and its stakeholders relating to tariff, valuation and origin has significantly declined. Economic operators are able to take informed decisions that stem from high predictability and certainty, leading to a reduction in Customs clearance and cargo dwell time.

Coordinated border management

In line with the concept of coordinated border management (CBM), cross-border regulatory agencies – the Veterinary Services Division, the Food Import Unit, the Government Pharmacist, the Mauritius Standards Bureau and the National Plant Protection Office – are housed at Customs to ensure expedited clearances.

Reforms by Government

The Mauritian Government has also taken many measures to ease transactions and promote exports, while taking environmental and social concerns into account:

- Extension and strengthening of berths – navigation channel of 16.5 metres capable of handling larger container vessels with a 12,000 TEU capacity.

- Automation in the textile industries – use of modern technology, such as robotics, for cost-effectiveness and competitiveness, as well as vertical integration from raw materials to finished goods.

- Use of renewable and clean energy (solar, waste-to-energy, wind and wave, energy efficiency/green building, and Deep Ocean Water Project) to reduce the country’s dependence on fossil fuels and oil imports.

- Promotion of aquaculture – investors are encouraged to go for high-value farmed fish with an “eco/organic” branding.

- Investment in additional cranes – total of 488,244 containers handled in 2017 and an average productivity of 22.5 moves per hour.

- High investment in the development of the ICT sector, with the intention of transforming the country into a “cyber island,” which has helped Mauritius to connect to global trade, transport and production networks – Mauritius has an open economy as measured by its trade in goods and services relative to total output, and it is worth noting that exports and imports make up 98% of the country’s GDP (Source: World Bank).

- Access to key markets on preferential terms has played a major role in the development of external trade for Mauritius – a total of nine multilateral, regional and bilateral trade agreements has been signed, with others at an advanced stage of negotiation.

- Development of a “One-Stop Shop” for port services – bunkering hub, ship stores, change of crew, repairs and inspection among others.

Going forward

There is a need to relentlessly push at the WTO for SVEs to be granted S+DT privileges in the same manner as they are granted to “least developed countries” (LDCs) to compensate for the specific and unique challenges that SVEs face. Otherwise it will be very difficult for SVEs to integrate into the global value chain and benefit from international trade. A precondition for the above, however, is that all SVEs should speak with one voice at dedicated sessions on SVEs at the WTO.

Last but not least, the “Annex D” group of organizations, supporting the implementation of the TFA, should give special attention and priority to SVEs for the purpose of building capacity in the area of standards, laboratory testing, and strengthening resilience to natural disasters.

More information

www.mra.mu